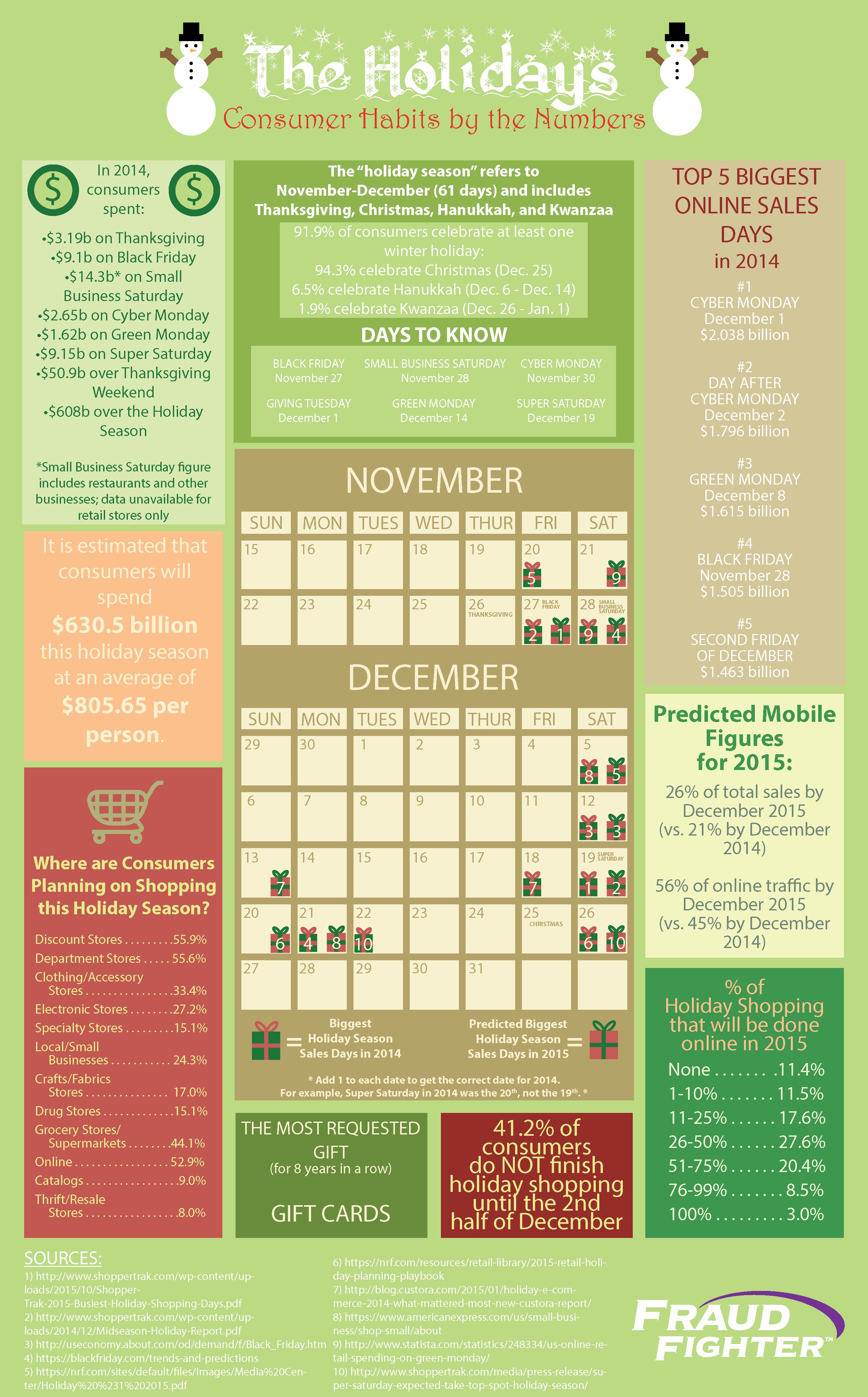

The holiday shopping season is a bonanza for consumers… and fraudsters. Here’s what you need to...

Starting April 1, 2026, FINTRAC (Financial Transactions and Reports Analysis Centre of Canada) is...

Why Omnichannel Fraud Is a Growing Concern Today’s customers interact with auto dealerships and...

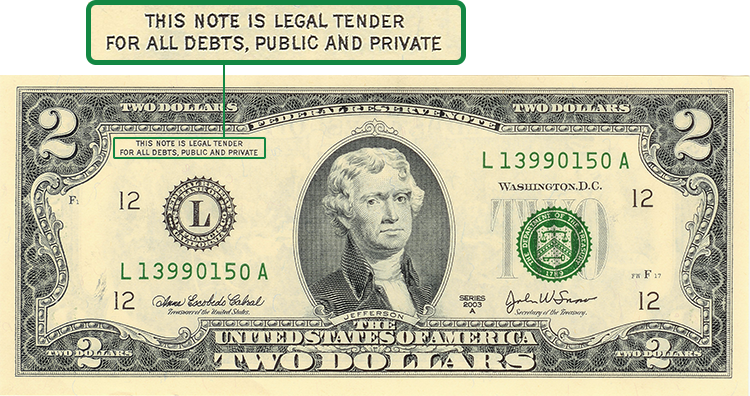

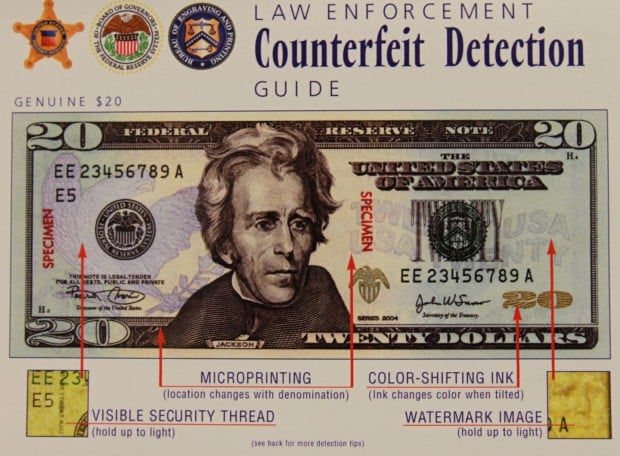

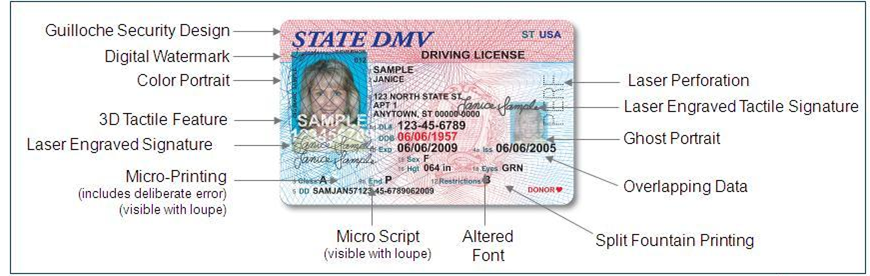

Counterfeits Just Keep Getting Better In 2023, a retail store in California unknowingly accepted...

In the middle of a busy Tuesday afternoon, the shipping manager at a regional logistics hub...

Note: This story is based on the real experiences and stories shared with us by our customers. All...

In today's increasingly digital and interconnected world, the threat of counterfeiting has...

To ensure your FraudFighter equipment remains effective and reliable, routine maintenance is...

Over the past few months, we’ve witnessed a troubling resurgence in ultra-quality counterfeit...

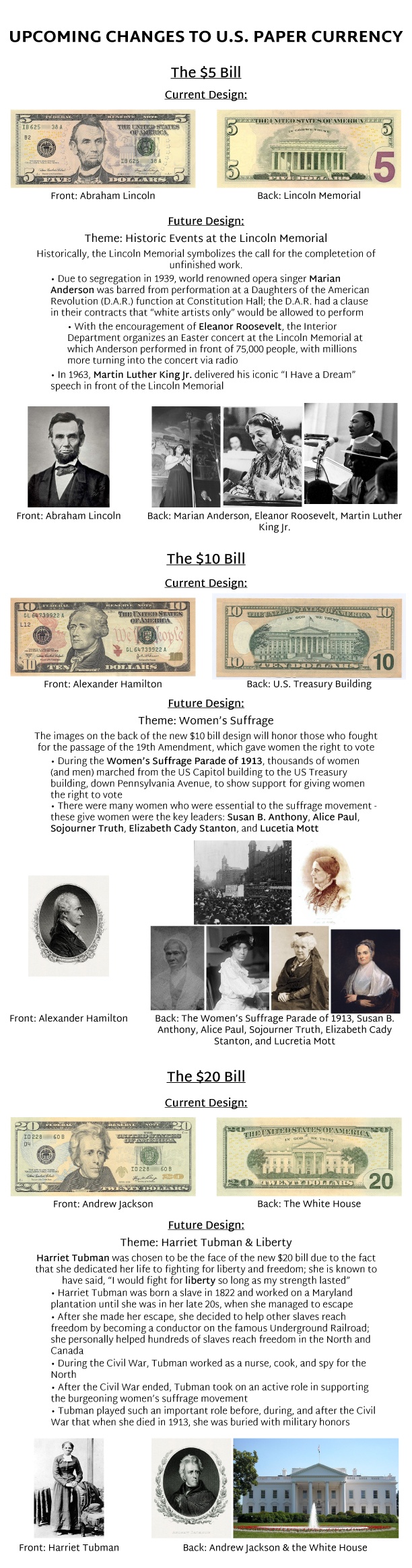

From the early days of the United States to modern initiatives for greater representation, images...

Economic downturns have long been a catalyst for fraud. During tough times, the vulnerabilities of...

Let’s face it—the car rental game is under siege. Fraudsters are stepping up their tactics, and no...

The countdown is on! IGA 2025 is set for March 31 – April 3, 2025, at the San Diego Convention...

Remember when a driver’s license was just a piece of plastic in your wallet? Those days may soon be...

If you thought losing your phone was bad, imagine losing your entire identity. That’s what happened...

If you're in the tribal gaming world, you don’t want to miss the 27th Annual Western Indian Gaming...

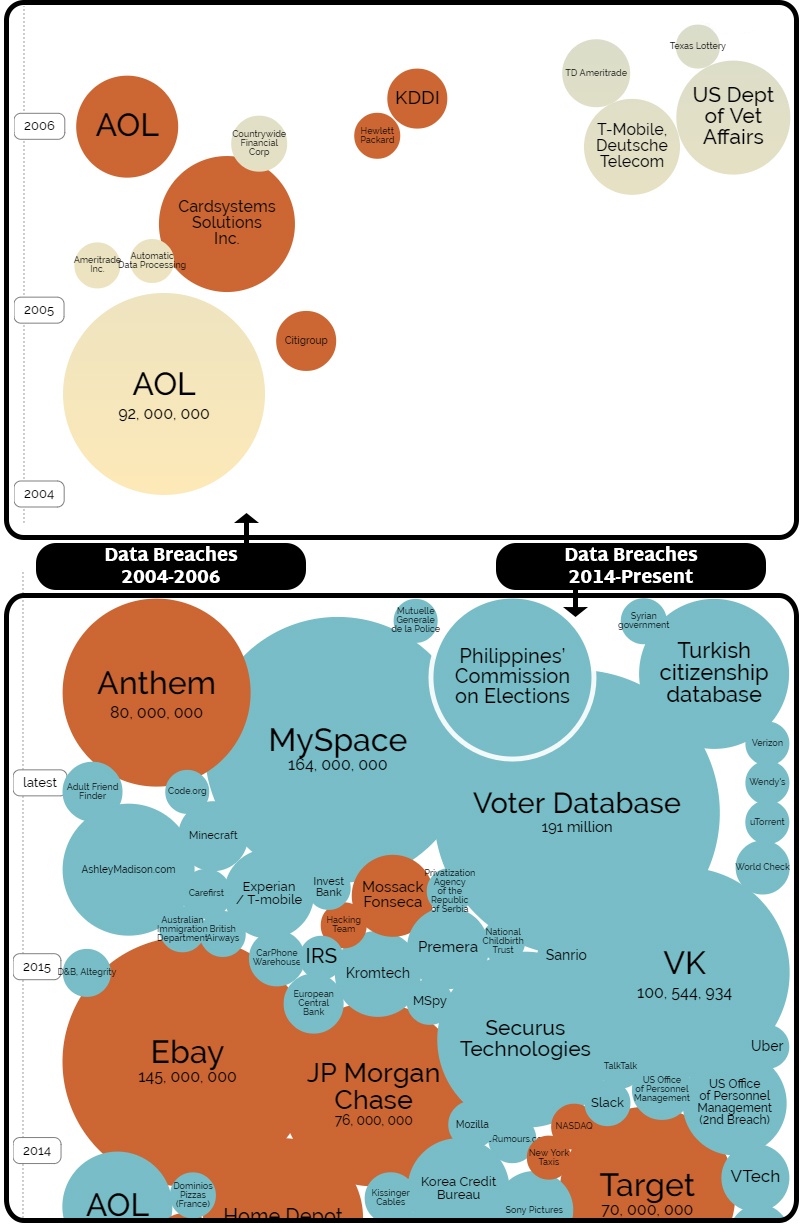

Data leaks are no longer isolated incidents; they’ve regretfully become a recurring headline in the...

Earlier this year, I was presenting at the IAFCI (International Association of Financial Crimes...

As the name suggests, the purpose of the Federal Trade Commission’s Standards for Safeguarding...

No one wants to face a significant loss, especially in the equipment rental industry where the...

You might be asking yourself; do I really need to pay for another service? Sometimes it seems like...

The reality is identity fraud has and will continue to rise. Over recent years, we have seen...

In today's digital age, hiring a contractor for home improvement projects has become easier than...

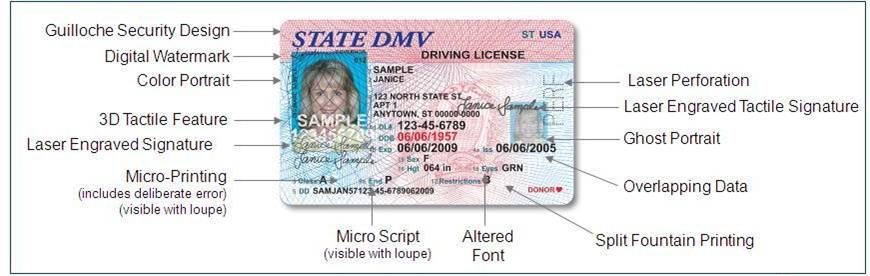

Recent trends in fraud have created the imperative to authenticate the identity of your customers...

Fraudsters are becoming increasingly sophisticated in their methods, making it ever more essential...

Car theft has been a persistent issue for decades, causing significant financial losses and...

In the fast-paced world of real estate, it's essential to stay one step ahead of fraudsters.Real...

Glendora, CA – Tuesday, September 19, 2023 – UVeritech, Inc announced today that it has achieved...

PALIDINDMV, a Driver’s License (DL) data verification check spanning 40 states, is now available as...

IDscan.net recently released a report, Fake ID Report 2023, which reveals crucial insights into the...

Nearing the end of Q2 in 2023, it seems like fraud is already abundant. T-Mobile had yet another ...

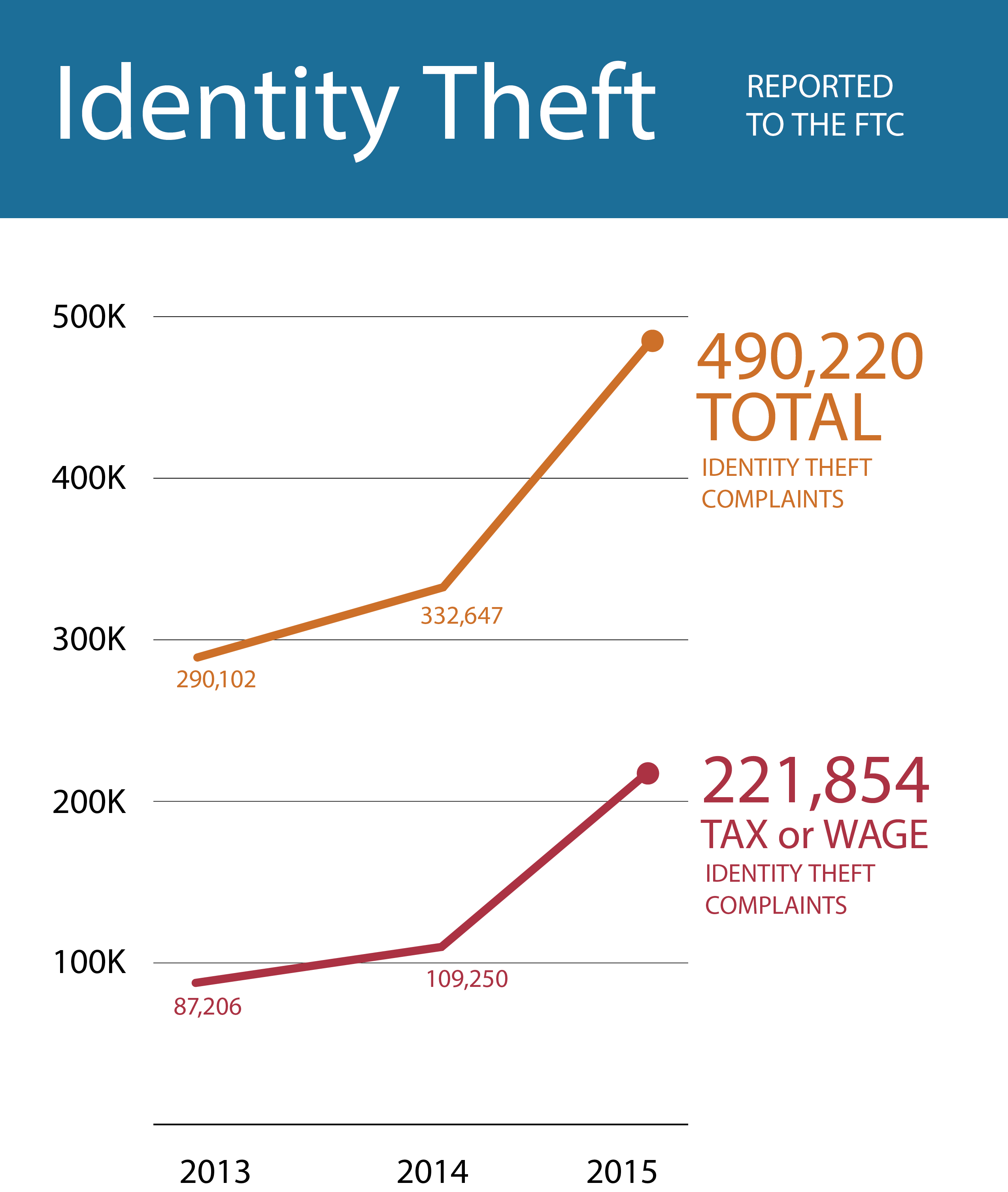

Identity theft cases are on the rise. Again. Year after year cases continue to skyrocket and are...

Glendora, CA – Friday, July 22, 2022 – UVeritech, Inc announced today that it has achieved SOC 2...

What is a Notary Public?

Fraudsters continue to use various nefarious methods to defraud liquor businesses and consumers...

Recent fraud events demonstrate how a business’ reliance just on DATA to verify customer identity...

Keep your liquor store on the right side of law enforcement.

Underage drinking. We all know it’s a problem, but how prevalent is it really? According to the USA

A customer walks up to your front desk. They flash an ID and hand over a credit card displaying the...

To stay competitive in the Auto Rental Industry it is essential that the renting process is fast,...

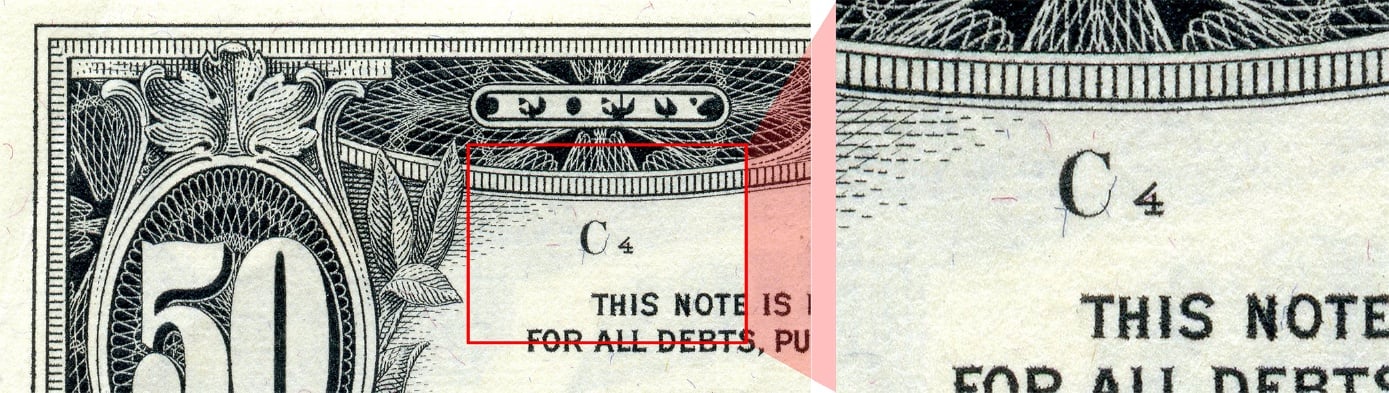

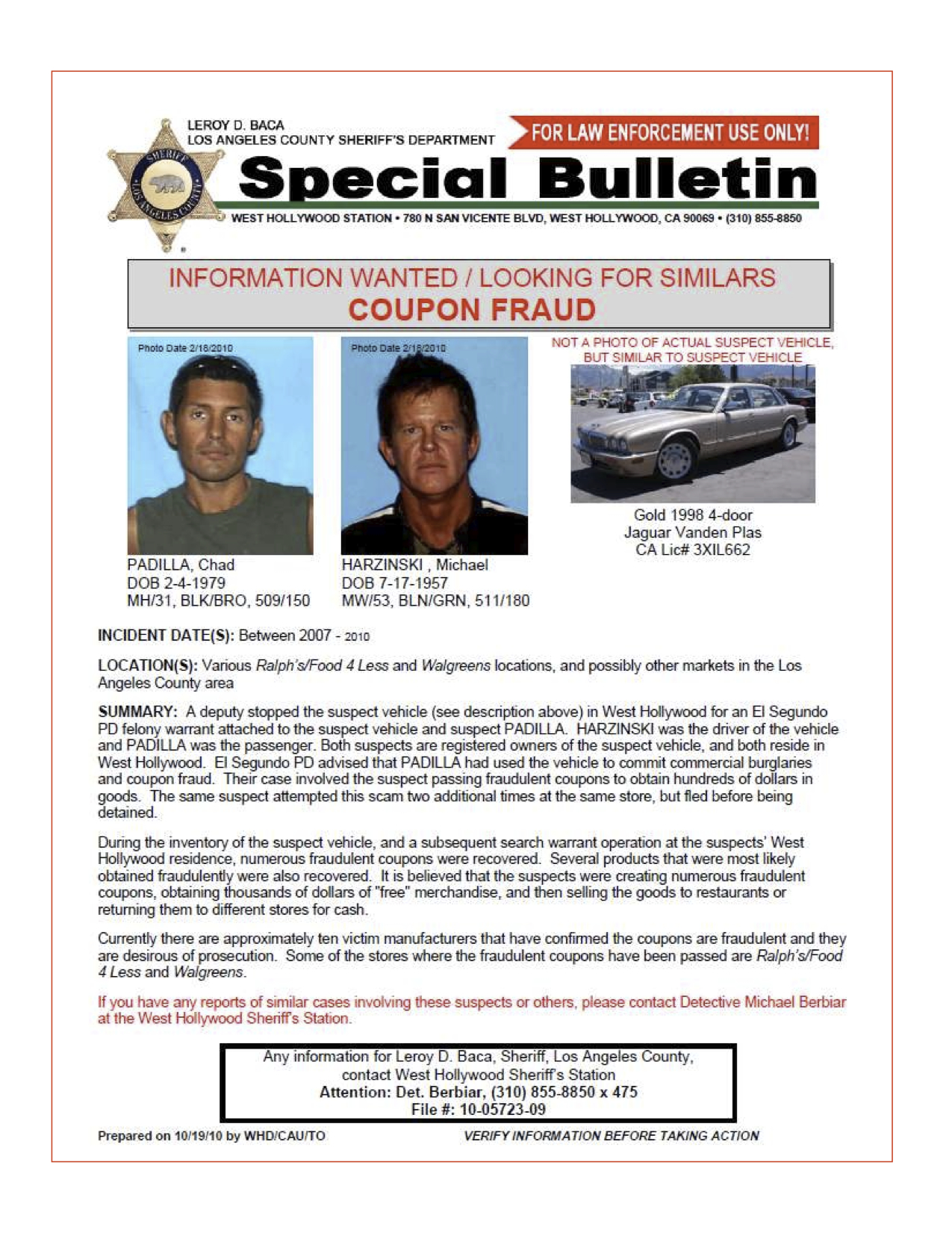

The scenario: A fraudster acquires large amounts of real $1 bills. He then goes through the process...

A new March 29, 2022 report by Javelin Research revealed that identity fraudsters continue to steal...

“Buy online, pickup in store” (BOPIS) has become ubiquitous. According to an article by Digital...

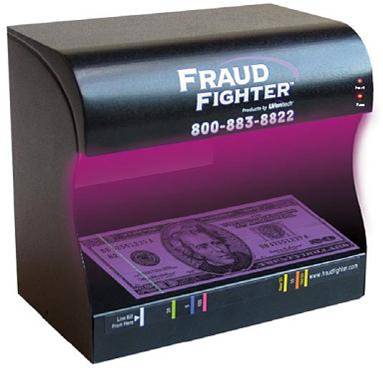

Counterfeit detection continues to be one of the most crucial steps a brick-n-mortar operation can...

This article addresses the ongoing epidemic of vehicle thefts in this country, first citing...

How "Know-Your-Customer" (KYC) can be a Jackpot for the Online Gaming industry

One of the most vital questions that confront managers of public-facing operations today concerns...

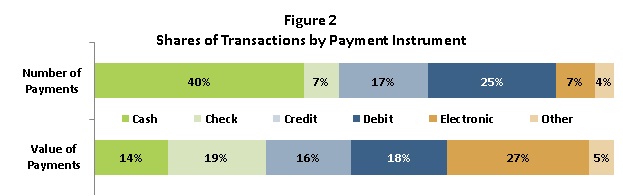

Enter 2022. The technological landscape is ever evolving and with it, payment methods. More and...

You detected counterfeit bills in the back office? Great! But it’s too late…

Just how prevalent is Credit Card Fraud today? The Federal Trade Commission’s Annual Data Book of...

Here’s a real-life scenario that one of our customers described to us - The shipping yards operated...

When you think about the selfie, your first thought likely is not about how useful it can be in the...

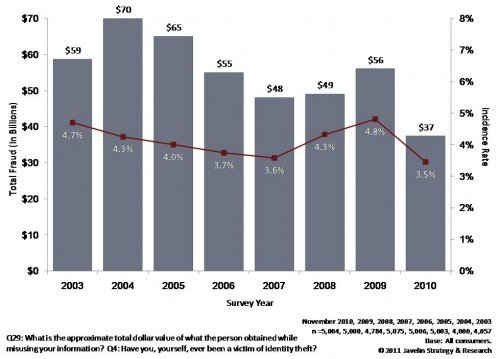

The rate at which Identity Theft is growing in the United States is nothing less than shocking....

What to do when they win! ID authentication should be a fundamental step anytime a “qualifying...

Incidences of Identity-Theft Related Cargo Theft are on the rise

As our world continues to shift further into the realm of the internet, so do our buying habits. A...

Online gaming had been growing steadily over the past 10-15 years, but the COVID-19 pandemic threw...

The customer standing in front of you seems like a safe bet; they have an ID document with a photo...

When the term “Identity Theft” is brought up in conversation, our thoughts usually jump to the pain...

When polled to reveal the top three issues facing M-Commerce and E-Commerce retailers regarding...

In the restaurant biz, CCPs or "Critical Control Points" are key individual steps in the food...

Retailers of all types face the inescapable reality that transactional fraud has been on the rise...

There is a surprising range of counterfeit detector options available in the marketplace today....

Incumbent banking institutions have emerged out of the pandemic to a landscape scattered with...

As of this writing in June 2021, fraud and cyber crimes are running rampant and unabated throughout...

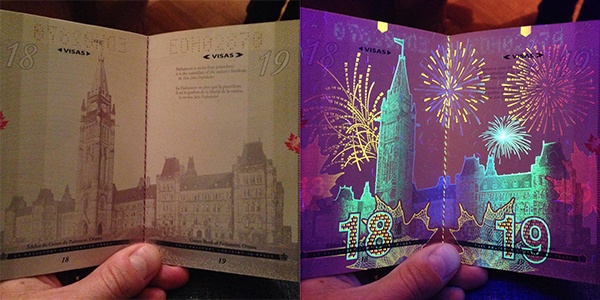

Trust what we cannot see? The best security might be completely invisible and hands-off to us, with...

What is ATO Fraud? Account Takeover (ATO) fraud begins as theft of consumer account...

LexisNexis (LN) recently released its Financial Services & Lending focused 2022 True Cost of Fraud...

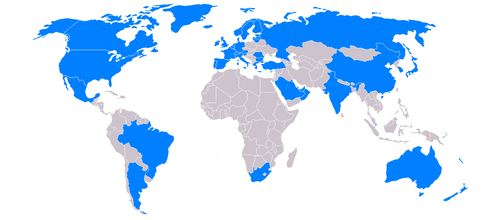

Countries around the world are designing ever-more intricate (and beautiful!) UV security features...

At this point, the concept of identity theft has thoroughly pervaded our popular lexicon and...

Employees tasked with running cash registers and point of sale (POS) systems are a store’s first...

As of this writing in early March 2021, COVID19 vaccine deployments have given society a proverbial...

A quick perusal of recent news stories using the keyword “counterfeit money” reveals the most...

Ah, the Selfie. Equal parts necessary vacation documenter to cringe worthy "maybe that wasn't such...

Two Packages, $136K of Counterfeit Currency CBP Officers in Chicago Seize Shipments Containing...

It is often said that the act of counterfeiting money is as old as money itself. No matter the type...

Fraudulent transactions have grown step-for-step with legitimate economic activity – and is booming...

Cashiers and Tellers Report Unable to “Feel” whether Money is Real or Not During our twenty years...

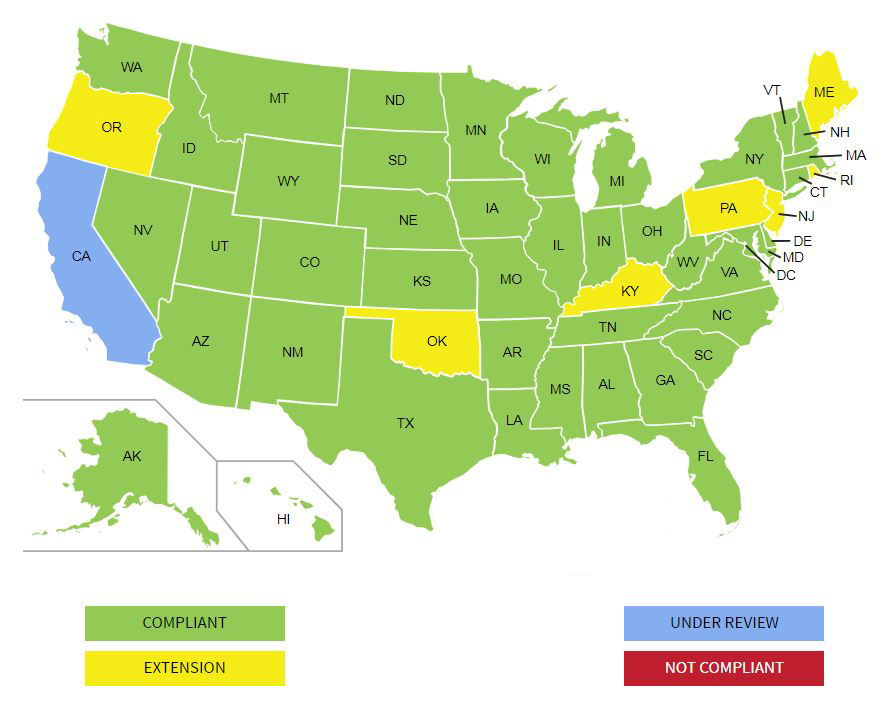

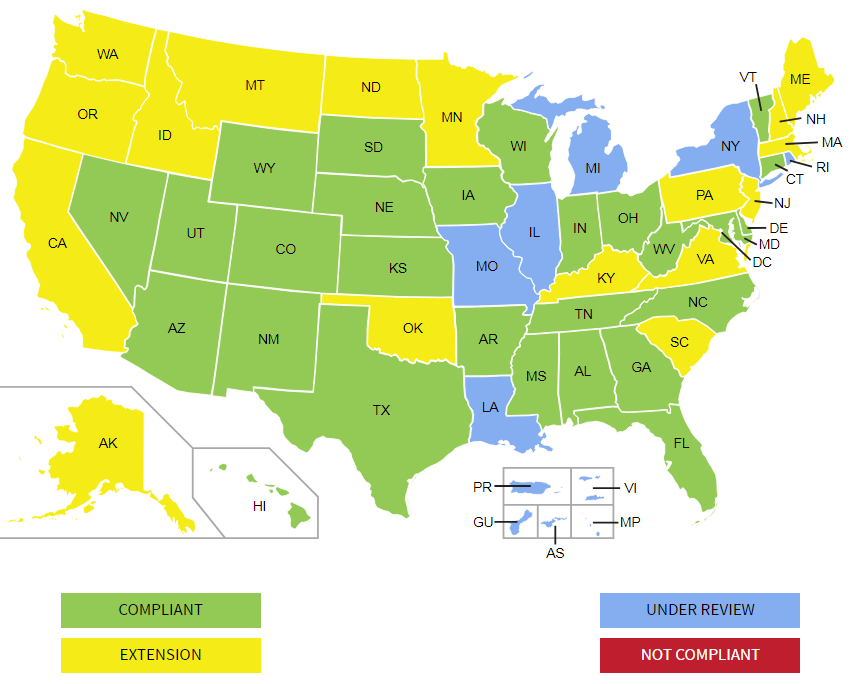

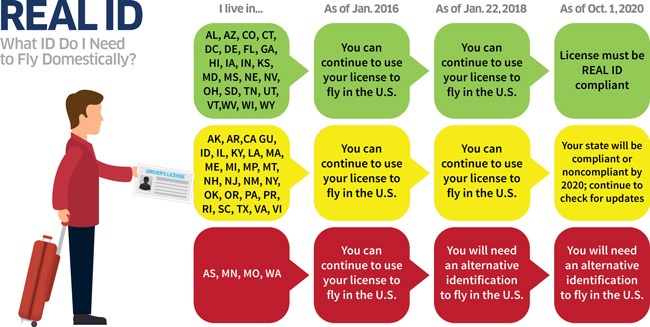

Information up-to-date as of April 24, 2019.

When it comes to assessing your risk of identity theft and fraud, being digitally compromised in a...

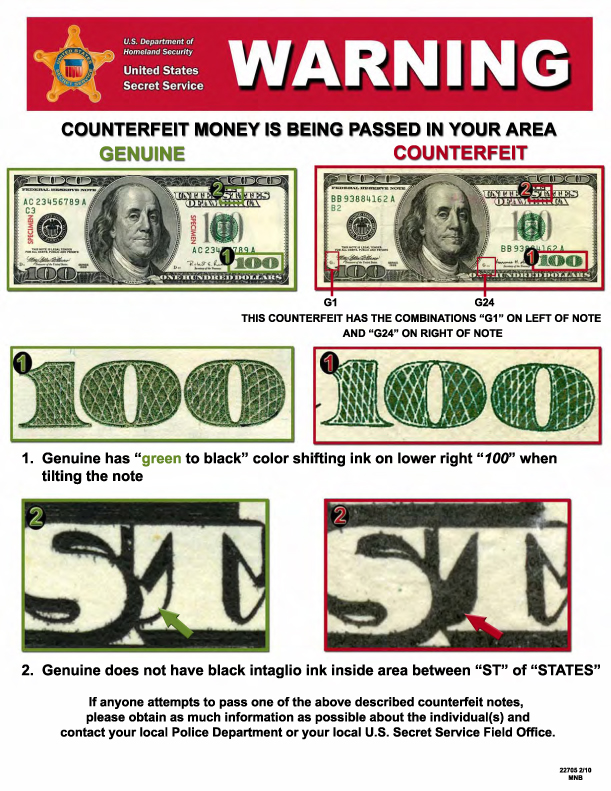

Several weeks ago, we began getting calls from a few clients asking us whether specific versions of...

You know it’s important to protect your business against fraud, but how do you protect your...

Increase Your Employees’ Productivity by Eliminating the Time-Consuming Task of Counting Money

The California DMV released its Real ID-compliant driver license and identification (ID) card on...

If you are in noncompliance with Form I-9 requirements, your business could pay a rather hefty...

Counterfeit money, of course, can be used to swindle real money and products from businesses, but...

Terrifying financial horror stories aren't fiction!

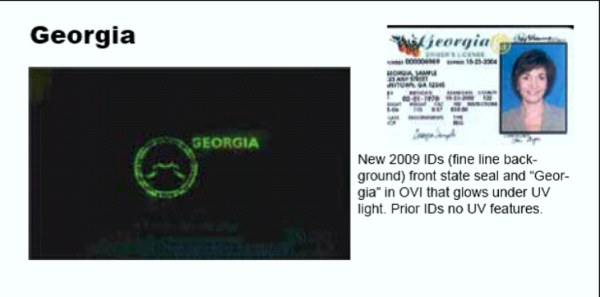

Many states are changing driver's license and identification card designs in next two years - which...

I found the below article so compelling, and so important as it relates to the current environment...

How the release of personally identifying information (PII) of nearly half the US population should...

• TABLE OF CONTENTS •Equifax Hack: The FactsHow Criminals Can Use This Stolen DataIdentity...

Retailers are on course to lose more than $70 billion globally to remote “card-not present” (CNP)...

Image of a Series 1928 Federal Reserve Note • TABLE OF CONTENTS •A Brief Background on U.S....

• TABLE OF CONTENTS •Why You Need to be Vigilant about Checking MoneyNaked Eye vs. Counterfeit...

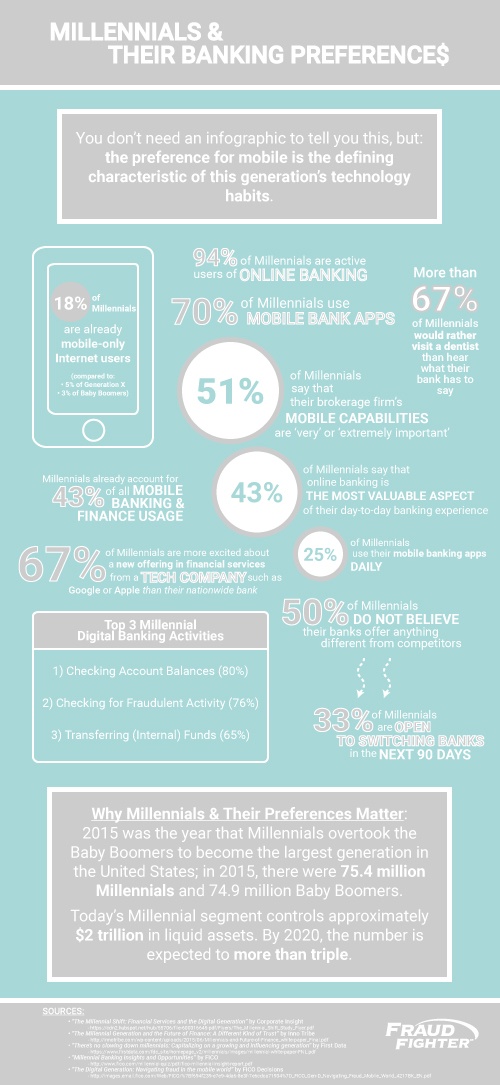

• TABLE OF CONTENTS •Common ATO Attack TargetsMillennials Seriously Question what Large...

• TABLE OF CONTENTS •What is New Account Fraud?New Account Fraud StatsThe Link between Identity...

• TABLE OF CONTENTS •CNP FraudIdentity Fraud via Phishing, Malware, and Social MediaOther Identity...

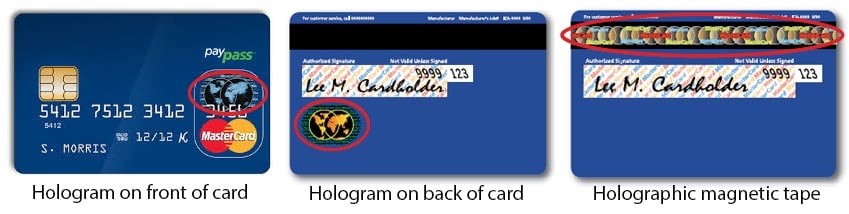

• TABLE OF CONTENTS •What is Card Shimming?Card Shimming vs. Card SkimmingWhat are CVVs?Why Cards...

• TABLE OF CONTENTS •Remote BankingMobile Client Onboarding is the Next FrontierMobile Identity...

• TABLE OF CONTENTS •What does the future of financial services look like?Millennials Seriously...

• TABLE OF CONTENTS •What is Return Fraud?Return Fraud StatisticsWhy is Return Fraud such a Problem?

• TABLE OF CONTENTS •Consumer Behavior during the HolidaysHoliday 2015 Retail Stats ReviewHoliday...

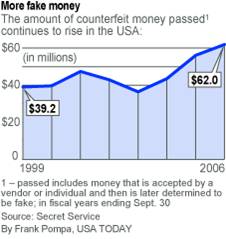

On November 17, U.S. Secret Service revealed that $30 million in counterfeit money had been...

Traditionally, “skimming” meant secretly taking small amounts of money from a larger amount of...

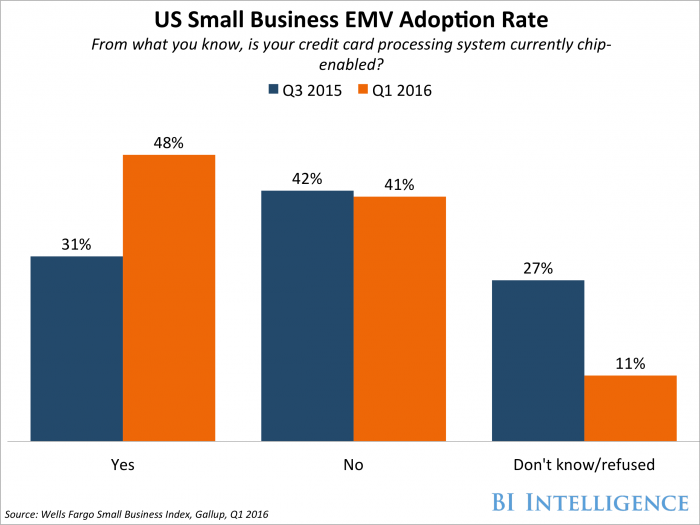

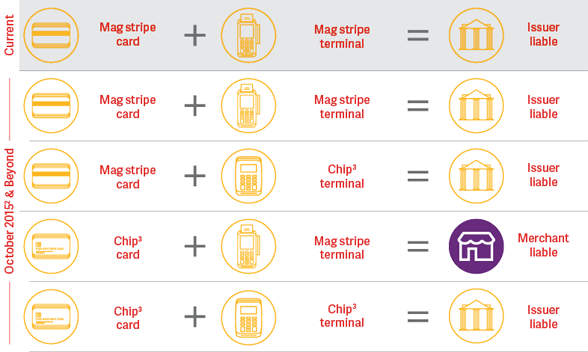

October 1, 2016 was the first anniversary of EMV’s adoption by the United States. Businesses who...

Since the beginning of the year, 7 states have issued updated versions of state identification...

Chip-enabled (EMV) credit cards are designed to be more secure than magnetic stripe cards because...

Identity Theft continues to rank as the fastest growing form of fraudulent crime A recent report by...

An estimated 9 million American identities are stolen each year – it’s no wonder why identity theft...

Mobile Identity Authentication Many potential business-cases point to the desire to have an...

Just a little over 5 months into 2016 and there are already multiple discoveries of counterfeit...

Ever since the signing of an armistice in 1953 that put a stop to the fighting in the Korean War,...

On April 20, Jacob J. Lew, the Secretary of the Treasury, announced that a redesign of the $20 bill...

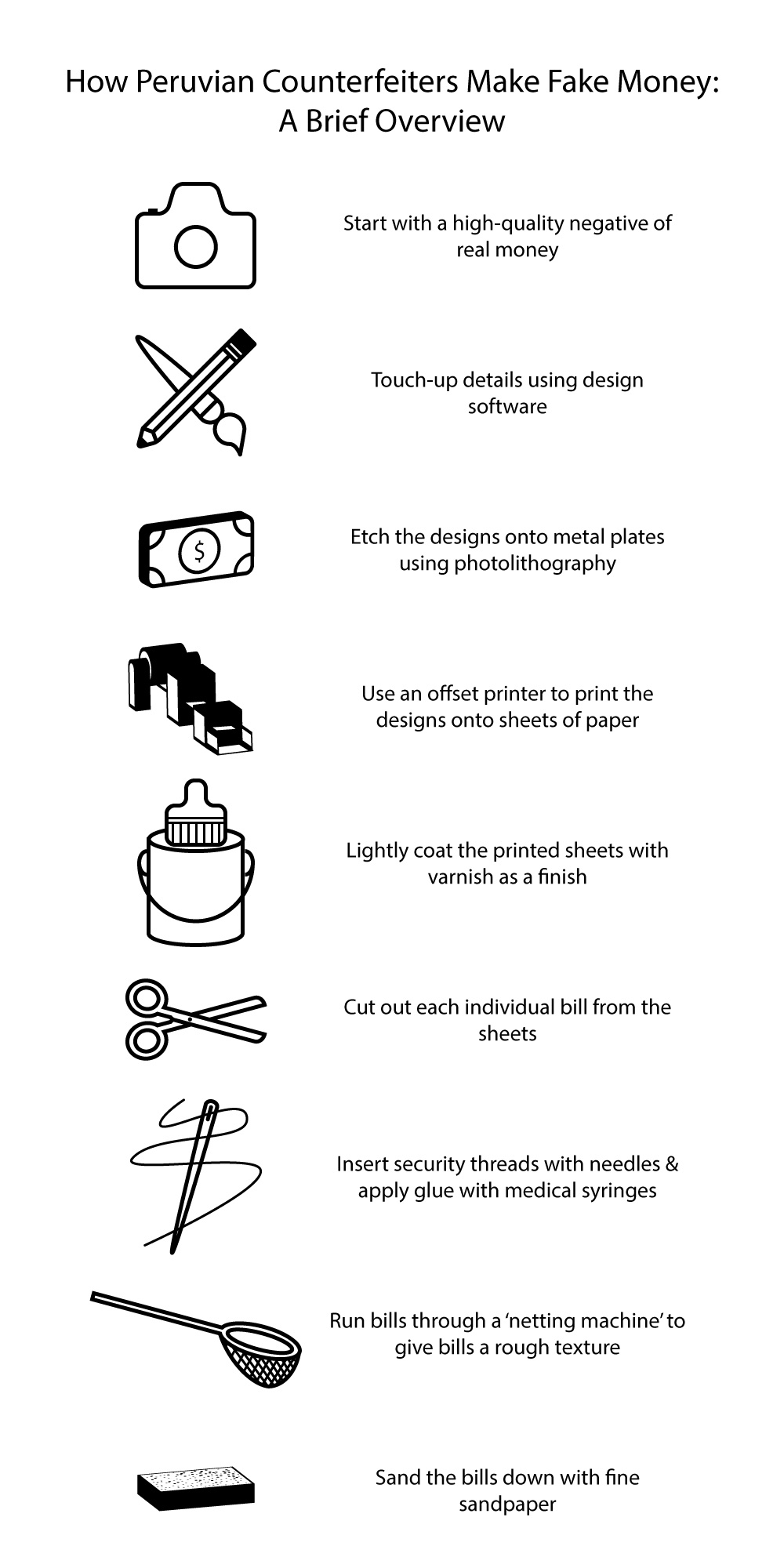

For decades, Colombia was known as the world leader in counterfeit money production. For the last...

Identity fraud is rampant. Just perform a Google search on the term and the evidence to support...

Earlier this year, a car salesman in Houston was kidnapped while taking a prospective client on a...

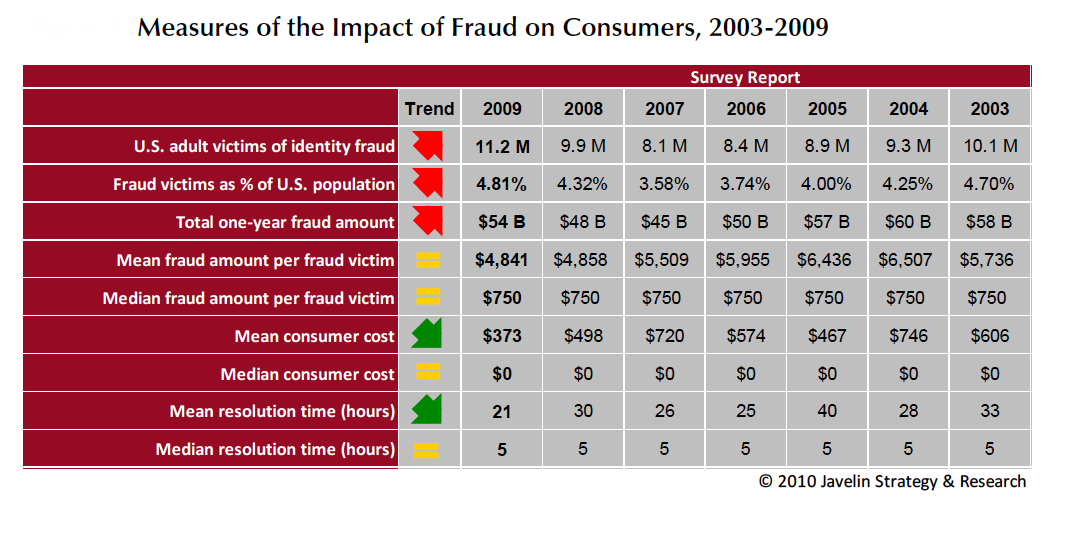

If preliminary estimates hold steady, the amount of fraud victims and the total amount lost to...

It was last year that I heard a prominent loss prevention professional - a name that many in the...

If you’ve been paying attention to the news, you’ve probably noticed something: the rapid rise of...

According to a March 11, 2015 Secret Service estimate, 0.25% of money that is currently in...

For most, the start of a new year is a time to reflect on goals and positive changes. It is when...

Can you tell which twenty is fake? The twenty on top is real and the twenty on the bottom is...

Photo by Whym via Wikimedia Commons

For many years, credit card fraud has been the favored method for fraudsters seeking to profit from...

Still sleeping off Thanksgiving dinner? Shopped 'til you dropped? Making your way back home after...

It was only a decade ago that we lived in a 4G-less world – at an intersection of equal parts...

Traditionally, the day after Halloween has been reserved for the Catholic observance of All Saints’...

A criminal that has your information can take over your life in a variety of different ways: he...

On October 9, Spanish newspaper El País reported that state lawyers representing Spain’s Treasury...

In short, yes, you should be worried – but not too much.

Before the advent of the internet, global electronic communications, and online databases, it was a...

In the previous post, we discussed what EMV and the fraud liability shift are as well as how it...

You may have noticed that new debit cards and credit cards are being issued with a visible...

Most people have some exposure to fraud deterrents in their daily lives. For the honest person,...

Like most millennials, if you left college tens of thousands of dollars in debt with looming...

Young people who are under the drinking age have long looked to fake IDs to get around the law....

To combat the recent tidalwave of identity theft cases across the United States, the Internal...

With the increase of mobile commerce brings a parallel increase in fraudulent mobile transactions,...

FraudFighter has always had the goal of providing its clients with the best possible product at the...

Fraud is big business.The Federal Trade Commission has estimated that 10.8 percent of U.S. adults...

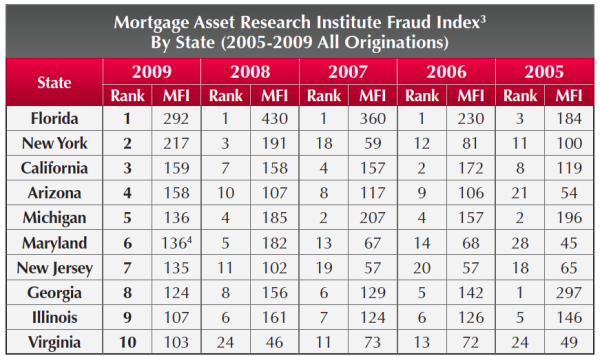

According to a new report, the majority of online fraud in the United States is coming from several...

When it comes to summer safety tips, identity theft and fraud may not be the first things that come...

In a short new series, Fraud Fighter will profile a variety of high-fraud cities across the country...

In our tech-based society, smartphones, tablets, and other mobile devices are central to our daily...

No matter how careful you've been to protect your personal data and information, there are still a...

Modern counterfeit detection relies on a wide range of specialized detectors, but there is a...

FraudFighter Products offers solutions to organizations that are concerned with verification of...

We often assume that major identity theft issues come from data breaches or scammers - but have you...

Scientists out of the National University of Singapore have found a method of utilizing nanohole...

We'd all like to assume that we are quick enough to recognize a scam before falling into a trap -...

Financial institutions have long been the target of phishing schemes and fraudulent activity- from...

Identity theft and fraud among senior citizens is rising across the country, with many states as...

With recent data breaches across massive retailers from Target to Home Depot, you might be...

The United Kingdom is reporting a huge jump in liability fraud, citing a 75% increase in bogus...

As the Internal Revenue Service continues to work to combat tax fraud this year, other federal...

Counterfeit money has been around as long as authentic money. Even some of the very first western...

Many individuals who are on the market for a new job are fearful of the risks that come along with...

When it comes to identity theft, your children are likely not the first ones you might worry about....

The Better Business Bureau of Connecticut is warning job seekers to watch out for examples of...

Despite the Securities and Exchange Commission's focus upon regulating the securities industry and...

In a wave of preventative measures for data protection, the Blue Cross Blue Shield Assocation...

Accurate identification papers are essential to safeguarding financial and legal transactions as...

Identity theft issues continue to plague the Internal Revenue Service, and the U.S. Treasury...

Counterfeiting and identity theft are major concerns for the public, and safety of private...

Millennials probably don't worry too much about identity theft or fraud -- but according to a...

Following a recent online attack that resulted in the diversion of tax refunds and the theft of...

For as long as governing bodies have released official documents and notes, counterfeiting has been...

Recently, in Brooklyn, a man successfully made a $1,500 purchase using fake identification at a...

Forged Document Detection as a Central Loss Prevention Strategy As highlighted in last week's...

Deep in the underbelly of the "Dark Web's" digital black market, identity fraud and counterfeiting...

Counterfeit money damages the U.S. economy and can substantially impact businesses of all...

When an identity is stolen, the damage can extend far beyond the credit report of the victim. When...

The modern era of counterfeit money production has enabled anyone with a home computer, a scanner...

In 2013, the U.S. government says it recovered more than $88 million in counterfeit currency in the...

Loss prevention is a many-faceted practice these days. Gone are the times when cameras on the...

At some point, every business should ask itself, “What is the easiest way to prevent fraud from...

Recently, a news story was featured on CBS 2 News Cedar Rapids, Iowa, that highlights the...

Does your business handle in-store credit applications? Are you verifying the identifications of...

The New Year is bringing a change to the credit card industry. In the United States, credit card...

The busiest shopping day of the year is approaching, Black Friday. Businesses are expecting their...

Just when we all thought cash was going obsolete it looks like this holiday season shoppers will...

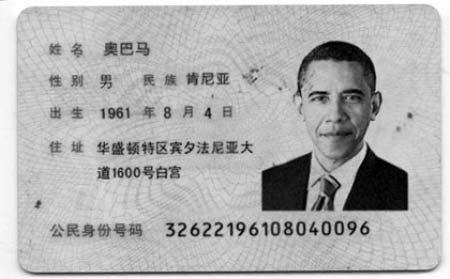

Astonishing expose published in GQ Magazine I read a very fascinating article published in GQ this...

I was having lunch with my friend, Crystal, the other day and she says to me “Oh, hey. You’ll find...

The holiday season is nearing meaning the busiest time of the year for retail businesses is...

Tax refund fraud is another form of identity theft that has recently afflicted the IRS. Recently

The usage of fake IDs in an in environment like a Gentlemen’s Club typically is for underage...

Black market websites, located in the “deep web” are known for supplying sophisticated criminals-...

It is a widely held belief these days that the end of the “cash economy” is upon us. With rapid...

$13,000 Rental by 19 year old triggers disbelief, outrage Many people were shocked and amazed...

We have reported much in recent months regarding the increasing sophistication of ID thieves, and...

Earlier this year, the European Central Bank (ECB) revealed that a record 670,000 counterfeit notes...

I get news-clippings everyday from Google. It's quite amazing, actually, this ability to have a...

Would You Have checked his $100 Bill for Counterfeit? When training your workers to detect and...

Warning:The following information is scary. Stop reading now unless you have a robust identity...

We have written much on the subject of the Modern Face of Identity Theft, and howtechnological...

Identity authentication is rapidly becoming an issue of great concern to the banking and other...

Trading Electrons The latest term trending in the financial world is cryptocurrency. Loosely...

Sharp Spike in Fraudulent Tax Returns Reported by IRS

Reports Already Coming-In about the New $100 note "falling apart'

Our nuclear plants have become like mini-fortresses following 9/11. Concerns over attacks on land...

The United States has launched a new $100 bill as of October 8, 2013, the first remake of the...

FBI Seizes and Shuts-Down "Silk Road" a leading dark market website. A Federal complaint revealed...

This article was originally published on CBinsight.com The Best Way to really "Know Your...

New Report by Tufts University Details Costs of Cash-Economy to both Businesses and Individuals I...

Yet Another Production Delay may Affect Release Date for New $100 Bill New Anti-Counterfeiting...

Fluorescent Security Feature On New $100 to be Identical to Previous $100 Bill, Only Better.

According to FBI statistics Identity Theft is the nation's fastest growing crime. Identity theft...

Every day, I get news clippings - courtesy of Google news - on the topic of counterfeit money. The...

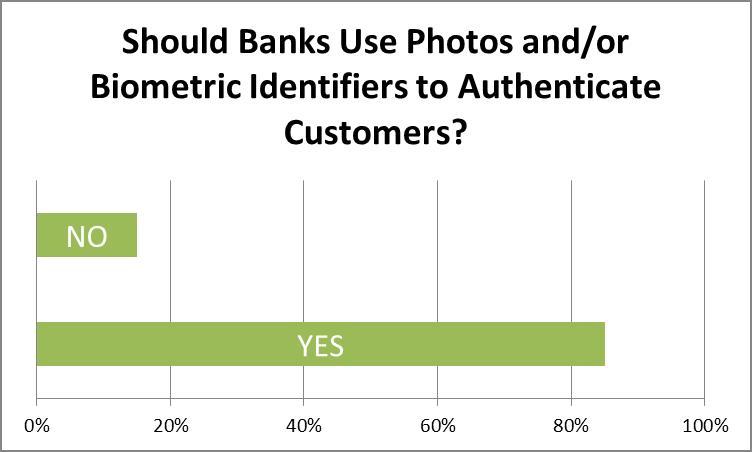

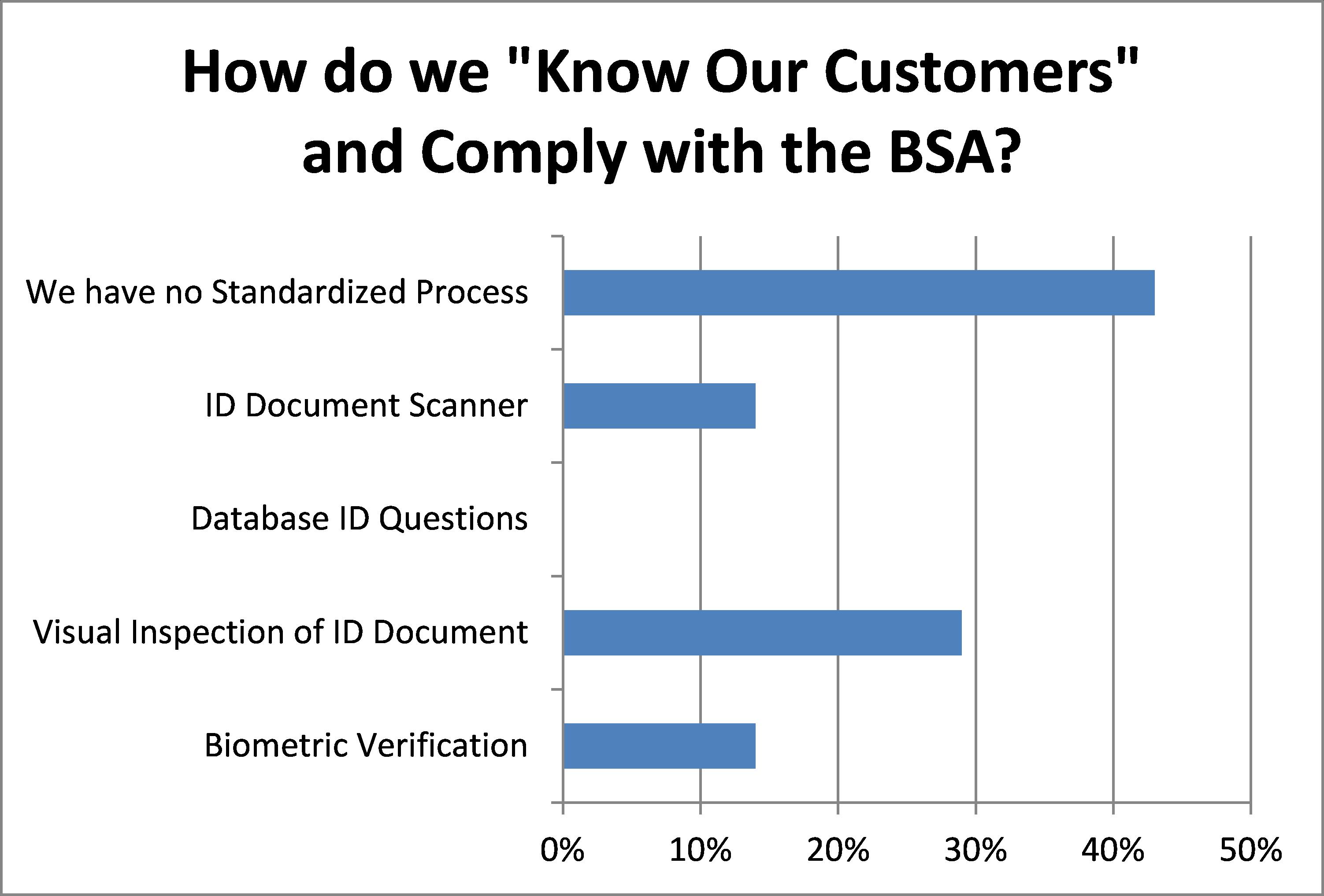

In early June this year, we conducted a survey of banking and financial professionals, asking...

In a survey of financial professionals conducted last month, FraudFighter discovered that a vast...

The U.S. Treasury Department's Bureau of Engraving and Printing (BEP) announced that the...

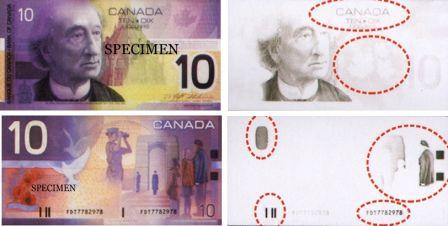

Over the past 14 months, the Bank of Canada has released a series of newly designed banknotes. The...

Faced with the extraordinary challenge of trying to bring a financial services operation into...

Financial Services Industry needs to become Global Leaders in Identity Authentication Over the...

When you sign up for something online, whether it's a social media site, shopping platform or...

People send me articles, news stories and reports all the time. Part of the fun (and, burden) of...

I really can't give the Federal Reserve or the Bureau of Engraving and Printing a hard time. The...

I read an interesting Article yesterday on Motley Fool, one of the sites where I go for relevant...

Bank Secrecy Act compliance is more important than ever to companies that deal with “covered...

Fraud and data security breaches come in so many different forms and from so many different...

Simply put, multi-layered fraud prevention means that you must seek to understand the...

The results are in, and even we have to admit that we are astounded by what has happened.

According to a recent survey of major U.S. retailers, conducted by the National Retail Federation,

The Federal Trade Commission reports that over 9 million Americans are victims of identity theft...

Halloween is over and the holiday season is upon us. This means retailers should expect large...

Peru Supplies 1/3 of all Counterfeits in U.S. Last month Peruvian authorities, in conjunction with...

Knowing how to spot fake money is a skill that every cash handler should know. With advances in...

Money counting is a matter of time and accuracy. Either you save time with the CountEasy(tm) Scale...

There are a number of ways to achieve compliance with anti money laundering regulations by...

Many of our customers ask us - Why is the UV security feature on the $100 bill more difficult to...

As technology advances and as more people become aware of the simplicity of digital

If Internet conversation is any indication, businesses and consumers continue to harbor fears of...

Anyone that has been in retail for any length of time knows that protecting your company's assets...

To deter or prevent illegal activity including terrorism and money laundering, Bank Secrecy Act...

The Bank Secrecy Act or BSA requires a written Customer Identification Program (CIP) for client...

Companies lose billions of dollars every year to counterfeiters who are clever enough to print...

(BSA) Bank Secrecy Act and (FACTA) Fair and Accurate Credit Transactions Act: Red Flag Rules ...

Here are three easy steps you can take, right now, with no cost and very little time investment...

"Get Money" isn't just a song by The Notorious B.I.G.

Passing Counterfeit Money Through Retailers is a Multimillion Dollar Industry Every year,...

Manually counting cash is one of the best ways to lose money in your retail business. Cash...

No Update From the Treasury Since June 2011 The U.S. Treasury has yet to announce a release date...

In 2009 the U.S. Treasury reported that over $400 Million in counterfeit currency was...

For as long as people have used paper currency, there have been attempts to counterfeit it. In...

The best way to detect a counterfeit bill often depends on the context, such as the type of...

At the heart of many acts of fraud lies the intentional misrepresentation of identity. When ORC...

Every year, retailers lose between $15-30 billion from Organized Retail Crime (ORC). It may sound...

Most loss prevention and asset management personnel make the mistake of thinking that shrinkage...

Most people associate the United States Secret Service with the protection of the President and...

Counterfeit currency. Not something most of us think about. We think we know what it is and some...

Loss. Whether it happens in the form of shoplifting, cash register shortages, product shrinkage...

In today's economy, organization - from "mom and pop" stores to giant retailers - are looking for...

In a recent speech to the GOP faithful, Presidential Candidate Mitt Romney held up Arizona’s...

Desktop publishing to make money: A simple business concept used either to supplement income or...

Judging by the number of Google searches devoted to it, counterfeit money continues to be a big...

Counterfeit money. According to the United States Secret Service, $261 million in counterfeit...

The world has changed much since September 11, 2001. Awareness of how fragile our way of life can...

In the past, fake ID’s have largely been associated with underage drinkers trying to get their...

I n the ongoing war against identity theft, individual battles are constantly being waged and...

“Extremely troubling,” is how one Arizona public safety officer described the small items in front...

If you have followed the news at all lately, you have likely heard that financial institutions of...

It is perhaps a sign of the times when the annual convention of anti-money laundering...

Scenario:A financial institution is opening a new branch, and is starting a major local PR blitz...

One of the biggest concerns of any financial institution – that is, any institution that routes...

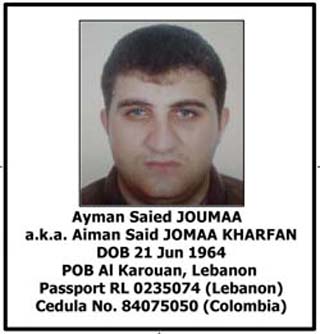

The last several weeks have seen a number of noteworthy arrests for money laundering. A fugitive...

The last decade brought about a tumultuous change in financial institution regulations. Many...

Every so often an identity fraud story comes along in the news that is not only impressive in its...

Criminals interpreted the American prospect of “making money” quite literally in the past month,...

As if it weren’t already difficult enough to verify identity documents, now comes a new wrinkle in...

Earlier this month, FraudFighter began providing advanced sample copies of our new Driver License...

If you read Part I of our blog series on identity fraud you almost surely remember the sum totals...

Two very important studies delving into fraud reports from 2010 were issued recently. The first, a...

Credit card processing servers. Poorly secured corporate networks. Point-of-sale terminals in gas...

Imagine you were offered this amazing business opportunity: you would join an effort by a local...

We have mentioned in a number of previous posts the international nature of many counterfeit money...

How easy is it to create counterfeit money? Up until a few months ago, the Reid brothers would...

(Note: This is the second article in our series Best Practices for Counterfeit Detection. For the...

Want an entertaining dinner party activity? Ask people around the table if they know how to tell...

Good news from the front in the battle against identity theft! Well, somewhat good news. With an...

It is always a treat to hear from actual identity thieves: understandably they are not often...

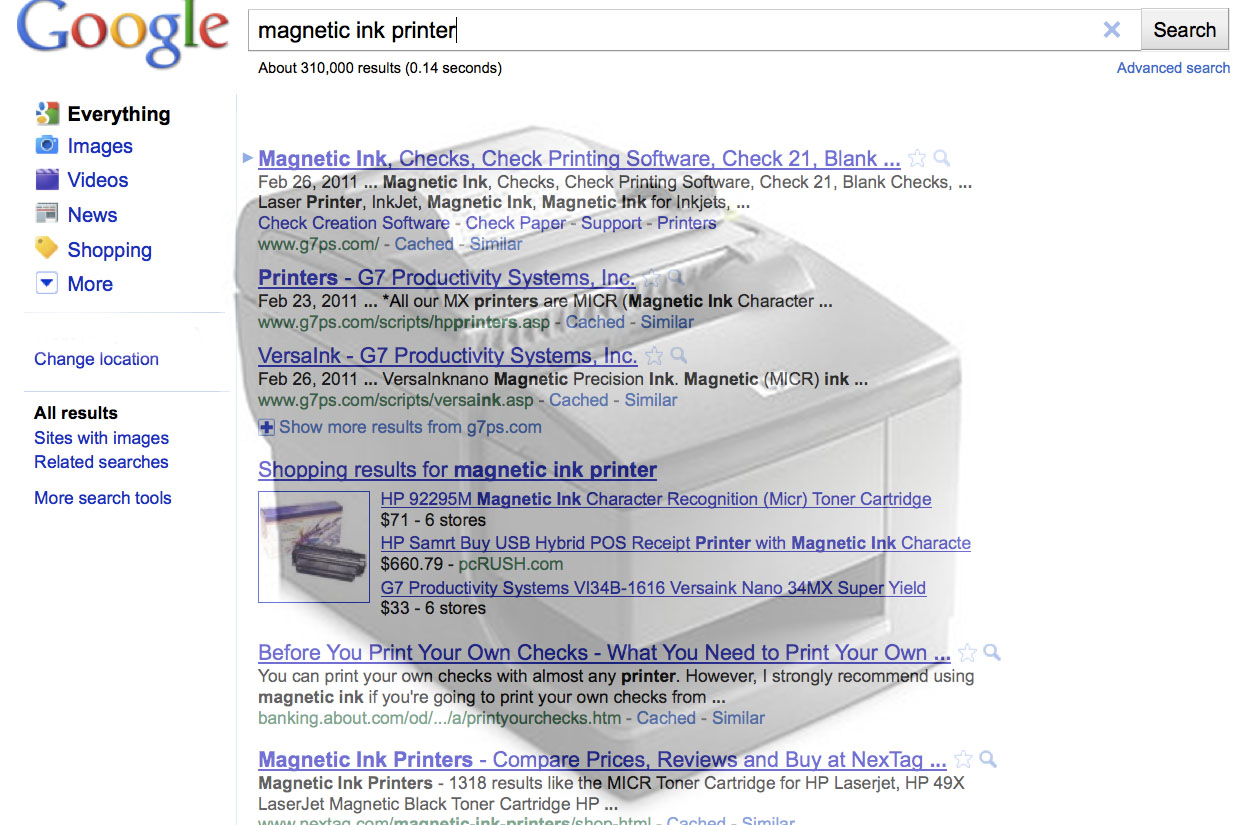

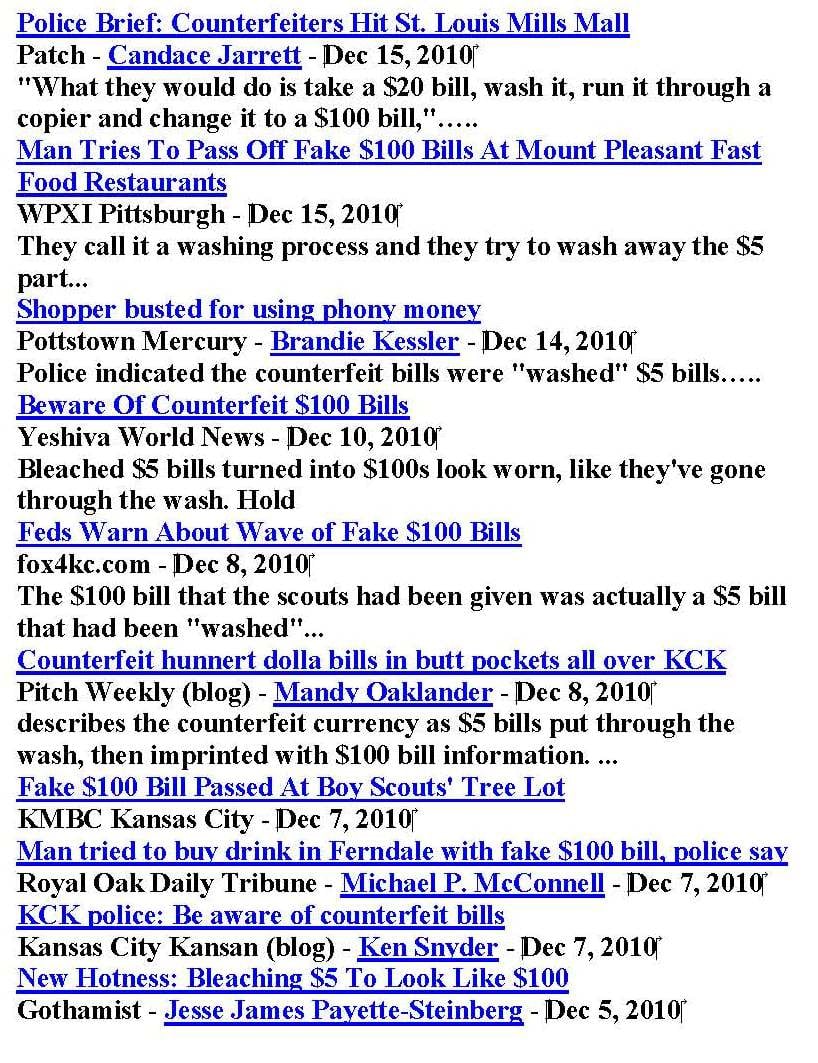

A few days ago, I typed the words “Washed $100 Bill” into Google News, and below is the first page...

Go into any of tens of thousands of restaurants, bars or retail stores these days, and chances are...

On the heels of last week's story about Australian airline tickets bought with counterfeit credit...

In an interesting Nov 25th article in Time Magazine, author Lucien Chauvin describes how Peru has...

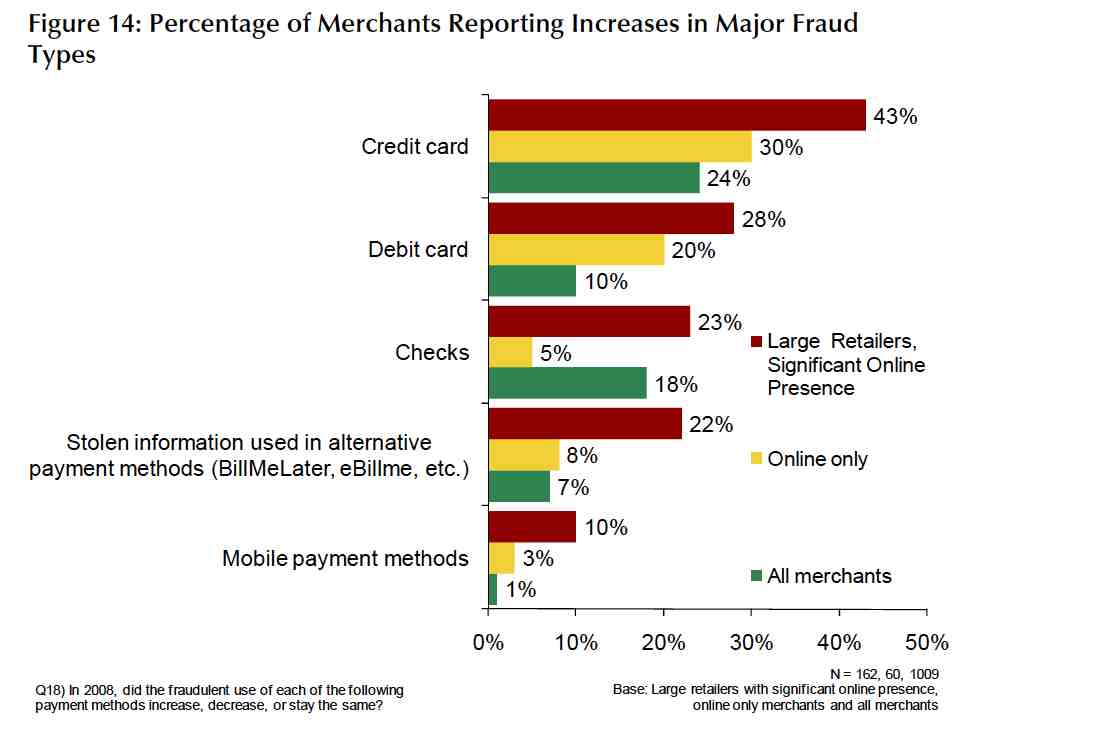

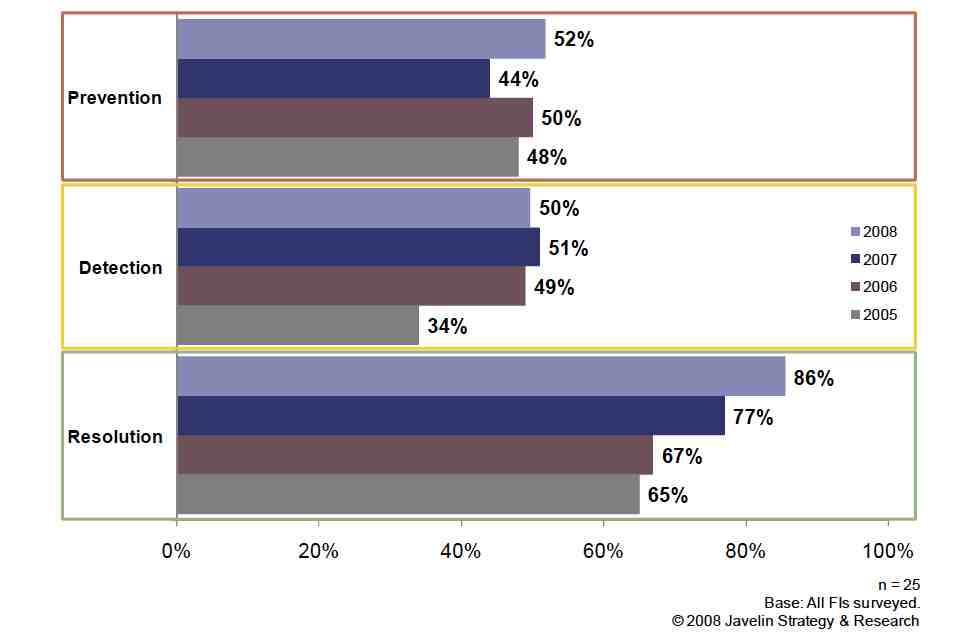

Out of the three groups affected by retail fraud – consumers, financial institutions and merchants...

We have mentioned in our previous posts that fraud committed on a stolen credit card affects three...

Recent articles in the Los Angeles Times and Inc. magazine discussed the release of a report from...

As we mentioned in our previous post, the impact of retail fraud on businesses and financial...

Rounding out our October spotlight on identity fraud and identity authentication, we have recently...

In continuing our September Mortgage Fraud spotlight, this week we are talking about the...

For anyone concerned about how mortgage fraud can affect them specifically, the LexisNexis...

It has been somewhat of an open secret that North Korea is the single biggest manufacturer of...

Hardly a day goes by without a news report mentioning identity theft or giving a heart-rending...

Fraud Fighter's Latest Innovation Passes the Test

We have talked in previous posts about international financial fraud as it relates to employment...

Mortgage fraud has been much in the news in recent years. After the dust created by the...

Money counterfeiting, as any other crime, doesn't stand still. Fraudsters continually evolve...

So far, we have been discussing the problem of counterfeiting only within the U.S., although it...

Earlier this week we discussed how financial institutions place improper focus on online identity ...

There’s a lot of semantic debate these days over what to name foreign nationals who violate U.S....

This past Sunday's Los Angeles Times featured an article quoting Fraud Fighter's own VP of Sales...

International Law Enforcement Takes-Down a “Top 10” Site

We mentioned previously the intaglio printing process that creates fine lines around the portraits...

(This is the third post in our counterfeit money series. The U.S. dollar printing machinery that...

In a startling revelation yesterday, one of the largest U.S. banks admitted in court that a...

As credit cards continue to supplant cash and checks as the preferred method of payment, credit...

We have mentioned here previously the new high-tech anti-counterfeitting features of the new $100,...

Big-box stores are a favorite target of fraudsters, because of the value of their products. So...

In another case highlighting just how widespread is the use of "washed notes", the Sacramento Bee...

In another great article on the National Retail Federation blogsite, Ellen Davis discusses return...

Ever since this past winter, we have been hearing from all sorts of businesses that the East Coast...

Burden, or Benefit?

Part 4 of a four-part Process for Setting-up a Red Flag Rules Compliance Policy UPDATING THE...

Casino environments are beset by opportunities to experience losses from counterfeit fraud....

Imagine for a moment you are a modern-day Al Capone. Through a combination of robbery, embezzlement...

Every day in the business world, organizations strive to be the best. They work to identify the...

If your organization is involved in the financial services industry, or in any way has a regular...

A recent issue of “The Week” magazine gave a nice overview of counterfeit money. The article...

This is the first in a series of articles discussing the challenges faced by casinos - regarding...

Part II of a Four-Part Procedure for Compliance with Identity Theft Prevention Requirements If your...

Part I of a Four-Part Procedure for Compliance with Identity Theft Prevention Requirements

For years, fraudsters have been efficiently producing credible counterfeit money using nothing more...

NRF Loss Prevention Blog Article In a very interesting blog article found an the National Retail...

.png)

.png)

.png)

.png)

.png)

.jpg)

.jpg)