PALIDIN DMV, a Driver’s License (DL) data verification check spanning 40 states, is now available as an additional check that can be added on to the PALIDIN system.

PALIDIN DMV augments FraudFighter's current market leading ID document authentication solution with its real-time and original-source DL data verification checks. The system verifies that your customer's unique record (name, address, DL#, etc.) exists within the issuing states' respective Department of Motor Vehicles driver database.

PALIDIN DMV is available as an extension module of FraudFighter's PALIDIN Desktop Enterprise and can also be easily accessed through our Mobile WebID and iOS / Android Apps.

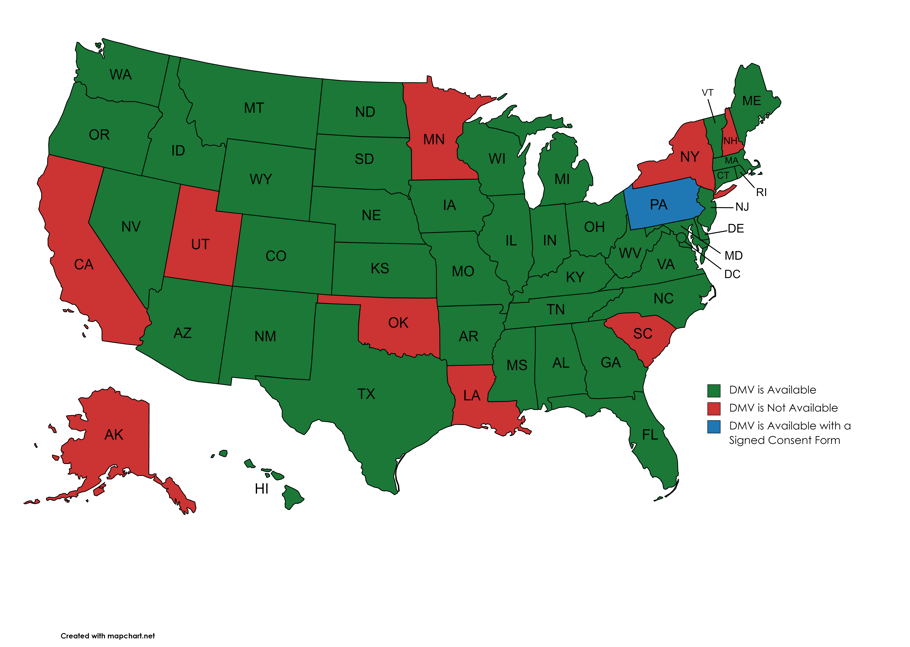

The green areas in the map below indicate the states where PALIDIN DMV is available today, with more states coming online in the near future.

Because PALIDIN DMV verifies DL data at the source, it is a more accurate and comprehensive data verification solution vs. other services that rely primarily on a consumer's phone number, email address, or credit check.

Other data-only or "Know Your Customer" (KYC) checks on the market only test knowledge of personal information that is unfortunately too easy for fraudsters to obtain, given cybersecurity breaches that have occurred over the past few years.

The PALIDIN DMV system operates at machine speed and at machine accuracy, driving a solution that sources identity data from the most trusted source - the original ID document, only after the document is verified as genuine and authentic. Potential human error and misinterpretation of results are fully removed from the system.

How it Works:

- Once a customer's DL is scanned into PALIDIN, the system forensically interrogates over 20 security features embedded on the ID document and returns a "Pass" or "Fail" authentication result within seconds

- PALIDIN then encrypts the DL data and securely pings the source state’s DMV, for a real time validation check of the presence of the customer record in the DMV database

PALIDIN DMV Provides the Accuracy & Flexibility your business needs

This powerful tool is available only when you need it, when the transaction process requires more information into who you're doing business with.

For example, auto dealers may just capture an ID scan for a test drive but may want to dig a bit deeper into a person's true identity before financing a $60,000 car. Before enabling sensitive access into an account, a Financial Institution may require additional layers of identity security, all without adding undue time and friction into the process.

After an initial ID scan / authentication, the customer record can be temporarily and securely stored within your infrastructure, to be called up again digitally for the final DMV verification check. There is no need to request another physical ID document scan from your customer, as PALIDIN DMV will pull from the original ID scan, and can then delete all PII per your security policies.

The PALIDIN DMV data verification can cost as little as a few dollars per scan and provides a benchmark of trust and assurance when combined with our forensic ID document authentication.

Talk to your FraudFighter representative today for more details on how easy and effective adding DMV verification checks can be to protect your business from fraud and loss.