For anyone concerned about how mortgage fraud can affect them specifically, the LexisNexis Mortgage Asset Research Institute has recently released their periodic "Mortgage Fraud Case Report", which details the fraud trends both in type and geographic region.

You can use the link below to download a free copy of the report for yourself. Meanwhile, here are several highlights of the report that should help you improve your fraud defense.

Where is mortgage fraud most prevalent?

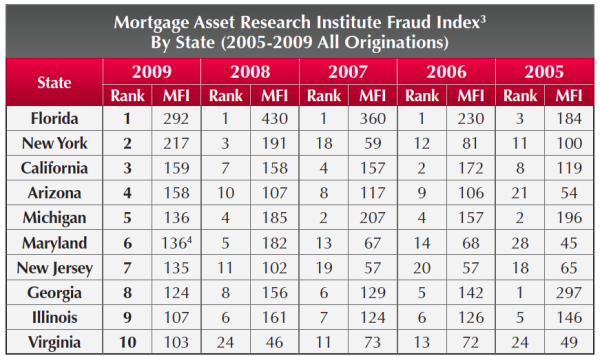

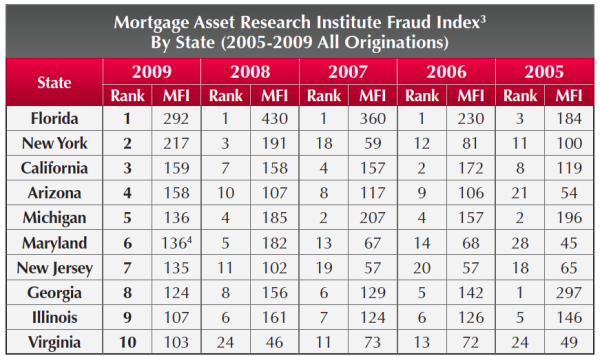

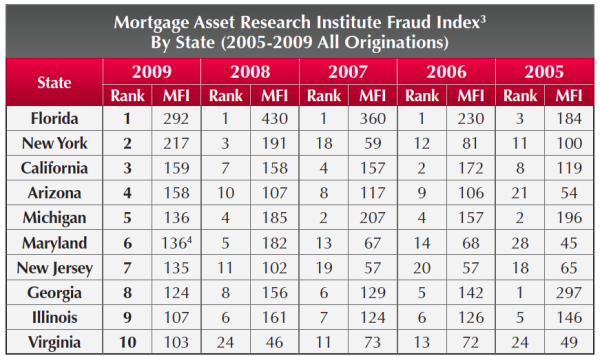

Note the answer to this is more complex than seems at first glance. The larger states naturally have more mortgage transactions, which of course means more fraud. Rather than take these basic figures, the MARI report calculates "expected" mortgage fraud based on the amount of loan originations, and then ranks states according to how far above they are from that expected number. Having crunched the figures, the report shows Florida as far and away the leader, with New York and California a distant second and third, respectively.

The Mortgage Fraud Index (MFI) number indicates how the number of reported fraud cases compares with the expected: at 100 it is exactly the same; at 200 it is twice the amount expected; and 300 three times as much, and so on.

What are the most common types of Mortgage Fraud?

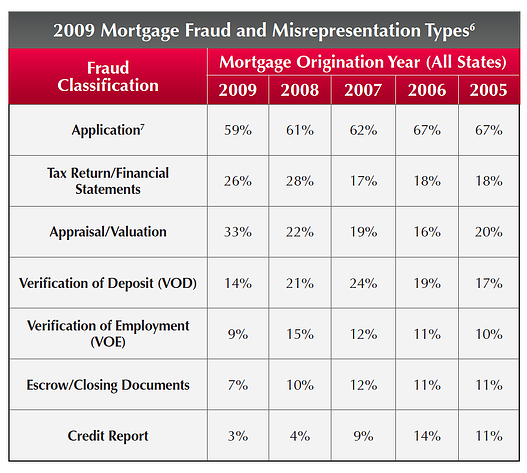

Though false appraisals and forged financial documents are making up an increasing amount of fraud, the overwhelming majority is still commited the old-fashioned way, through lying on applications. Borrowers use false identities or inflate their incomes to qualify for loans they have no intention to pay off.

The MARI recommends more rigorous verification of both. "Unfortunately (and rather unbelievably)," they note there are still "some lenders who continue to rely upon stated information and borrower sourced documentation."

A thorough identity verification process should be part of any rigorous verification process. Given that the verification technology is both unobtrusive and, compared with the costs of coping with fraud, highly inexpensive, there is no reason for lenders not to take a minute during the application to verify the applicant's ID -- particularly now when this ID can be all too easily stolen or forged.

As the old saying goes, an ounce of prevention is worth a pound of cure.

Download the LexisNexis 12th Periodic Mortgage Fraud Case Report