employee verification

If you are in noncompliance with Form I-9 requirements, your business could pay a rather hefty...

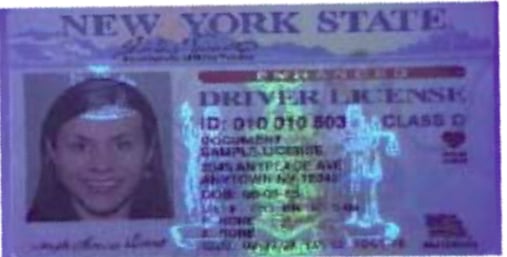

Accurate identification papers are essential to safeguarding financial and legal transactions as...

Anyone that has been in retail for any length of time knows that protecting your company's assets...

In a recent speech to the GOP faithful, Presidential Candidate Mitt Romney held up Arizona’s...

The world has changed much since September 11, 2001. Awareness of how fragile our way of life can...

As if it weren’t already difficult enough to verify identity documents, now comes a new wrinkle in...

There’s a lot of semantic debate these days over what to name foreign nationals who violate U.S....