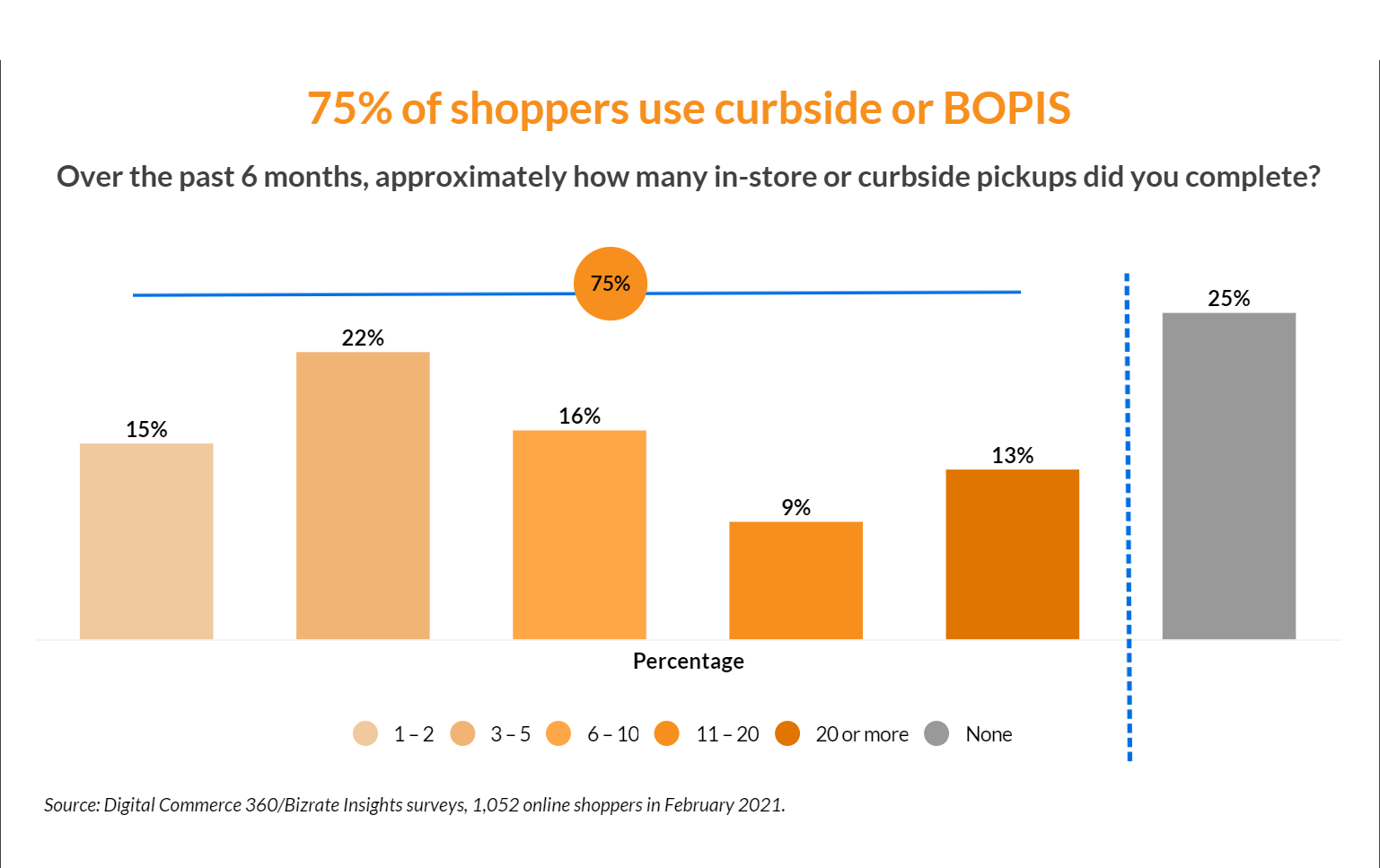

“Buy online, pickup in store” (BOPIS) has become ubiquitous. According to an article by Digital Commerce 360, the percentage of retailers offering curbside pickup increased greatly during the COVID-19 pandemic from single digits to the majority. Previously, only 6.6% of retailers included the option, but by early 2021 that number had grown to 50.7%. This shows that with the limits placed on indoor shopping by COVID-19 retailers were quick to adapt and provide more flexible solutions to their customers.

The implementation of BOPIS helped maintain customer satisfaction during the pandemic by giving shoppers a safer way to make and acquire their purchases. This process allowed customers to pay online with their credit card and pickup their items from the store at their convenience, whether this be in-store or curbside pickup. In BOPIS transactions, a customer typically only needs to show their ID to successfully pickup the item they paid for online.

Consumers have responded quite positively to BOPIS and many buyers still use it as a part of their regular shopping habits.

While happy customers are what every business strives for, BOPIS also has one big downsize, its vulnerability to fraud. This area of commerce is fraught with opportunities for identity fraud. Criminals can use stolen payment info to make an online purchase, and then present a fake ID at the time of pickup. Employees are often less trained in proper identity authentication and may struggle to catch a fake ID, especially during the quick interaction that comes along with a BOPIS transaction. An employee, presented with an ID, may not have the time or know-how to properly verify the validity of the document. Fraudsters are ready to capitalize on this vulnerability and can craft IDs that look and feel real to the unsuspecting eye.

BOPIS purchases aren’t the only ones in danger of being victim to this type of fraud. Any card-not-present (CNP) transaction presents a risk of identity fraud to businesses and bystanders alike. Whether a customer is planning to pickup at the store, a distribution center, or receive a remote drop off (ex. a large purchase such as a car) your business should plan to take the crucial steps to protect itself against this type of fraud.

Fraudsters may use stolen credit cards or stolen credentials and password combos when conducting a purchase online and when paired with a fake ID, the likelihood of them being caught at pickup or remote drop off is quite minuscule. In fact, according to a LexisNexis study in 2020, the percentage of total successful fraud attempts against mid & large sized retailers increased from 43% to 48% in just one year. Industry experts anticipate that this type of fraud will only continue to grow, the question then becomes how can a business successfully detect this type of fraud without severely disrupting the experience for their shoppers?

A quick and effective identity authentication solution is crucial to prevent identity fraud and still maintain customer satisfaction. By authenticating the identity of the person at the time the goods are being picked up or delivered, you can protect your business against these types of losses. UVeritech’s PALIDIN solutions come in a wide variety to meet the needs of your individual business.

PALIDIN is the world’s most advanced document identification and authentication system. Using proprietary technology, the authentication “engine” classifies, reads, and authenticates official credential documents more accurately and for a broader population than any other solution.

For a Fixed Location Solution (Warehouse or In-Store)

PALIDIN Desktop is perfect for a fixed location where customers come up to a counter before picking up their goods. PALIDIN Desktop conducts an automatic forensic examination of identity documents, often conducting as many as three to four dozen different tests to ensure that the authentication result is accurate. By using one of the specialized identity document scanners supported by PALIDIN, the desk worker can scan the ID of your customer. The PALIDIN software will then run multiple tests against the document to ensure it is real. Results will be given quickly, a seamless process for both business and customer alike.

In one incident, a car dealership using our PALIDIN Desktop solution had an ID image they scanned give a result of “invalid”. The potential customer left and then later emailed them another photo of the ID to try to prove it was valid (not taken through the PALIDIN scanner) and the information on the ID in the picture had been altered! The information captured in the initial scan on PALIDIN Desktop and the information details now showing on the emailed copy did not match likely due to some photoshoping on the part of the potential customer. Our client knew immediately that they had just avoided a costly fraudulent transaction.

For a Flexible Solution (Curbside or Drop Off)

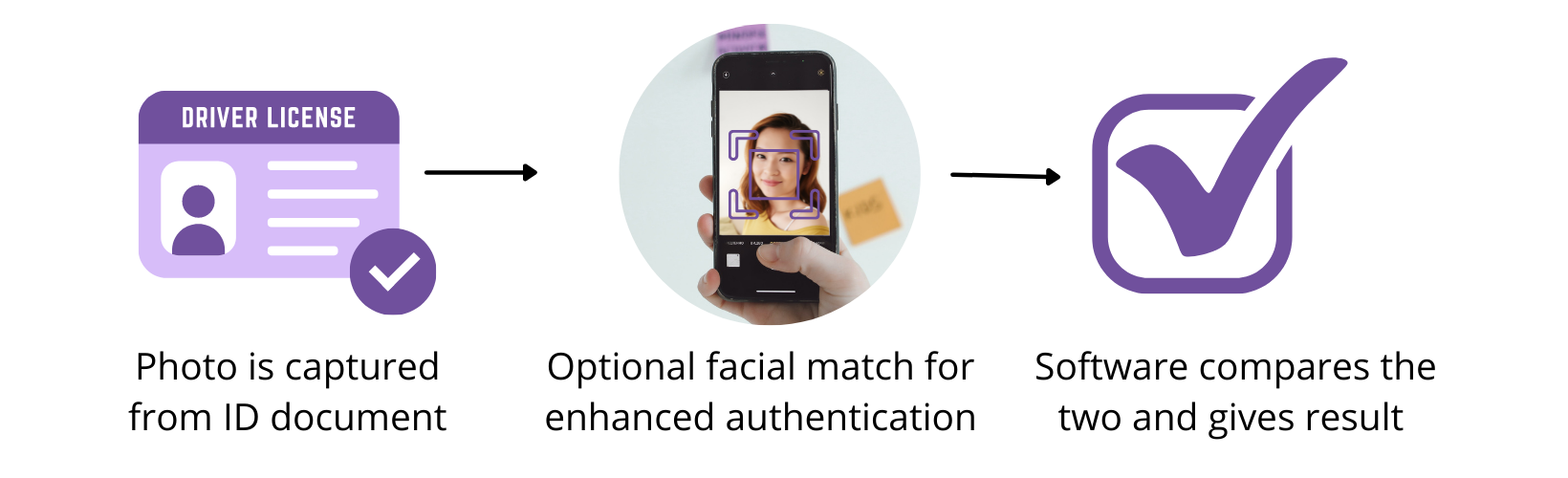

PALIDIN.Mobile uses the camera of a mobile device to scan the front and back of a customer's ID document. Our document authentication engine performs forensic-level tests to ensure the authenticity of the ID and cross-checks the personal data stored in the barcode against the printed information on the front.

This solution is perfect for quick desk-free interactions and works on both mobile devices and tablets. PALIDIN.Mobile’s flexibility makes it ideal for businesses in which the interactions with a customer may be at their car during a curbside pickup or in any other location in which a computer setup would be too cumbersome.