Good news from the front in the battle against identity theft! Well, somewhat good news. With an asterisk attached. The latest study conducted by Javelin Strategy & Research, a financial services sector consultancy, shows that after years of steady growth in number of victims and the dollar amount of losses, 2010 marked the first year identity fraud has decreased. But the picture is not all rosy: the average out-of-pocket cost for consumers has actually spiked up dramatically. This is not at all good news for retailers and financial institutions, as the newly-pinched victims will no doubt take out some of the frustration on them.

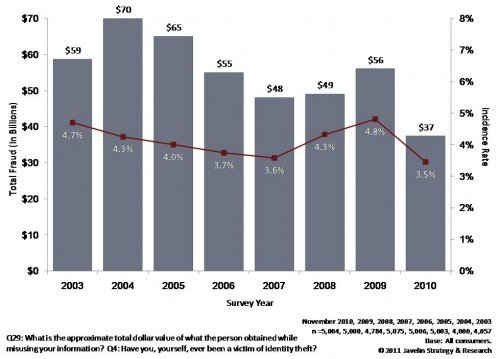

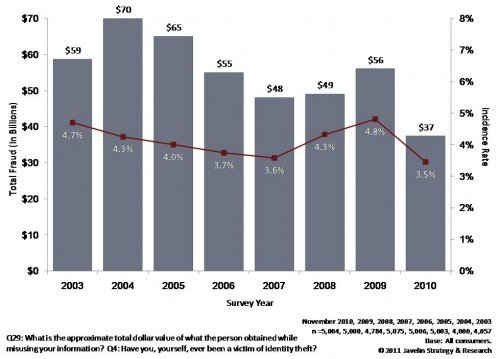

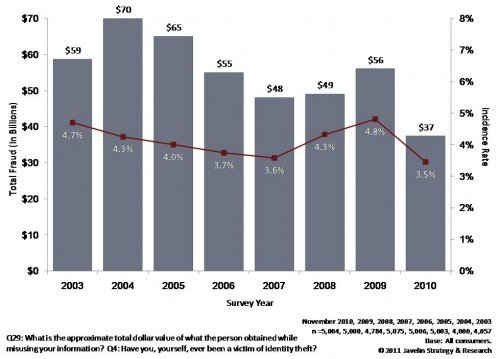

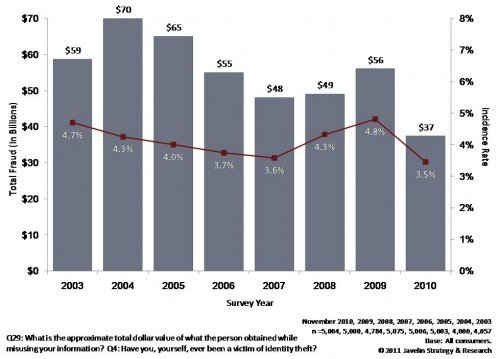

But let's start with the good news first. Last year 8.1 million adults were affected identity theft, a 28% decrease from the year before. The total annual loss from this fraud was the smallest amount in eight years, falling 34% from $56 billion to $37 billion. The proportion of the population victimized by identity theft last year was 3.5% – the first time since Javelin started keeping record in 2003 that it has been less than 4%. The mean fraud amount per each incident also slightly decreased from $4,991 to $4,607.

Javelin points out that a lot of this decrease is attributable to fewer big-time data breaches. As we have mentioned in several previous posts, it's inefficient for identity thieves to steal accounts one at a time – they prefer to maximize their efficiency by stealing by the thousands, or even millions, from large retail corporations or payment processors. Just a couple years ago, a single but well-performed hack netted the names, addresses and other personal information of 130 million financial accounts from Heartland Payment Systems, which processed payments from small and medium-sized restaurants. The size of the breach was nearly triple the previous record of 45 millon accounts lost by TJX companies, propriotors of Marshalls and TJ Maxx. More recently, according to Javelin, the breaches have fortunately fallen off, with 404 breaches exposing only 26 million records, compared to 2009 when 604 breaches exposed 221 million.

So much for the good news. Now onto the caveats: consumers affected by identity theft actually saw a rise in costs, due to the changing focus of fraudsters, which means they will 1) have less money to shop with, and 2) be a lot more cautious and selective where they spend it.

What accounts for the rise in the costs to consumer? Blame it on those pesky fraudsters again. They have shifted away from targeting credit cards and towards debit cards. Last year, 36% of fraud on cards in circulation was via debit; compared with 26% just the year before. And whereas most of the former carry zero-liability policies, meaning they reimburse the victims for any losses to fraud, most of the latter do not. As James Van Dyke, founder of Javelin, explained "The rise in the amount the average victim lost can be attributed to the cloning of credit cards in other people's names and rising debit card fraud, which usually take longer to detect and lead to higher losses." In other words, lots of effort and legalities have to be exerted to resolve debit card fraud. Hence the higher costs.

While this may mean less direct loss from fraud for businesses, it will almost certainly mean more indirect ones. Previous surveys of fraud victims by Javelin noted they tend to exhibit a 'once-bitten, twice shy' attitude, purposefully avoiding the businesses and places where that fraud occured. This is also evident in surveys of financial institutions' customers, which also noted, time and time again, that people place high value on fraud prevention policies.

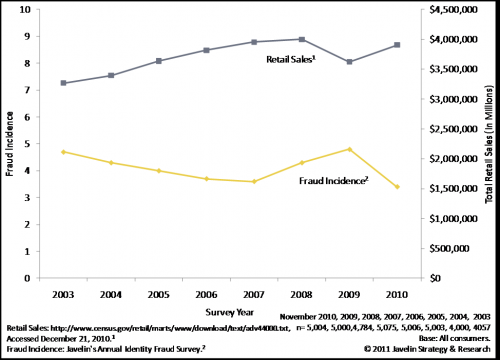

Finally, a word on some counterintuitive Javelin's findings within the retail sector. The incidence of fraud, in their research, has been “almost perfectly inversely mirroring retail sales over the past seven years”. As retail sales go up, identity fraud goes down; when sales are down, identity fraud goes up. There may be many explanations for this correlation, Javelin suggests, but the most likely is that the economy affects fraudsters as well. The report summary concludes this data “may indicate how the state of individuals’ financial conditions correlates to their likelihood to perpetrate identity fraud”. When times are tough, there are more people looking to make money through stealing others' accounts.

But while the overall trend is undeniably positive, the battle is far from won, Javelin and its partners noted. “In order to retain consumer trust and confidence, businesses must continue to take all steps necessary to safeguard data and educate customers” said Steve Cox, president and CEO of the council of Better Business Bureaus, which co-sponsored the study, in a press release accompanying the study. “Now is not the time to let up.” With over 8 million victims averaging nearly $5,000 losses each, now is indeed the worst time to let up.