Nearing the end of Q2 in 2023, it seems like fraud is already abundant. T-Mobile had yet another huge data breach putting over 37 million customers’ information at risk and it appears that $60 billion dollars of pandemic benefits may have gone to fraudsters instead of actual people in need. On the business side, predictions are that worldwide eCommerce Fraud will reach a staggering $200 billion this year.

To understand how we got here, let’s look back at what some of the biggest fraud trends were last year for both consumers and businesses alike.

An Overview of Fraud in 20222

Consumers

According to the FTC, consumers lost almost $8.8 billion to fraud scams, up 30% from the year prior. The FTC received over 5.2 million reports of fraud with the top categories of fraud reported being imposter scams, debt collection scams, and identity theft. For individuals, imposter scams ranked 1#. In these types of scams, fraudsters often impersonate government officials or businesses to trick individuals into sending money or giving away their personal information.

While consumers of all ages were impacted by fraud last year, it appears older adults were particularly vulnerable. The FTC found that adults aged 60 and over reported the highest median losses from fraud at $1,000 per person. Scammers often target older adults with imposter scams such as fake tech support calls or sweepstakes scams. These scams can be particularly devastating for older adults who may have limited financial resources.

Businesses

Signifyd’s The State of Fraud 2023 report found that in 2022 fraud pressure on businesses increased 34% from the year prior. Fraudsters continued to use multiple methods to game the system including account takeover fraud, synthetic identity fraud, and credit card fraud. These fraudsters tended to target high-end luxury items such as mobile devices, jewelry, automobiles, luxury goods, and more.

Luckily, last year wasn’t all bad news. While fraud attempt numbers may still shock, the good news is fraud prevention measures are working. In PwC’s Global Economic Crime and Fraud Survey 2022 they found that rates of successful fraud attempts reported by organizations have gone down 3% since 2018. By enhancing fraud protections, many businesses have substantially reduced their susceptibility towards fraud.

For businesses hit by fraud, the PwC survey found two forms of fraud were most prevalent: cyber fraud and customer fraud. While most industries had cybercrime listed at the top, there were two major exceptions, financial services and retailers. Both had customer fraud in the number one position. Warding off customer fraud is a precarious position for any business to be in, requiring that the balance between the client’s experience and fraud prevention measures is just right. Too strict measures could turn away legitimate customers or decrease customer satisfaction, whereas too little could lead to an uptick in fraudulent transactions. However, these measures are crucial to protecting a business’ bottom-line as well as consumers who may themselves be victims of identity theft.

Online Imposter Scams

The FBI’s Internet Crime Complain Center (IC3) has been tracking fraud trends and complaints from consumers for many years now. In the last five years, reports submitted by consumers show $27.6 billion losses, over $10 billion of which occurred just in 2022. The most prevalent type of crime? Phishing.

Email phishing scams are a type of imposter scam where fraudsters attempt to trick individuals into revealing sensitive information such as passwords, credit card numbers, bank information, or social security numbers. Phishing emails often appear to come from legitimate sources, such as banks or other financial institutions, and they typically contain a link that directs the recipient to a fake website designed to look like the real thing. Once the victim enters their information, the fraudsters can use it to steal money, commit identity theft, or make fraudulent transactions.

More recently, these scams have targeted employees and businesses by sending emails that look like they are coming from a member of the business’ organization. Some examples are emails that ask for updated W-2 information, claim that an employee is requesting their direct deposit information be updated, or an email from a “supervisor” asking for a purchase to be made. In their report, the IC3 found that $2.7 billion was lost to Business Email Compromise scams.

To avoid falling victim to email phishing scams, it is important to be vigilant and cautious when opening emails or clicking on links. One way for consumers and business to protect themselves is to always verify the sender's email address and look for any suspicious or unusual elements in the email, such as poor grammar, odd email URLs, or unusual requests for information. If the email is claiming to be from someone the sender knows, they should double-check with the sender via a different method of communication before replying to the email or clicking any links.

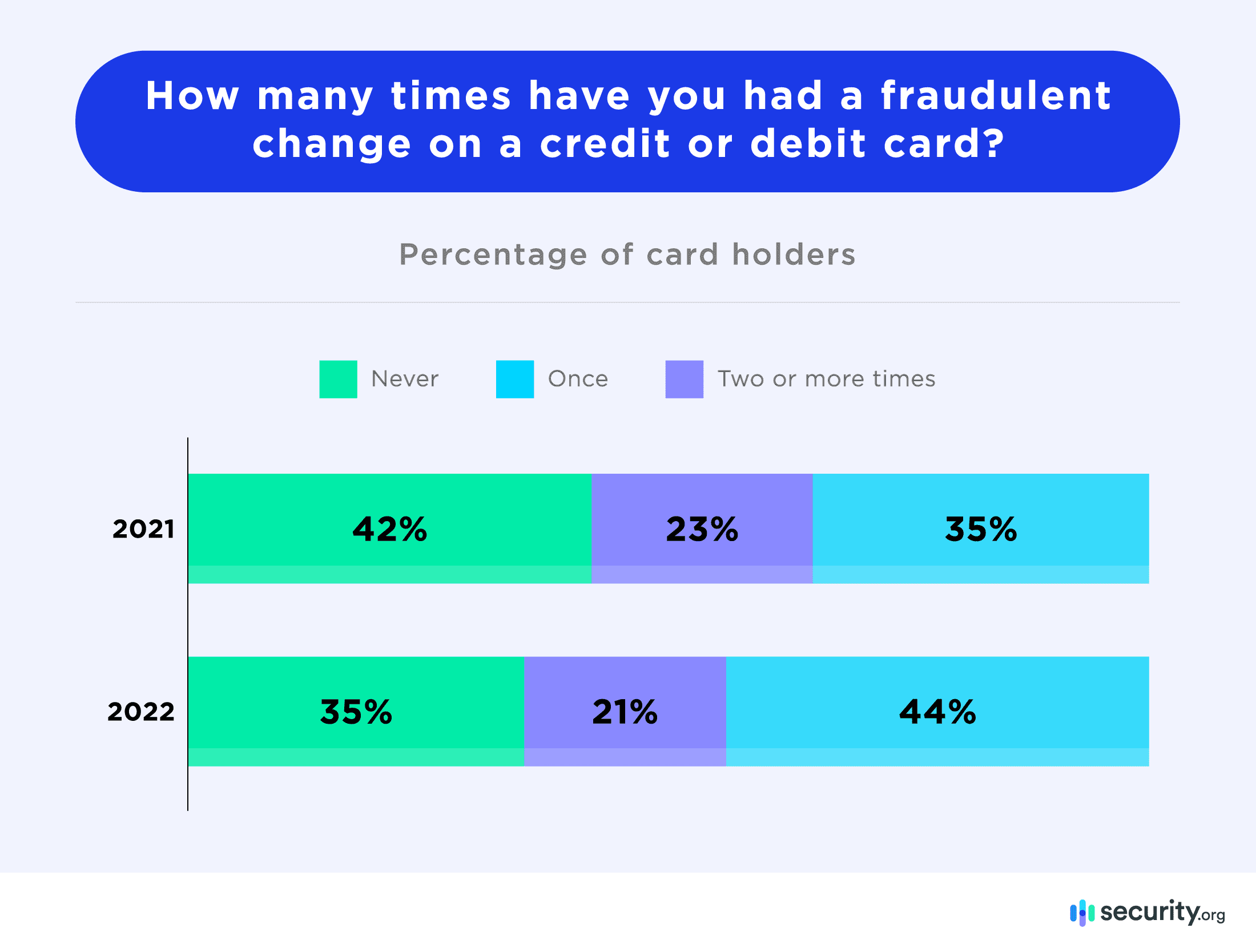

Unfortunately, many consumers can relate to the experience of having their credit card information stolen or compromised by a phishing scam. According to research done by Security.org, 65% of American credit and credit card holders have been victim to fraud in their lifetime. This is an increase from the 58% they saw in 2021.

Consumers can take several precautions to protect themselves from credit card fraud such as regularly monitoring credit card statements and reporting any unauthorized charges immediately. Many banks and financial institutions provide free email/text alerts to immediately let the consumer know when a suspicious transaction has appeared on their account. Consumers should also be cautious when providing their credit card information online and only use secure (HTTPS) websites.

Online Ecommerce Fraud

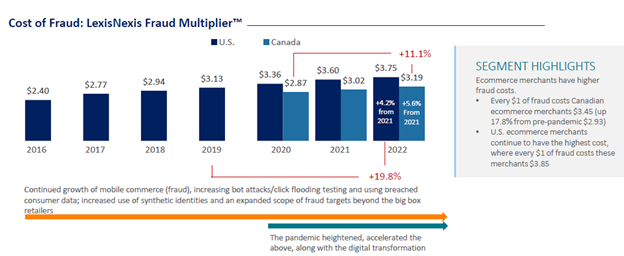

Running a business online not only opens the door to additional profits but also several types of scams. Fraudsters can target online businesses in a variety of ways, including through account takeover attacks, identity theft, and credit card fraud. Account takeover attacks occur when a fraudster gains access to a customer's account by stealing their login credentials through data hacks or phishing schemes. Once inside the account, the fraudster can make unauthorized purchases. These unauthorized purchases can result in devastating losses for a business. According to the LexisNexis 2023 True Cost of Fraud Study for Ecommerce and Retail, the cost of fraud for US merchants has increased by 19.8% since 2019. Each $1 of fraud cost US eCommerce retailers $3.75 in 2022.

Another way fraudsters can target online businesses is identity theft. By stealing a customer's PII, such as their name, address, and social security number, fraudsters can open new accounts or make fraudulent purchases. Criminals often target financial institutions first by creating a Synthetic Identity. Once they can establish substantial borrowing power, they then go to retailers to conduct fraudulent transactions.

Implementing Know-Your-Customer (KYC) procedures is an important step that businesses can take to prevent various forms of fraud. One simple way to do this is by including an identity verification check such as PALIDIN in your normal transaction process. PALIDIN is a fast and secure solution that businesses can use to authenticate the identity documents of their customers, no matter where they are. With PALIDIN, businesses can quickly and easily verify the identity of their customers, reducing the risk of credit card fraud and other types of financial crime.

Taking the extra step to prevent fraud not only stops criminal transactions but also helps build trust with customers. While we may think of consumers’ and businesses’ experiences of fraud as two separate things, they are often interconnected and when fraud affects one of them, it also affects the other. By doing their due diligence to make sure they KYC, businesses can help protect individuals who may be victims of identity theft while also preventing business losses.