One of the most vital questions that confront managers of public-facing operations today concerns the delicate balance between fraud and customer experience:

“How can we grow and expand our operations while mitigating fraud and retaining customer satisfaction and loyalty?”

The answers to this chronic problem do not come easy, especially for companies who conduct a portion, or all of their business via remote channels instead of in-person. Companies with online transactions are seeing vastly increasing rates of fraud and face complicated challenges clamping down on fraud while ensuring a friction-free transaction process for the consumer.

The online sales channel continues to grow. Digital US Commerce reported a growth rate of 32.4% in online sales compared to the year prior. While this is great news for online businesses, the reality is the competition of online vendors is increasing as well. In 2020, GoDaddy shared that they had seen a 48% increase in new subscribers just between the months of February and April of that same year, that's a lot of new business' entering the playing field. No doubt the COVID-19 pandemic played a huge role in the shift, but the trend is likely to be ongoing.

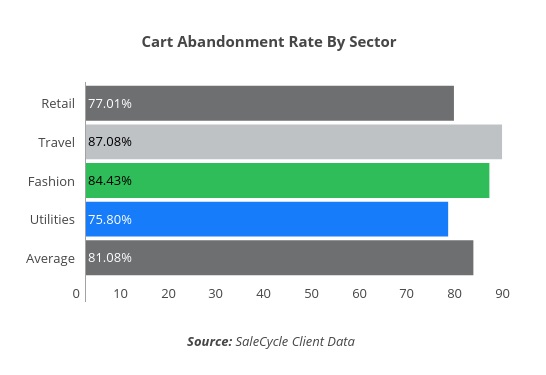

With a multitude of online options to choose from, it is critical that businesses provide a seamless experience for its users. SaleCycle.com reports that the retail industry sees on average a 77.01% Cart Abandonment rate. There can be several reasons for this, such as customers finding the purchasing experience too much of a hassle, making it difficult for a company to add additional steps of fraud protection that may be received negatively by consumers.

If a consumer experiences slower transaction confirmation times on a given website, this can cause purchase friction and dissatisfaction, which may lead to them exiting the merchant’s website before the transaction can complete. A single negative experience may cause customers to avoid that business in the future.

An even worse scenario would be if a customer was charged for a transaction that was abandoned, and never went through. This can result in chargebacks for the retailer along with very high potential for lost future business, given the bad experience. It is a continual challenge for remote channel merchants to manage the amount of necessary security friction to prevent fraud.

Conducting transactions online means that the retailer does not physically hand purchases to the customer and it’s not always clear if the goods have been delivered to a legitimate location. Further, not obtaining delivery confirmation (i.e., not getting signature upon delivery) can weaken merchants’ defenses against chargebacks, especially in the case of friendly fraud.

What are some crucial steps your business can take to prevent fraud?

1. Introduce a Multi-Layered Approach to Fraud Prevention

Instead of just focusing on one area of fraud prevention, here at FraudFighter we recommend targeting multiple areas. In doing so, your business can create a more seamless experience for your shoppers and better target fraud.

A study by Lexis-Nexis (The True Cost of Fraud Study, 2020) has shown that “Traditional verification checkpoints”, using physical attributes (physical address, date of birth, social security number, etc…), are less effective at detecting and preventing (the rising trend towards) organized fraud. This is particularly challenging for transactions conducted online or through m-commerce.”

Moreover, a report from a prominent retail security working group has determined that “a multi-layered approach that includes identity verification, identity authentication and transaction risk assessment can reduce false positives and the need for manual reviews.” Although identity authentication may not reduce the overall number of fraud attempts, it can reduce the level of successful fraud transactions and the associated costs of such losses.

2. Confirming Valid Payment

Credit Card fraud continues to rise, increasing even more with the plethora of online avenues for fraudulent transactions to take place. Furthermore, in a card-not-present (CNP) transaction, the merchant, not the issuing bank, is responsible for paying back a customer in the case of a phony credit card. As a result, online retailers experience a double loss when the fraud occurs, both losing the product that was shipped and the money required to payback the bank on behalf of the real cardholder.

It is critical to safeguard your ecommerce business against credit card fraud. One of the best ways to do this does not rely on validating the card itself (beyond the measures already in place), but rather identifying the person making the transaction. By ensuring that the identity of the person making the transaction matches the payment method given, you can significantly decrease your business’ credit card fraud risks.

3. Verify Identity

One of the, if not the most, important step in your multi-layered approach to tackling fraud should be the authentication of the identity of the person making the transaction. By using a sophisticated identity authentication tool (such as our PALIDIN solution) to ensure that the ID document provided by the customer is valid and has a name that matches the credit card being used you can greatly reduce the risk of a fraudulent transaction going through.

PALIDIN is a modular solution that presents a retailer a variety of options that can be customized to fit your operation’s needs. For ID verification, that includes the ability to check IDs against a global database to ensure legitimacy. What’s more, for consumer convenience you can select to have your customer be given the chance to create a reusable credential that can be automatically submitted for future interactions. Doing so can help eliminate that “hassle” element for repeat business. Viable options for this include providing facial images, voice-print recordings, and fingerprints. Other methods may include behavioral biometrics, such as how one types on their device, how much their hands shake while typing, walking/gait patterns, pressure on the screen when clicking and interacting with screen content, and more.

4. Mobile Verification

Taking identity authentication measures one step-further, our retail customers use our mobile, cloud-based solution, PALIDIN WebID, to ensure that a customer’s physical ID is real and also verifies that the person making the purchase matches the picture shown on the ID.

At this critical juncture in the CNP process, the software application – whether it is a shopping cart, online account management software or some other unique application – can prompt the user to enter their mobile phone number so that an identity authentication can be conducted. This will then allow an SMS (text message) to be sent to the client.

The SMS message will contain a link which will, in turn, open the PALIDIN WebID authentication solution. The client can then follow the steps to capture the images of the document as well as a live “selfie” to ensure that their identity matches that of the document. At this point, many potential fraudsters will drop the transaction, unwilling to take a photo of themselves in the midst of committing a crime.

While this may not be a friction-free process, the long-term benefits to both client and company can be enough to overcome the objections, especially for high-dollar transactions.