Preparing Your Business for the Fraud Liability Shift

In the previous post, we discussed what EMV and the fraud liability shift are as well as how it will affect businesses, especially small businesses. In this post, we will focus on helping you build a successful strategy that will protect your business from the upcoming fraud liability shift as well as discuss why this strategy will help protect your business from fraud.

A brief overview of the fraud liability shift

As a retailer, you’ve always been more annoyed than worried about fraud: if someone purchased products from your store using a counterfeit or stolen credit card, the only cost to you was the time used to report the fraud. However, come October 1, 2015, that is all about to change.mj n

Due to the increased security of EMV-compliant debit/credit cards, payment brands determined it would be appropriate to transfer the financial liability of fraud from them to merchants who accept the cards as a form of payment. In essence, because they have upgraded to a more financially secure standard, they decided they will no longer be on-the-hook to financially resolve fraudulent transactions occurring within the previous standard’s technological framework. In other words: if you don’t make costly, time-consuming upgrades to your POS system within the next few weeks, you could be liable for fraudulent transactions that, if large enough, could permanently cripple your business financially.

Upgrading to an EMV-compliant POS system will not be cheap by any means- depending on the size of your business, an upgrade could easily cost thousands of dollars and countless man-hours to implement. Consider Target™, for example. Since its 2013 data breach, Target has poured at least $100 million towards EMV compliance; and finally, after two years, they have finished upgrading the POS systems in all their stores. This begs the question: if Target, even with all its resources, still took two years and $100 million to upgrade its POS systems, what chance does a small retail business have to protect themselves from fraud liability in just a few weeks?

To upgrade or not to upgrade?

The most obvious option of protecting your business from the fraud liability shift is, of course, to upgrade your POS system to be EMV-compliant. However, as mentioned above, this option will not only cost a lot of money, but a lot of your (and your employees’) time as well: businesses can expect to pay between $300-$600 per POS terminal and spend dozens of hours training employees how to use the new POS terminals. These high costs of EMV-compliance are obviously more able to be absorbed by large businesses, but for small businesses, who make up 99.7% of the total number of US businesses, these are the kinds of costs capable of shuttering a small business.

If you find yourself doubting whether or not you can afford to upgrade your POS machines, you are not alone: about 57% of small business owners have cited the cost of a new POS terminal as the reason for their inability to be EMV-compliant by October 1st. It is estimated that small businesses spend, on average, less than $200 per year on upgrading their POS systems; and upgrading just one POS terminal to be EMV-compliant will cost at least double, if not triple, that. If you’re like most small business owners, an entire overhaul of their POS system is simply in neither the monetary nor time budget.

If you do not have the time or money to upgrade your POS terminals by October 1st, don’t worry just yet! There is a simple, affordable option: UV counterfeit detectors.

Affordable fraud liability shift protection

Recent research suggests that approximately two-thirds of small businesses have experienced credit card fraud, with seven percent of all card transactions being fraudulent. With such a prevalent level of credit card fraud, businesses would be smart to invest in a fraud prevention system even in the absence of the October 1st deadline.

A UV counterfeit detector is a compact, straightforward machine that houses UV lights capable of revealing security features embedded on credit cards that are naked to the human eye. The purpose of a counterfeit detector is not to detect fraudulent transactions as they are happening, but to prevent fraudulent transactions from even happening in the first place; before a credit card is even run through a POS terminal, a UV counterfeit detector will be able to tell you whether or not it is a counterfeit.

Having a preventative measure in place before the fraud liability shift will help to effectively reduce your business’s exposure to being financially liable- if you are capable of stopping fraud before it even happens, you can avoid the upcoming financial consequences of fraud.

The advantages of UV counterfeit detectors

Not only are UV counterfeit detectors a fraction of the cost of upgrading a POS terminal, they are also incredibly easy to learn how to use and to incorporate into your existing POS system. All you would need to do to use a counterfeit detector is place a questionable debit/credit card under the UV lights and match up the exposed security features with the established security features of that particular card. You don’t even need to hook it up to your POS terminal- it works independent of any POS system, is smaller than a shoebox, and does not require much maintenance.

In order to best explain why the preventative measure of a UV counterfeit detector is an incredible advantage, an overview of a couple of credit card security features needs to be given first.

Although criminals may be able to create counterfeit credit cards that look and feel real enough to bypass a busy point-of-sale employee, a couple of security features are incredibly difficult to mimic correctly and pass the scrutiny of a knowledgeable employee, especially when machines are used to detect their presence: the hologram and the UV logo.

Credit Card security features: the Hologram and UV Logo

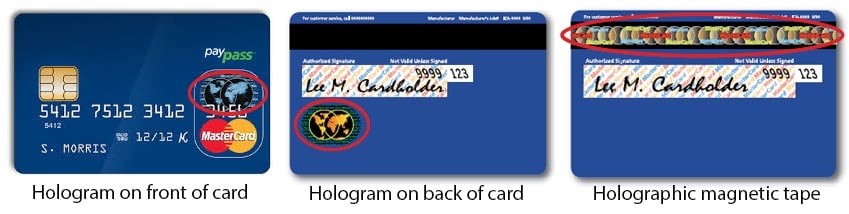

Most people are likely under the impression that the hologram found on credit cards are stickers – they are actually holograms that have been printed onto the cards using a special metallic film. The machines needed to create quality holograms are quite expensive, and even with the use of such machines, it is incredibly difficult for anyone except the most seasoned of criminals to replicate passable security holograms.

The location and size of the hologram differs depending on the credit card brand. MasterCard®, for example, has a few different designs for their cards: one design features a hologram of a globe on the front of the card, another design features the same hologram but on the back of the card, another design features a holographic magnetic tape. Although holograms are visible under normal light, UV lights greatly amplify the ability to see the details of holograms.

The holographic security feature is obvious, but many people are unaware about the ultraviolet ink security feature of credit cards. Depending on the brand of the credit card, a logo that is visible only under UV lights will be featured somewhere on the card. A VISA credit card, for example, will feature a V in the center of the VISA logo on the bottom right of the card (the card used to feature an eagle on the center of the card) when placed under UV lights.

Knowing to reference the handy booklet – included with the counterfeit detector – that lists all known holographic and UV-visible security features on all the major credit cards is the only training an employee will need to be able to tell if the card about to be used is a counterfeit. If the security features are different, non-existent, or located in another position, the card should be determined as a counterfeit.

To summarize, the advantages of using a counterfeit detector are four-fold:

- Prevention: even an upgraded POS system can’t prevent fraudulent transactions from happening in the first place

- Affordability: a fraction of the cost of upgrading a POS system or being financially liable for fraudulent transactions

- Ease of installation: there is no need to do anything to your current POS system- simply screw in the UV bulbs, plug in the power cord, and it’s ready to be used

- Ease of use: there are virtually no man-hours wasted training employees how to use a brand new POS system – employees need to know how to do is check security features on a credit card helped under the UV light against the listed security features found in the booklet

The additional advantages of counterfeit detectors

UV counterfeit detectors are actually capable of verifying security features beyond credit cards: they are capable of revealing the security features found on identification cards (ex: driver’s licenses), checks, and currencies.

Like credit cards, identification cards are produced with a variety of security features, especially the newer identification cards and driver’s licenses. Although you are able to easily see and feel some security features, such as the hologram and engraved signature, other security features, such as micro-printing or ultraviolet ink, cannot be readily detected without the aid of machines. It is these more hidden security features that are almost impossible to effectively counterfeit; in fact, they are so hard to produce correctly that the official manufacturer of the new California driver’s licenses initially had only a 20% success rate when printing the cards.

The ability to detect the security features on identification cards goes hand-in-hand with the verification of credit cards. Unless your credit card has a photo of your face printed on the card itself, you will be mostly likely asked to present identification along with your credit card when making a transaction. For this two-step verification reason, having a UV counterfeit detector is even more incredibly useful when it comes to credit card transactions. With a counterfeit detector in your arsenal, criminals will have to be ready with not only an expertly forged credit card but an expertly forged identification card as well.

Although paying with a check is a pretty uncommon sight in this day and age, with the rise in EMV-compliance, crooks might resort to good old-fashioned check fraud. There are not as many security features on checks, but the security features that do exist have been optimized for UV lights. When placed under a UV light, a genuine check will not glow like regular paper does, but rather, it will appear dull. Most checks also have security marks that can only be seen using a UV light; all checks issued by the government have intricate security marks. A good number of employees, especially those who are younger, probably do not have much experience handling checks during a POS transaction, and will not know if a check looks fake or not. Simply checking for security features under the UV light will likely thwart any attempts at fraud by check.

Lastly, the counterfeit detector is advantageous to have because it is also capable of revealing the hidden security features found on cold, hard cash. Just about every millimeter of a bill – whether it is the one dollar bill or the hundred dollar bill – has been enhanced by some kind of security feature; the newer bills have even more security features. Some security features are obvious, such as color-shifting ink, and some are more discreet, such as the watermark and the security thread.

One of the most common ways to check if a bill is counterfeit is to check its security thread. The security thread is composed of different colors of polyester, embedded vertically into the paper, and glows under UV lights. The fact that the security thread is a different in material and color, and embedded into the paper, makes it very difficult for forgers to recreate a bill that will pass scrutiny under a UV light. The location of the security thread is uniform according to denomination, making it incredibly quick and easy for an employee to check if a bill is genuine. Having a counterfeit detector streamlines this process even further by indicating where the security thread should be located on each denomination when placed under the UV light.

Although counterfeiting cash was a much more popular activity in the past, fraudulent cash transactions are still very much an everyday problem. Just four years ago, the Secret Service determined that they had removed approximately $261 million in counterfeit cash from circulation in just one year. Once EMV-compliance occurs, instances of counterfeit cash transactions will likely occur more and more frequently. After all, what business doesn’t accept cash?

It is unfortunate that the payment brands who are responsible for the fraud liability shift are not willing to help merchants afford the cost of switching over to EMV-compliant POS terminals. Yes, starting October 1st you will be financially liable for any fraudulent transactions if you do not make the costly upgrade to your POS system. But the upcoming fraud liability shift does not need to be a source of stress for you or your business; you are not without an option. UV counterfeit detectors give some power back to the merchant in the sense that he/she will have some kind of say over the method of verification and can prevent fraudulent transactions from occurring in the first place even without expensive upgrades or time-consuming training.

Ready to get your hands on UV counterfeit detectors? |

Want to learn more about EMV & the fraud liabilty shift? |

.png)