anti money laundering

This article was originally published on CBinsight.com The Best Way to really "Know Your...

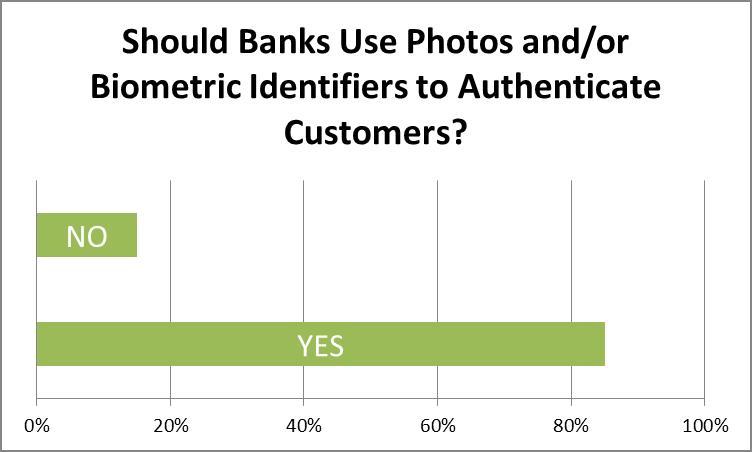

In a survey of financial professionals conducted last month, FraudFighter discovered that a vast...

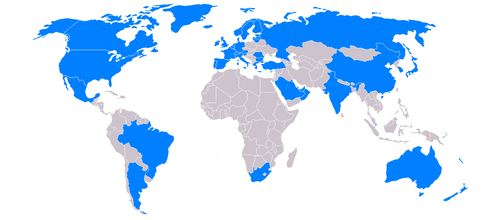

Bank Secrecy Act compliance is more important than ever to companies that deal with “covered...

To deter or prevent illegal activity including terrorism and money laundering, Bank Secrecy Act...

The Bank Secrecy Act or BSA requires a written Customer Identification Program (CIP) for client...

Passing Counterfeit Money Through Retailers is a Multimillion Dollar Industry Every year,...

If you have followed the news at all lately, you have likely heard that financial institutions of...

It is perhaps a sign of the times when the annual convention of anti-money laundering...

Scenario:A financial institution is opening a new branch, and is starting a major local PR blitz...

One of the biggest concerns of any financial institution – that is, any institution that routes...

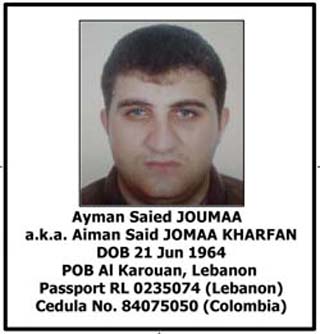

The last several weeks have seen a number of noteworthy arrests for money laundering. A fugitive...

The last decade brought about a tumultuous change in financial institution regulations. Many...

Mortgage fraud has been much in the news in recent years. After the dust created by the...

In a startling revelation yesterday, one of the largest U.S. banks admitted in court that a...