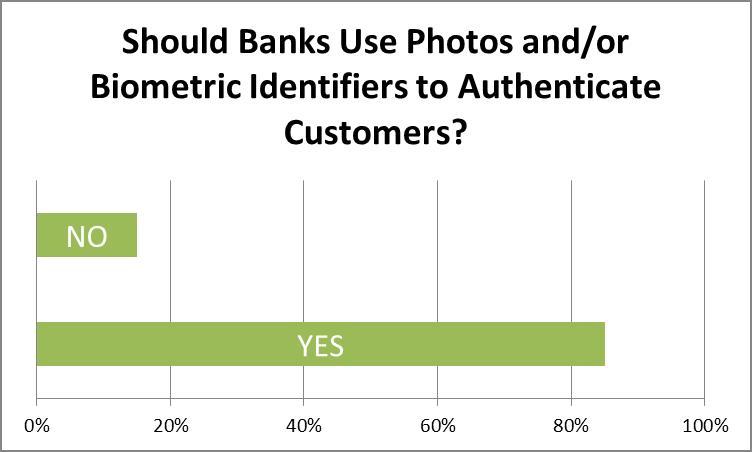

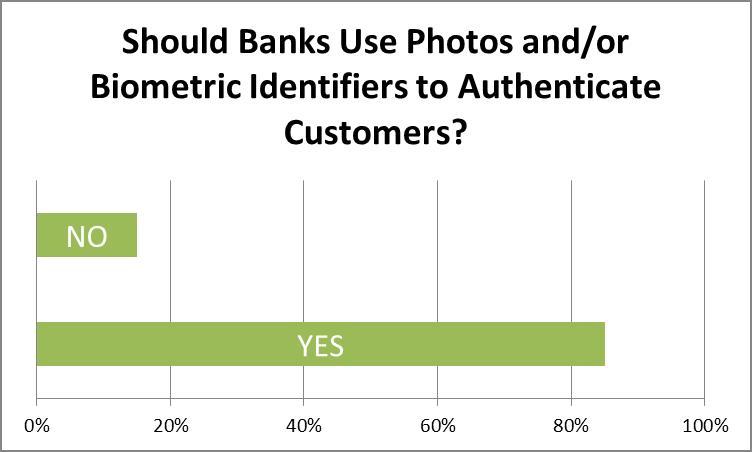

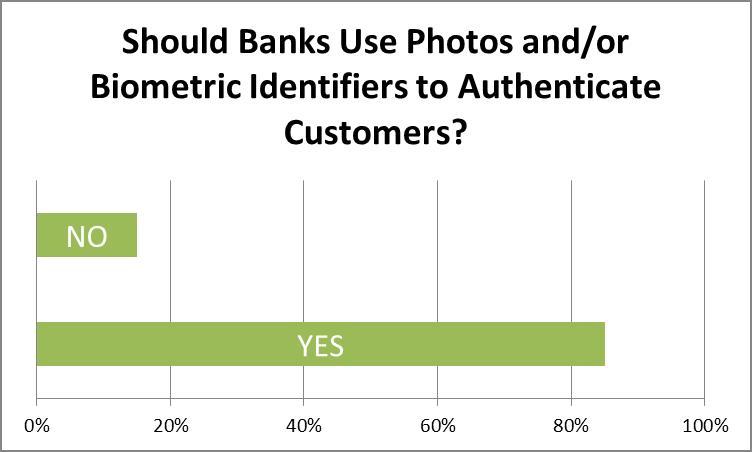

In a survey of financial professionals conducted last month, FraudFighter discovered that a vast majority - 85% - of professionals in the financial services industry believe that their branch operations ought to be conducting some type of identity authentication that utilizes photos and/or biometric verification.

In a survey of financial professionals conducted last month, FraudFighter discovered that a vast majority - 85% - of professionals in the financial services industry believe that their branch operations ought to be conducting some type of identity authentication that utilizes photos and/or biometric verification.

The survey was posted into numerous groups on LinkedIn that focus on financial technology and operations issues. Groups included AMLAC (Anti Money Laundering), Bank Managers, ComplianceEx, Financial Services Regulation, Fraud Control, Mortgage Fraud Prevention, Payment Systems Network, and several other professionally focused groups.

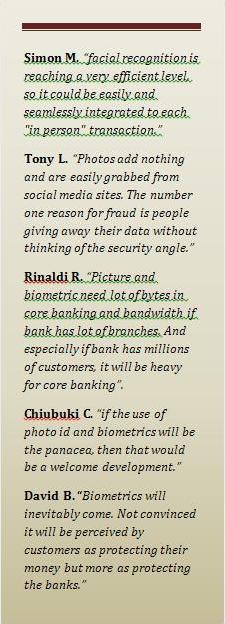

Participation in the survey was very high, and the discussions and comments were heated.

Why People Objected to the Idea

Most often mentioned as reasons why banks may fail to  adopt such technologies included

adopt such technologies included

- Cost - with some respondents expressing their opinion that the cost of implementing such a tecnological solution may be prohobitive; and

- Complexity - the danger of slowing down the transaction process. The fear that introducing new procedures into the transaction process will cause transactions to be delayed.

- Innefectiveness - references to credit cards and bank cards with photos on them having been largely ignored by retailers and others, and fears that even fingerprints can be "hacked" and replicated.

Why Most People Supported the Concept

Overwhelmingly, however, the opinions expressed by those who took the survey were that such measures are necessary. Banking and other financial industry professionals are well aware of the rising incidences of fraud involving stolen identity.

Identity theft "rings" have become organized. This means that there is now a capacity by organized crime groups to collate and assemble identity data acquired from numerous different sources. Hacked data from one event can be matched to stolen data from another. These "packages" of stolen identity data are then sold to distributors, who assemble individual identities, including forged ID documents. "Dark Markets" where these identities are sold can put the street-level fraudster's picture on the fake ID document, effectively allowing that person to assume the identity of another person.

Often included in the stolen data packages that are sold with these identity sets are passwords and answers to secret questions that have been hacked. This means that reliance on passwords, public record database questions, and even secret answer questions for securing individual's financial assets exposes both the bank and the asset-owner to potential loss.

For this reason, foreward-thinking managers of financial institutions are beginning to turn to advanced document authentication and biometric solutions as a means to thwart this new, intelligent breed of identity thief.