Earlier this year, a car salesman in Houston was kidnapped while taking a prospective client on a test-drive. The gory details include being beaten and thrown in the trunk of the car. Only through remarkable good fortune did he get away with only bruises.

A quick Google search shows that this event is not as rare as one might think. Although not a daily, or even a weekly, event, the fact is that sales people in the auto industry do put themselves into some jeopardy when they climb into the car with an unknown person and let them take the wheel.

The Deterrence Effect

At FraudFighter, we have been in the business of preventing crime for over 15 years. There is a simple lesson we’ve learned in that time.

The best possible result that any crime prevention solution can achieve is that the criminal decides they’re not even going to try to commit the crime at your establishment.

When they see your fraud detection procedures, the prospective fraudster determines the risk is too great, and choose to go elsewhere.

This is the deterrence effect and it is a great point of pride for us that so many clients report that they have experienced this when they use our products.

How MobilVerify Helps Auto Dealers

Deterrence is one major benefit of our newest product release, MobilVerify for Dealerships. With MobilVerify, the salesperson will have the power in their hands to authenticate the identity of the individual on-the-spot. Using a smartphone, or a tablet, MobilVerify will allow your salesperson to conduct this first and most important of fraud prevention steps before the potential criminal even has a chance to begin.

Much crime occurs because the perpetrator believes their actions can be conducted anonymously. The belief that they won’t be identified emboldens the fraudster to attempt their crime. They think that they can hide who they are by using disguises and fake identities. The simple act of stripping the anonymity away from the transaction can deter a significant number of attempted fraud events. Regardless whether the transaction is a simple credit card purchase, or an application for credit or a new account, this axiom holds true. Deprive the ability of the fraudster to hide their true identity – or to perpetrate their false one – and the odds of the crime occurring drop dramatically.

The process of definitively identifying your customers not only increases the safety for your employees, but also drastically reduces your exposure to stolen identity fraud. This category of crime has been identified by the FBI as the fastest-growing type of crime in America. Automobile dealerships have seen this rapid change in the dynamics of identity fraud first-hand, as they are targeted widely for credit application fraud.

Authentication of Identity Documents

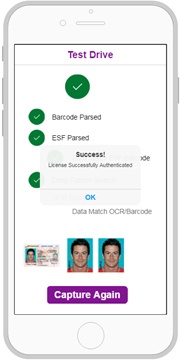

MobilVerify uses a two-step process to authenticate a driver license. First, the user captures the barcode from the back of the document. Data on the barcode is decrypted and parsed. This allows the software to identify the document type (for example, what state issued the document, what type of ID it is, etc.). The software is also able to capture the individual fields of data from the barcode, such as first name, last name, address, height, weight, document number, expiration date and so on.

Next, the video camera function of the smartphone or tablet is used to view the front of the license. Armed with knowledge of what type of document it is, the viewer is able to look for specific characteristics on the document. Approximately 60% of licenses contain an Enhanced Security Feature (ESF). This is a proprietary technology that allows an instant authentication. For the remaining licenses that do not have the ESF, a process of pattern-matching is conducted. The deep library of known design features and elements on each different document type enables this pattern patch to occur.

Overall, this process requires around 30 seconds from start to finish.

Archiving of ID Document Details

One of the benefits realized by users of MobilVerify is the ability to securely archive ID document data. The business use cases for this vary, but are dominated by the need to be able to produce evidence an authentication occurred, or to have evidence available in the event that an investigation is necessary.

Identity authentication records can be attached to specific transaction records. In this way, management can ensure that sales people are complying with rules regarding the need to authenticate IDs.

If a fraudulent transaction does occur, archived ID records can be provided to investigators, law enforcement and prosecutors to aid in finding and eventually prosecuting the perpetrator.

Integration of Client Identity Information

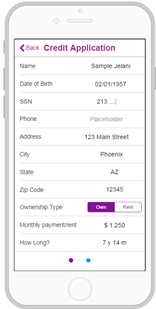

If the prospective client chooses to proceed with an automobile purchase, the time required to enter the individual’s details, and the accuracy of the data entered, can be improved by simply “pushing” the data read from the ID document into a credit application form.

Primary personal data can be automatically synced to a credit application form, and the sales rep or client can then manually fill-in the additional details, including Social Security Number, employment information, income, bank accounts or other required information. Each client application can be customized to their individual needs.

It would also be possible to simply push the personally identifying information into the standard credit application, and print it out so that the customer can then complete the form. We realize that making the jump to a fully digital credit application process might be a challenge for some organizations, so in this way, a hybrid process is enabled which can allow the dealership to potentially upgrade to a fully digital application process in the future, while still realizing some time savings by pushing client data into printed credit application forms.

Summary

MobilVerify steps customer authentication into the 21st century. The power of knowing who you are dealing with creates an environment of safety for your employees, and automatically reduces the likelihood that fraudsters will even attempt to perpetrate identity fraud in your locations.