fraud

You might be asking yourself; do I really need to pay for another service? Sometimes it seems like...

IDscan.net recently released a report, Fake ID Report 2023, which reveals crucial insights into the...

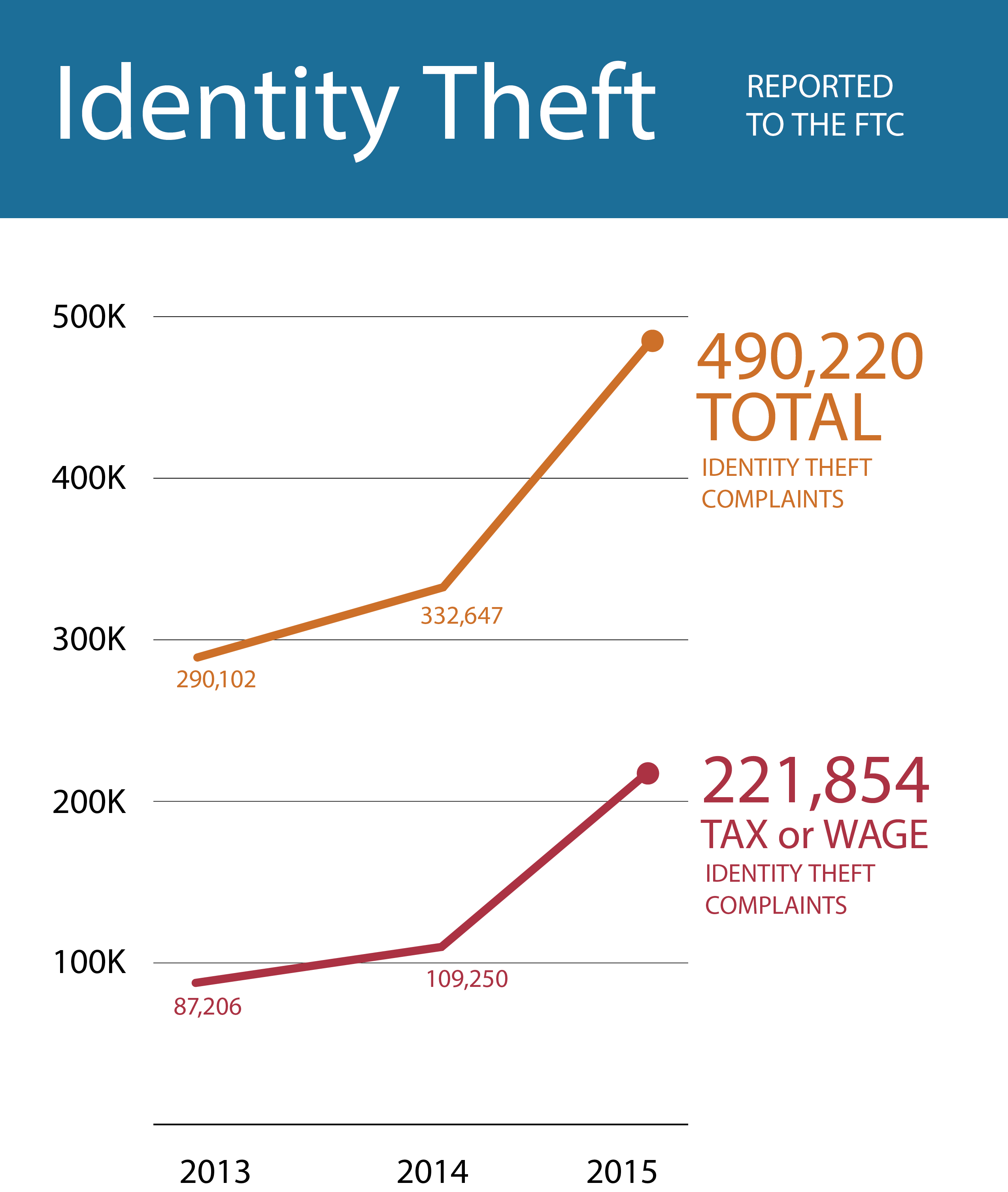

Identity theft cases are on the rise. Again. Year after year cases continue to skyrocket and are...

It is often said that the act of counterfeiting money is as old as money itself. No matter the type...

• TABLE OF CONTENTS •Common ATO Attack TargetsMillennials Seriously Question what Large...

• TABLE OF CONTENTS •What is New Account Fraud?New Account Fraud StatsThe Link between Identity...

• TABLE OF CONTENTS •What is Return Fraud?Return Fraud StatisticsWhy is Return Fraud such a Problem?

• TABLE OF CONTENTS •Consumer Behavior during the HolidaysHoliday 2015 Retail Stats ReviewHoliday...

An estimated 9 million American identities are stolen each year – it’s no wonder why identity theft...

Earlier this year, a car salesman in Houston was kidnapped while taking a prospective client on a...

If preliminary estimates hold steady, the amount of fraud victims and the total amount lost to...

It was last year that I heard a prominent loss prevention professional - a name that many in the...

If you’ve been paying attention to the news, you’ve probably noticed something: the rapid rise of...

For most, the start of a new year is a time to reflect on goals and positive changes. It is when...

Can you tell which twenty is fake? The twenty on top is real and the twenty on the bottom is...

It was only a decade ago that we lived in a 4G-less world – at an intersection of equal parts...

Traditionally, the day after Halloween has been reserved for the Catholic observance of All Saints’...

Before the advent of the internet, global electronic communications, and online databases, it was a...

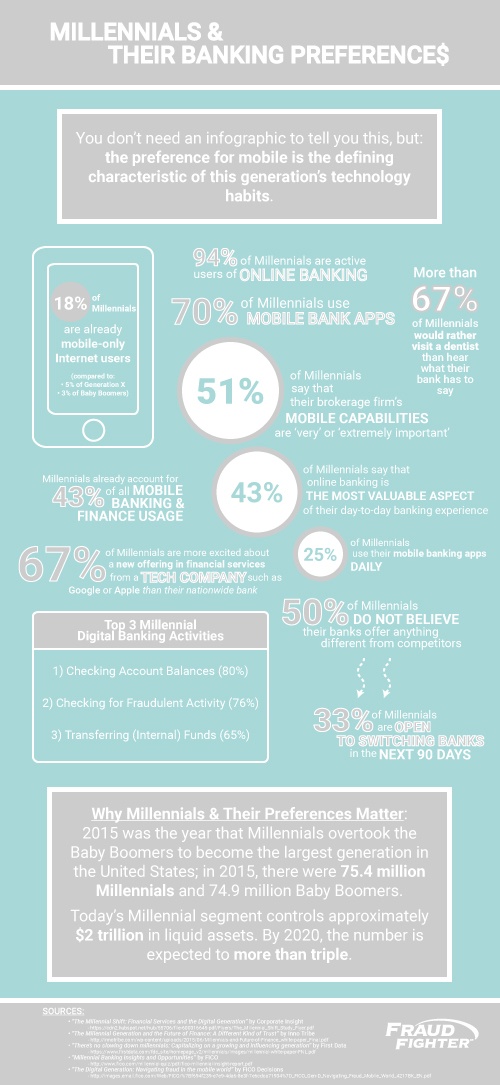

Like most millennials, if you left college tens of thousands of dollars in debt with looming...