Annoyed with Millennials? Well, Now They're Your Biggest Customer Base

An estimated 9 million American identities are stolen each year – it’s no wonder why identity theft is the #1 complaint amongst American consumers, according to the Federal Trade Commission (FTC).

Although dealing with identity theft and fraud is akin to addressing the elephant in the room – no one wants to do it – it is becoming increasingly important that businesses, particularly those in the banking industry, take the lead in providing fraud prevention solutions for their customers, lest they want to miss out on profiting from the biggest generation since the Baby Boomers: the Millennials.

Millennials, unlike previous generations, live and breathe technology. And this coupled with the fact that rampant rates of identity theft and fraud have left American consumers – no matter which generation they’re from – fearing identity theft the most whenever they’re online, means that preventing and addressing security concerns needs to be a priority when attempting to attract this upcoming technology-dependent generation as customers.

Who are Millennials & Why You Need to Pay Attention to Them

The actual years vary slightly depending on who you ask, but it is generally accepted that the Millennial generation describes those who were born in the early 1980s-early 2000s. The Millennial generation is usually painted with a broad brush, typically being described as something along the lines of: lazy, entitled twenty-something who still live at home with their parents.

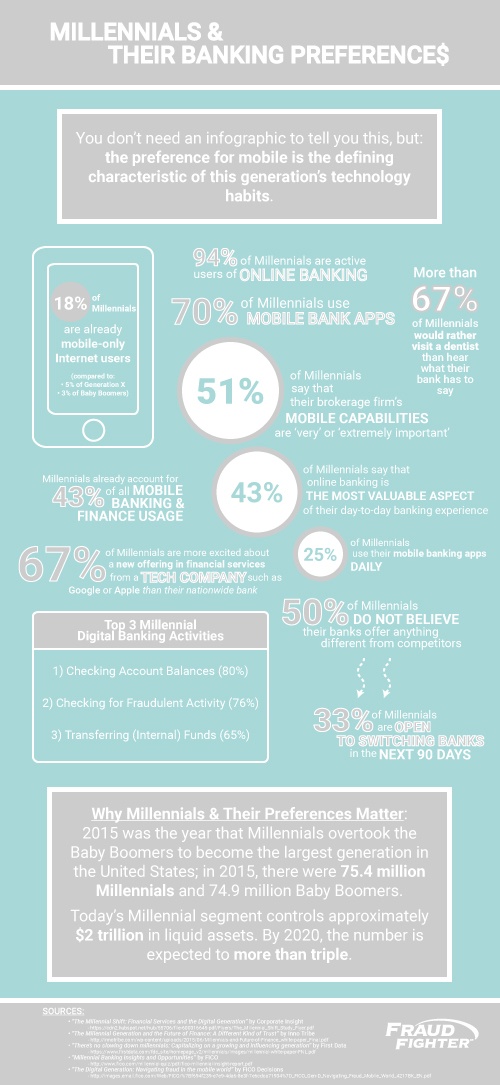

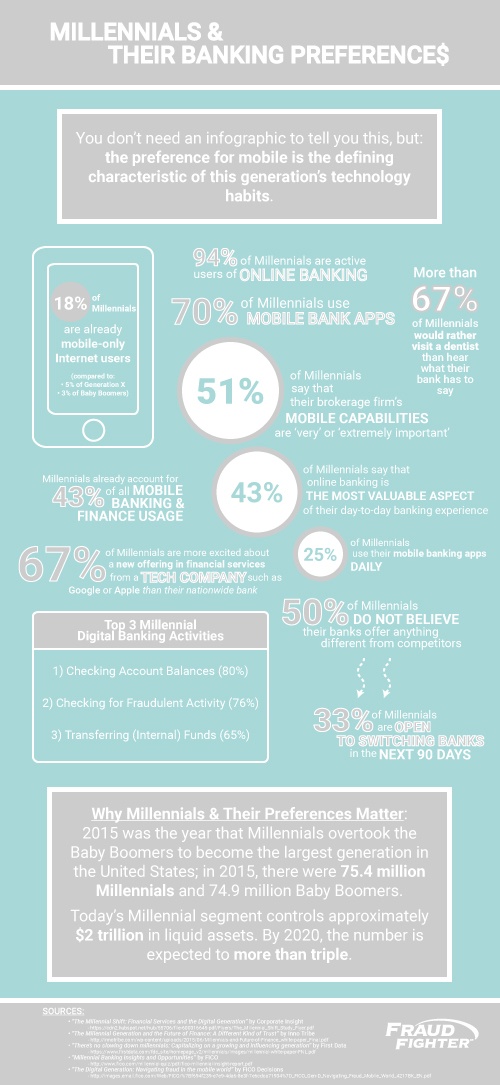

No matter your feelings about Millennials, you’re going to have to put them aside because they’re about to be your biggest customer base. In fact, according to the Pew Research Center, 2015 was the year that Millennials overtook the Baby Boomers to become the largest generation in the United States; in 2015, there were 75.4 million Millennials and 74.9 million Baby Boomers. As much as you hate to admit it, you’re going to need them. Soon.

“As the most numerous generation in American history, millennials are about to eclipse baby boomers in just about every way. Despite all of the buzz about twenty-somethings moving back with their parents, today’s millennial segment controls approximately $2 trillion in liquid assets. By 2020, the number is expected to more than triple. And that will get vastly bigger as millennials enter their prime earning years”

If technology hadn’t become so ubiquitous perhaps marketing to and reaching Millennials wouldn’t be that different than marketing to and reaching previous generations.

Being surrounded by technology since birth, Millennials understandably have an implicit trust in and affinity for technology, more so than they have for people or companies:

“[N]otions of trust are changing, and the concept has an entirely different sense for Millennials who have a greater trust in technology since it is integrated in their daily lives”

This preference for technology is immediately acute when it comes to finances, as one recent consumer research study showed: “Millennials prefer to work with their bank through a phone – on-demand – via mobile app.” The most concrete assumption about Millennials is that not only are they technologically saavy, they know how to use technology to make their voices heard.

Millennials are not simply using technology for posting pictures of selfies and watching how many ‘likes’ they receive – they are using technology, namely the Internet and the devices that connect to it, as a “digital megaphone” with which to lavish praise or air grievances directly to companies that cross their paths. Millennials understand that because of technology, they are both the first generation with a direct line to just about any CEO and the first generation to have the power to influence, in real-time, the directions of companies.

Put another way, Millennials are a generation that trusts technology than the empty promise of a comfortable future.

“Millennials share their experiences via social media and digital channels, which means they’re using a digital megaphone that greatly amplifies their opinions and perhaps influences the opinions of others. When Millennials are positive, they will recommend a bank, open additional accounts and essentially assist in promoting the bank. When negative, Millennials will close accounts and chronicle their experience online.”

Don’t believe that Millennials have the power to make or break a business, even established ones? Read: Sea World.

When the biggest generation has been given the ability to have their voices heard by anyone at any time, you have to be ready to listen.

Millennials' Preferences

Just like any other generation, economic circumstances heavily influenced the preferences and perceptions of the Millennial generation.

The most important thing to keep in mind about Millennials is that they “have different preferences from their Boomer parents, particularly when it comes to financial products, technology and the way they interact with companies”, largely due to how they perceive the future.

| Millennials: The Present and Future |

|---|

| • 60% of Millennials cannot afford housing |

| • 67% of Millennials believe that there’s no Social Security left from them |

| • <33% of Millennials think that they will have enough money for retirement |

| • 96% of Millennials spend at least 50% of their income on rent (• 77% of Millennials are willing to live with at least 2 roommates) |

| • 42% of Millennials said they are interested in helping companies develop future products and services |

| • Are set to inherit $30 billion from Baby Boomers but 57% of Millennials say that inheritance won’t change their spending habits |

For a great deal of Millennials, their youth was shaped by the financial crisis at the turn of the century and further molded by the subsequent sluggish economic recovery that we still remain in today. Maybe it makes sense why Millennials are known to be self-centered: they know what it’s like to live in a world in which a better future is not promised. In other words, Millennials have to confront a different future than the future their parents confronted, and so, their preferences and choices are understandably different than their parents’ generation.

“[A]mong Millennials, there is broad agreement across major demographic subgroups that today’s young adults face greater economic challenges than their parents’ generation faced when they were starting out”

- Pew Research Center

Essentially, for Millennials, “yesterday’s the past, tomorrow’s the future, but today’s a gift”, and technology is how they will make most of their day. To Millennials, technology is and needs to be practical as well as affordable. Millennials view technology not only as a time-saving convenience, but also as an essential part of saving money.

Take a look at the infographic below detailing the preferences of Millennials as well as how they differ from previous generations:

Even if you remember nothing else from this post, you need to remember this: Millennials live and breathe technology. Your company must embrace and continuously implement new technologies if you want stay in business.

How Millennials React to Fraud & Why They React the Way They Do

“According to a Deloitte Center for Financial Services report, 54% of consumers under 35 years old are concerned about the security of mobile devices for banking purposes.”

Even without the looming presence of Millennials on the horizon catalyzing technological developments, the issues of security and fraud for banks and businesses in the financial sector need to be dealt with immediately. It can’t be a surprise that all consumers, including Millennials neither want their identities stolen nor do they want their accounts being used fraudulently.

“Data breaches and card theft are consumers’ top safety concerns. Consumers want the power to proactively protect themselves against fraud and other account misuse.”

As mentioned in the intro, 9 million American identities are stolen each year. This means that transactions – retail purchases, transferring funds between accounts, and the like – need to be secure, with layers of fraud protection. Because, as mentioned in the section above, Millennials are not only unafraid to use the power of social media to complain about companies’ mistakes, but also, do not have brand loyalty when it comes to banks.

“All it takes is one fraud incident, whether it’s identity theft, lost or stolen information, ATM skimming or a compromised account to send those Millennials packing”

–FICO survey

| After a bank experiences a fraud incident: |

|---|

| • 22% of all US consumers will close all accounts with the bank |

| • 29% of all Millennials will close all accounts with the bank |

| • 21% of all Millennials would actively discourage their friends and families from using the bank |

| • 25% of all Millennials would make negative comments on social media (Facebook, Twitter, Instagram, etc.) |

As Alex Matjanec, CEO of MyBankTracker points out, “The tolerance level is so low.”

“When Millennials are positive, they will recommend a bank, open additional accounts and essentially assist in promoting the bank. When negative, Millennials will close accounts and chronicle their experience online.”

In other words, if you are a bank: if you have any hiccup that isn’t handled correctly with the utmost care, you will need to be prepared to deal with the onslaught that is the PR nightmare that can only be induced by the Millennial generation.

What Millennials Want (Out of Financial Technology)

“Millennials know they have options when it comes to banking. They’re not shy about demanding a relationship that works on their terms.”

Of all the things said about what Millennials are or are not, the one thing Millennials are not are uninformed consumers. If anything, Millennials will put a lot of effort into researching a product before purchase, more so than any other generation. And this is all because Millennials trust one thing above all else: technology.

“Millennials trust technology, even more than face-to-face relationships and the ‘bricks-and-mortar’ user experience, [and so] they are looking for entirely new digital products that are relevant to their daily lives.”

If you are in the banking or financial sector, making sure that Millennials can confidently place their trust in your technology is the key to your survival in the Millennial future.

According to the Millennial Disruption Index study: “[T]here is no escaping the impact that this generation will have on demand for financial services, and the changing character of their delivery.”

More precisely, the two main challenges facing banks right now are customer acquisition and enhancing user experience, both of which not only go hand-in-hand but also “face reinvention in the light of drastically different consumer preferences . . . At its core, this change is driven by a number of technological factors, including mobile, social, data, and design.”

Enhancing user experience is how banks will be able to acquire Millennials as customers. And how is user experience enhanced for this generation? Trustworthy technology.

Fraud Prevention via Mobile Apps

You don’t need a study to tell you that Millennials are quite attached to their mobile devices. As more and more Millennials enter the workforce, their demand for financial technology - namely those that will enable them to easily and confidently manage their finances from their smartphones - will continue to rise.

“The mobile customer experience will become the critical competitive battleground for financial service firms.”

As explained above, trust in financial technology needs to be able to address customers’ fears about identity theft and fraud. And since “Millennials are far more likely to close accounts and switch banks when they have a negative experience related to fraud”, making sure that banking technology, such as mobile bank apps, have fraud prevention measures in place is key.

“Consumers are looking for greater protection from fraud and sophisticated identity theft. . . . Combined with the sharp increase in ATM compromises, it’s clear that fraud prevention and communication are more vital than ever.”

– TJ Horan, vice president of product management at FICO

Of course, researching and investing in fraud prevention technology won’t be simple or free, but banks that don’t will soon fall by the wayside because businesses, no matter what industry, cannot afford to miss out on acquiring the largest generation thus far as a base of customers.

“Marketing to and serving this young generation represents a major challenge for financial service firms, but one they cannot afford to ignore given the sheer size and future economic muscle of this group”

Banks that embrace technology the way that Millennials do will come out on top:

“Millennials will influence and generate demand for FinTech innovation in firms at both ends of the market cap spectrum. Understanding this emerging and dynamic customer segment will separate the leaders from the laggards in financial services over the next decade, and could help build competitive advantage. Being part of this generational shift will not only be exciting but will also be exceptionally rewarding for those firms that are able to attract, retain and delight Millennial customers.”

At minimum, banks need to make sure that all technology they release, especially mobile apps, have some level of fraud prevention technology, such as image capture technology, in which the Millennial generation, can build trust.

“Financial institutions ought to take the long view of their mobile app strategy, which makes this question too important to ignore: what is our app doing differently to protect the customer from data fraud? A mobile app can have the coolest of features but won’t have staying power with this group – or any group for that matter – if it isn’t secure. This is where layered security such as tokenization, encryption, and fraud detection services are going to be a necessary piece of the value proposition. . . . If the technology behind the scenes doesn’t work, and work across a variety of channels, then it won’t be doing its job. . . . advances in predictive analytics and image capture technology are making digital “faceless account enrollment” a reality.”

.png)