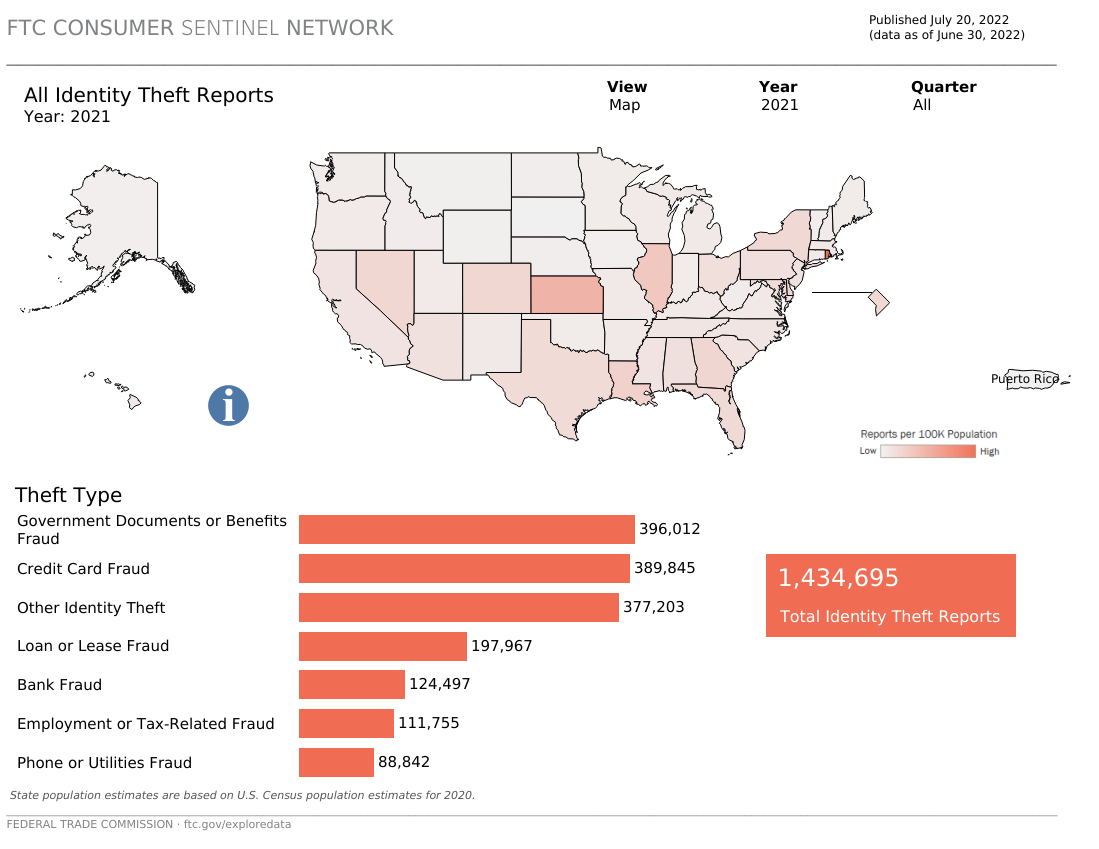

Identity theft cases are on the rise. Again. Year after year cases continue to skyrocket and are not predicted to decrease anytime soon. The ID Theft Center reported that fraud and scam reports in 2021 reached higher levels than any previous year since they began collecting the data back in 1999. According to a map created by the Federal Trade Commission Identity Theft Reports in 2021 reached an intimidating total of 1,434,695 for US Citizens.

Which brings us to the question, why is this type of theft so prevalent?

To fully understand the abominable mind of the criminal, we will take a deep dive into the methods used for thievery against unsuspecting citizens and businesses alike. Then we will examine the ways in which they use stolen identity to their benefit.

How do fraudsters steal your information in the first place?

Fraudsters are after your Personal Identifying Information (PII), such as social security number, name, address, DOB, driver’s license number and more. These can be used by the thief to commit a variety of different types of crime. Unfortunately, there are numerous ways in which PII can be stolen. While we may live in a digital age, the methods used by thieves to steal identities can often be more reliant on tried and true “analog” methods such as:

More frequently, identity thieves have utilized cyber methods to obtain valuable PII data such as:

What motivates identity thieves?

Criminals may have multiple motivations for stealing someone else’s identity. While some may use another’s identity to cover up a crime they already committed, others may steal the info for personal reasons. However, it is much more likely that they are driven by the financial incentive - as the stolen PII can give them ways to commit various types of lucrative financial crimes.

What do identity thieves do with your PII?

There are several ways in which an identity thief can use your PII. Below are just a few examples of crimes they might commit:

The toll of identity theft

For an individual victim, ID theft can result in lasting financial, emotional, and physical costs. It can sometimes take months to resolve credit and financial issues that arise when someone has made fraudulent use of a stolen identity. In some unfortunate cases, finances lost due to the theft cannot be recovered. The stress induced by such an instance can lead to emotional and physical exhaustion and may affect the individual even after the situation has been resolved.

Even Children are frequently targeted by identity thieves. In fact, in many cases, a child’s identity is the ideal target for the professional identity thief looking to build a synthetic identity, because a child’s PII profile is a blank slate - they have yet to take out loans or open a credit card and are therefore less likely to be flagged as fraudulent when being used to open a new account. Also, any fraud committed on a child’s identity is unlikely to be discovered for years – perhaps not until they themselves apply for school loans or a credit card in early adulthood. Often the thief is someone the victim knows personally. However, with the increase in online and social media usage, virtual thieves are becoming more common as well.

Businesses do not get off scot-free either – financial institutions, rental agencies, retailers, online businesses, and other organizations are increasingly feeling the effects of identity fraud. Criminals can open fraudulent bank accounts or use stolen credit card information to make illicit purchases. These actions can result in significant financial losses for the business and potentially severely damage the trust from the company’s consumer base.

Luckily, introducing Know-Your-Customer authentication steps into your business’ processes can greatly reduce the risk of fraud. Such identity authentication practices could include using a secure and fast solution such as PALIDIN, which can quickly authenticate the identity document of your consumer no matter where they are.

.png)