Two very important studies delving into fraud reports from 2010 were issued recently. The first, a Lexis-Nexis annually-released paper examined trends in

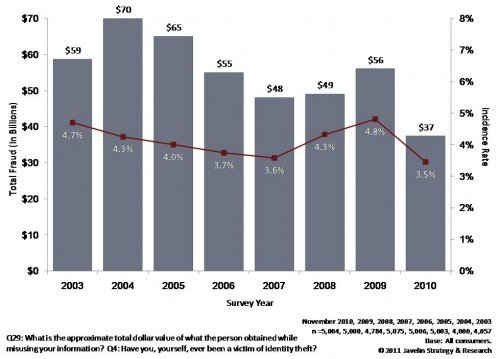

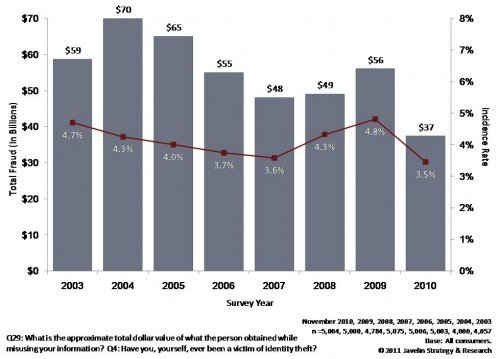

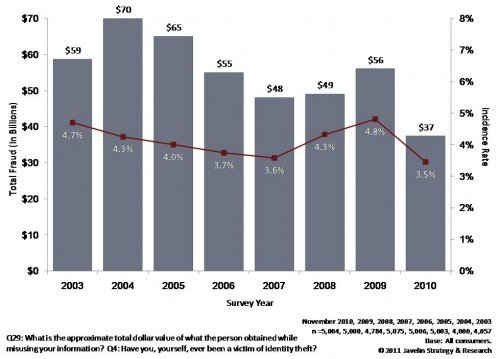

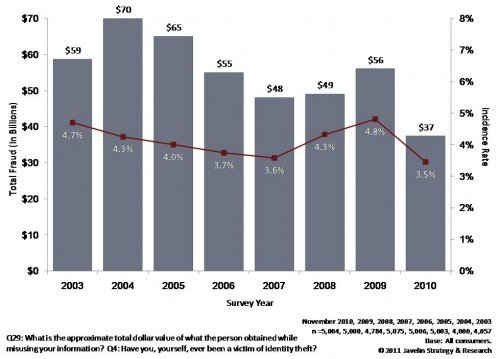

mortgage fraud, valuing the losses from all cases of mortgage fraud at $1.5 billion -- a number, they noted, which was almost certainly on the low end of the actual amount. The second, an identity theft survey by the very respected Javelin Strategy group, found direct losses to identity theft last year amounted to $37 billion.

The much greater losses to ID fraud should not surprise anyone who has followed the financial industry with any attention -- after all, a substantial amount of all financial crime, including mortgage fraud, comes from false identity documents presented by the fraudsters involved in a transaction. A loan application taken out by a fraudster using a stolen identity counts for both an ID theft and mortgage fraud; thus, there is a lot of overlap

Both the mortgage fraud losses of $1.5 billion and identity theft’s $37 billion also contain a lot of very important trends within them, as we recently discussed in our webinar. If you have not had a chance to see it yet, it is available for free, for a limited time at http://central.fraudfighter.com/webinars/ . This post is a guide to the webinar, summarizing and highlighting key points and expanding in several areas that we had to cut back in the interests of time.

Just as the webinar, the guide is organized into three parts: giving the background and statistics of current fraud trends; connecting their gradual growth and development to current practices in identity verification; and lastly, recommending a new approach to identity authentication that we believe will decrease fraud risk, stave off fraud losses and put businesses in fuller compliance with regulations. Posts two and three will be coming over the next several days.

Let us go back to that $37 billion number. From a cursory examination, it would seem to indicate actual good news: it represents an over 30% drop from the $56 billion the previous year. The amount of victims in 2010 -- 5 million -- is also 28% lower compared to a year before and the lowest count in nearly a decade. Credit card fraud caused by stolen identities likewise decreased from $23 billion to around $14. All good news right? Not quite.

While the detectable amount of fraud may have shrunk, the undetectable portion has likely increased. We know this because of the significant rise in New Account fraud. These are cases when fraudsters dispense with the traditional method of identity fraud - appropriating existing accounts - and opt to make completely new bogus ones out of whole cloth. Because there is no consumer victim to report suspicious transactions, these cases are notoriously hard to detect. New Account fraud represented $17 billion -- just under half -- of the reported $37 billion of fraud, and since the real number may be much higher, the grand total for fraud may need to be revised significantly northward.

Several signs point to an increase in mortgage fraud as well. There has been a 5% pickup in the amount of Suspicious Activity Reports filed by financial institutions. Even more alarmingly, the first two months of this year saw a doubling from the same period last year of fraud investigations involving transactions of $1 million or more. Of the slightly more than 3,000 investigations launched up to February 2011, 72% involved million-dollar transactions.

Clearly then, identity fraud is surviving, if not thriving, despite stringent prosecution. A $37 billion loss, if good in relative terms, is still a staggering amount in absolute ones (it is, for example, larger than the annual GDP of three states). To understand why that is the case, as well as to see what can be done about it, read the second part of series.