bank secrecy act

Financial Services Industry needs to become Global Leaders in Identity Authentication Over the...

Bank Secrecy Act compliance is more important than ever to companies that deal with “covered...

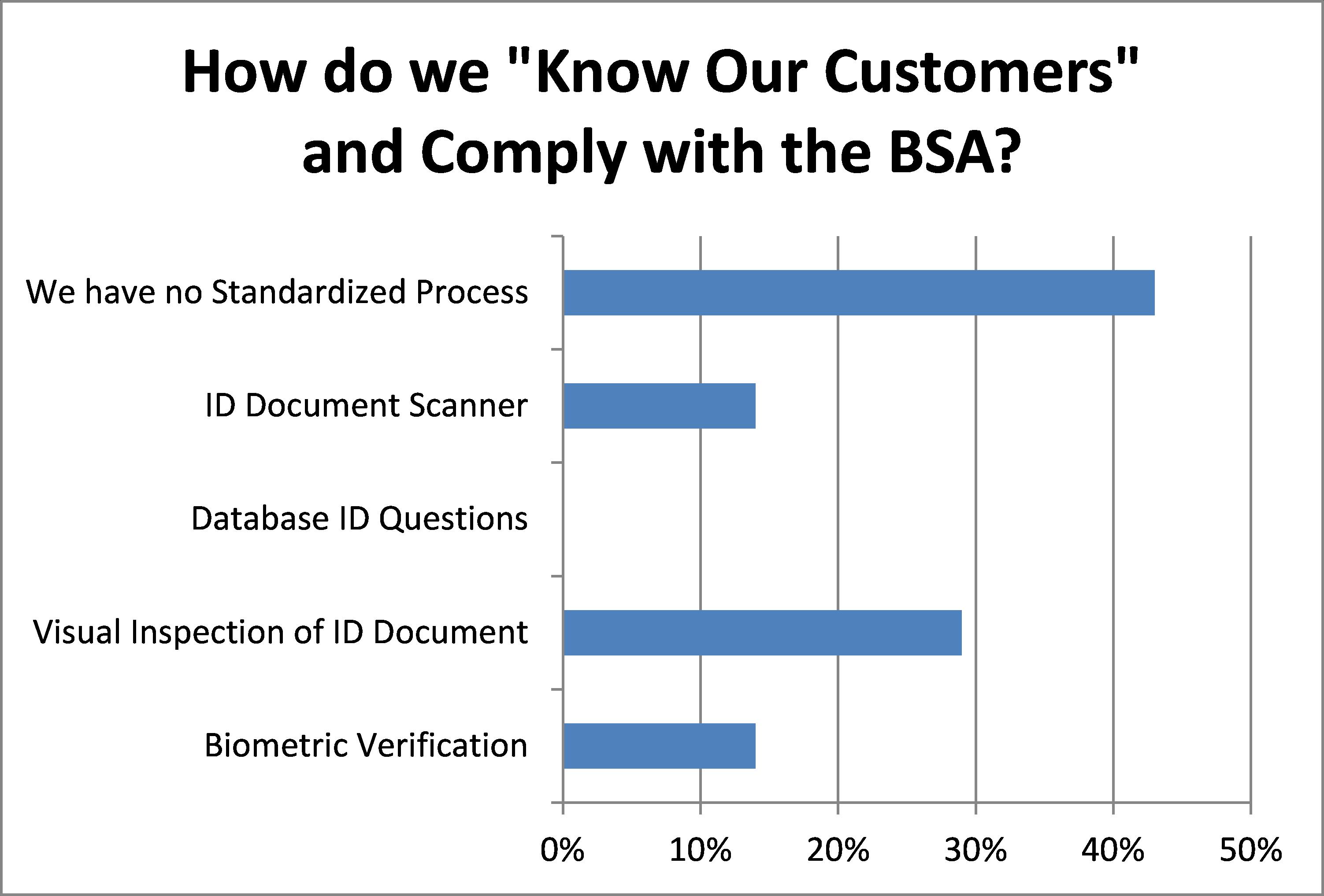

There are a number of ways to achieve compliance with anti money laundering regulations by...

To deter or prevent illegal activity including terrorism and money laundering, Bank Secrecy Act...

The Bank Secrecy Act or BSA requires a written Customer Identification Program (CIP) for client...

(BSA) Bank Secrecy Act and (FACTA) Fair and Accurate Credit Transactions Act: Red Flag Rules ...

If you have followed the news at all lately, you have likely heard that financial institutions of...

Scenario:A financial institution is opening a new branch, and is starting a major local PR blitz...

The last several weeks have seen a number of noteworthy arrests for money laundering. A fugitive...

The last decade brought about a tumultuous change in financial institution regulations. Many...

As if it weren’t already difficult enough to verify identity documents, now comes a new wrinkle in...

If you read Part I of our blog series on identity fraud you almost surely remember the sum totals...

Rounding out our October spotlight on identity fraud and identity authentication, we have recently...

In continuing our September Mortgage Fraud spotlight, this week we are talking about the...

In a startling revelation yesterday, one of the largest U.S. banks admitted in court that a...