red flag rules

This article was originally published on CBinsight.com The Best Way to really "Know Your...

There are a number of ways to achieve compliance with anti money laundering regulations by...

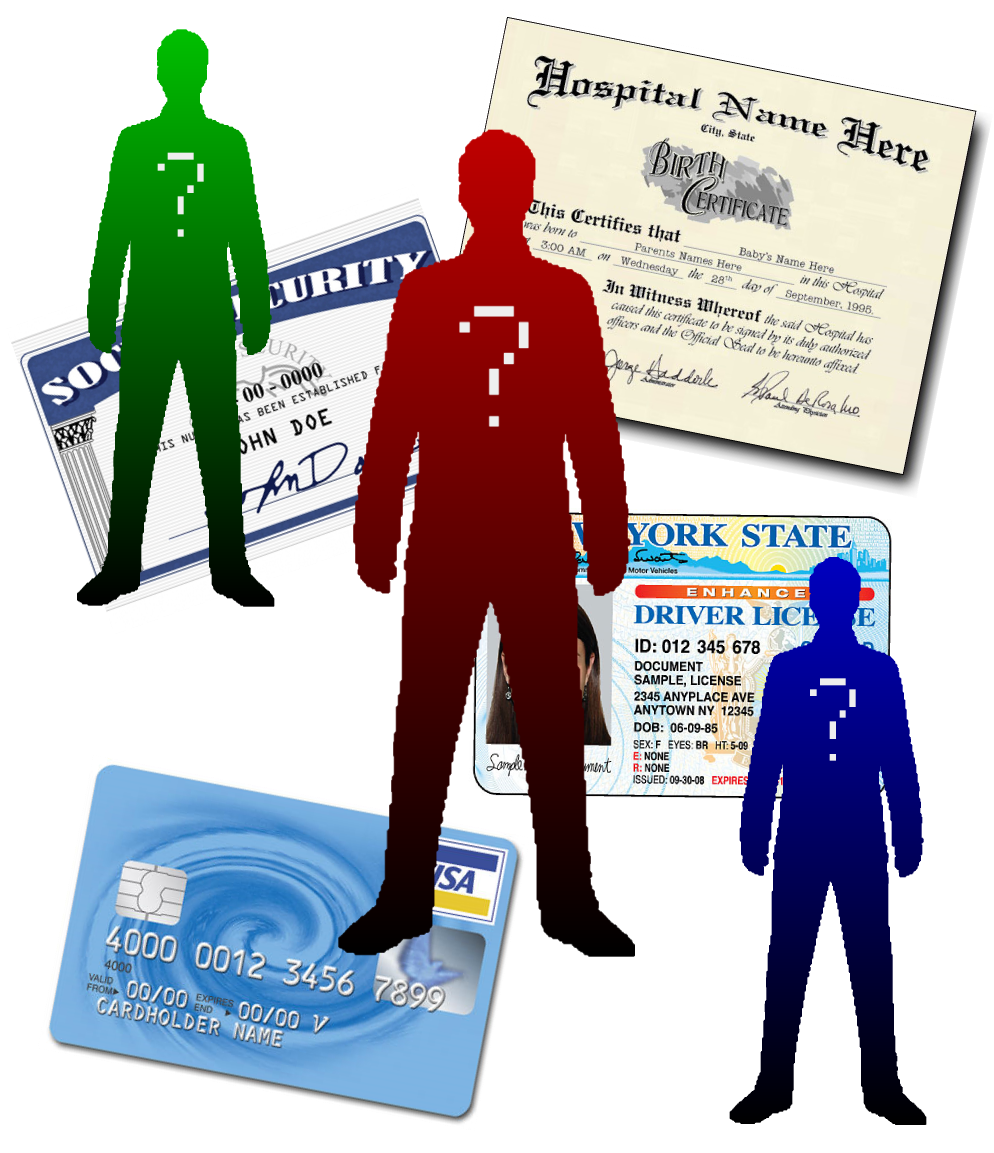

I n the ongoing war against identity theft, individual battles are constantly being waged and...

If you have followed the news at all lately, you have likely heard that financial institutions of...

Scenario:A financial institution is opening a new branch, and is starting a major local PR blitz...

Burden, or Benefit?

Part 4 of a four-part Process for Setting-up a Red Flag Rules Compliance Policy UPDATING THE...

Casino environments are beset by opportunities to experience losses from counterfeit fraud....

If your organization is involved in the financial services industry, or in any way has a regular...

Part II of a Four-Part Procedure for Compliance with Identity Theft Prevention Requirements If your...

Part I of a Four-Part Procedure for Compliance with Identity Theft Prevention Requirements