• TABLE OF CONTENTS •

Why You Need to be Vigilant about Checking Money

Naked Eye vs. Counterfeit Detectors

Naked Eye Counterfeit Money Detection Methods

Counterfeit Detector Types

TL;DR: All U.S. currency has security features - some visible with the naked eye, some not. You can detect counterfeit money to an extent by checking for visible security features. Learn about the visible security features by clicking here.

You’ve probably heard it before: “Cash is king”. Ever wonder why that phrase exists?

Although the origin of the phrase is unclear, the phrase is used to describe the importance of cash, mainly for businesses, though the phrase can apply just as well for individuals.

The reason why cash is important for businesses – and individuals – is that cash provides immediate flexibility to changing financial situations and protection against volatile financial markets. In other words, having a good amount of cash on hand is vital for the health of the business, regardless of the financial circumstances.

For example, a business with a large amount of their equity tied up in property will likely be unable to pay their workers in the event of a falling market, and therefore, falling property prices. However, a business with a large amount of their equity in the form of cash will likely be able to pay their workers regardless of the financial market.

Nothing will ever live up to the flexibility and safety of having cash on hand – which is one of the reasons why there are virtually no business that don’t accept cash but many businesses that do not accept debit/credit cards.

Until some other monetary instrument that is more immediate, tangible, and universal than cash is invented, cash will always remain a staple for transactions, no matter how big or small. And this is explains why money is so susceptible to counterfeiting: it is able to be used anywhere.

In 2015, the Secret Service announced that it had seized $58 million in counterfeit cash. However, this seizure is only a fraction of the amount of counterfeit cash actually in circulation. By their own estimates, the Secret Service determined that counterfeit cash had caused $968.6 million in actual loss that same year. This coupled with the fact that a counterfeiter named Frank Bourassa had created $250 million in counterfeit U.S. currency just 3 years earlier goes to show that the amount of counterfeit money currently in circulation is much bigger than the amount the Secret Service seizes year after year – it could likely be in the billions.

Why You Need to be Vigilant about Checking Money

Of course, it’s important to check money considering just how much counterfeit money is in circulation. The sheer amount of counterfeit money in circulation makes it clear why it is important to know U.S. currency well enough, at least with relative certainty, to make a determination as to whether or not a note in question is suspicious or potentially a counterfeit.

And the fact that each issue remains legal tender despite new issues being released further stresses the importance of being vigilant about checking money.

Some countries such as the U.K. render their old currency issues as non-legal tender soon after new issues are released. In fact, the U.K. released a new issue of their £5 note four months ago, and as of midnight May 5, 2017, the old £5 note could no longer be used as legal tender in shops, restaurants, or any other business. For those wondering: the old £5 note can be exchanged for the new £5 note at a bank at which an individual is a customer, the Bank of England, a building society, or a Post Office.

In the United States, however, a new issue of a note does not mean that any of the note’s older issues are no longer considered legal tender.

Take, for instance, the case of the 1953-issued $2 bill that an 8th grader used to pay for her school lunch back in 2016. School officials confiscated the old bill, assuming that it was a fake, but after a bank examined it, it was determined to be a real bill. Even though the bill was over 60 years old and a newer issue of the $2 bill had been released in 1976, the school - as well as any other organization or business, - had to accept the old $2 bill as legal tender.

Businesses have two competing ideals: protecting their bottom line and not alienating customers. And the existence of counterfeit money continually pits those two ideals against each other, as the above points illustrate:

- Protecting the bottom line: Knowing the security features and their locations on each denomination, respective of their issues, since all U.S. money is legal tender, regardless of when they were issued

- Not alienating customers: If you don’t know the security features and their locations on each denomination, you risk alienating customers who are paying with real money that may be older than what cashiers are used to; and alienating customers is a quick way to go out of business

These two competing ideals further get muddled from the fact that counterfeit bills can be produced at such a high-quality that even the most scrutinizing naked eye examination cannot detect whether or not a bill in question is real or fake.

And so, businesses have to make a two-fold decision:

- Will counterfeit money prevention measures be adopted and practiced?

- If counterfeit money prevention measures are adopted and practices, will they be based on the naked-eye, counterfeit detectors, or both?

Naked Eye vs. Counterfeit Detectors

The purpose of the rest of this post is to give an overview of the various counterfeit money detection methods available.

How do you tell the difference between real and fake money? By checking for security features found on all U.S. currency.

Some security features are visible, while other security features are invisible

There are two choices when it comes to checking the security features on money: via the naked eye or via counterfeit detectors. “Via the naked eye” refers to methods that are not aided by anything other than your eyes and sense of touch and “via counterfeit detectors” refers to methods that are aided by machines or other products designed to detect counterfeit money.

Naked eye counterfeit money detection methods will be discussed first.

Naked Eye Counterfeit Money Detection Methods

There are several different security features on U.S. currency that can either be seen with the naked eye or discerned by touch, helping to develop at least a cursory judgement about whether or not a note is real or fake.

Prior to 1990, only one security feature existed on U.S. currency: raised printing. Since then, every U.S. note issued, with the exception of the $1 bill and the $2 bill, has been released with at least 3 security features: raised printing, a security thread, and microprinting.

In 1996, starting with the $100 bill, two new additional security features were incorporated onto the $10, $20, $50, and $100 bills: color-shifting ink and watermarks.

In 2013, the newly designed $100 bill was released, with one more new security feature: a 3-D security ribbon.

Newly designed $5, $10, and $20 bills are set to be released within the next decade or so, starting with the $10 bill in 2020. Read more about the upcoming changes to the $5, $10, and $20 bills here.

To summarize, there are currently 6 key visible security features:

- Raised Printing

- Security Thread

- Microprinting

- Color-shifting Ink

- Watermarks

- 3-D Security Ribbon

Each of these security features can be detected via touch and/or the naked eye to some degree – and how to do so for each security feature is discussed immediately below this paragraph. However, just because these security features are or are not detected via touch and/or the naked eye does not mean you can be 100% confident that the bill is either real or fake; that level of confidence can only be brought about using counterfeit detector-aided methods – more on why this is so below.

Raised Printing

Raised printing is exactly what is sounds like: print that is raised. You’ll notice that real money has a texture when you run your finger along the bill, unlike regular paper that feels smooth to the touch. The areas that feel raised are those that are printed. For example, as seen in the above image, the grooves which make up Alexander Hamilton’s portrait on the 2006-Present issue of the $10 bill are raised.

All issues of all denominations have raised printing.

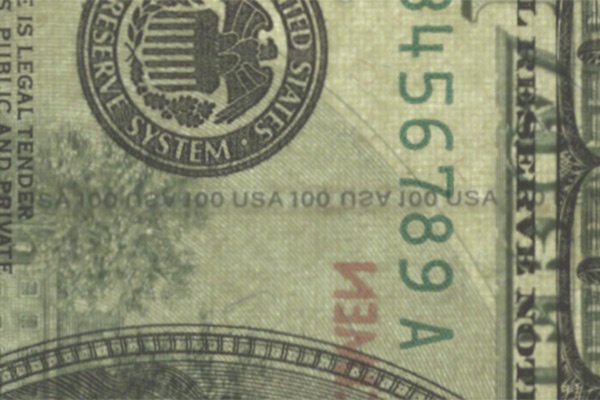

Security Thread

A security thread is a clear thread inscribed with the denomination of the note on which it is embedded. The security thread is not visible unless held up to the light. The placement of the security thread differs according to denomination, but all security threads are embedded vertically. For example, as seen in the above image, the security thread runs vertically to the left of Benjamin Franklin’s portrait on the 1996-2013 issue of the $100 bill.

It is worth mentioning here that the security thread glows a different color under UV light, respective of the issue of each denomination. The color of the security thread can only be seen using a counterfeit detector.

Like microprinting, security threads exist on each denomination issue released 1990 and later, with the exception of the $1 and $2 bills.

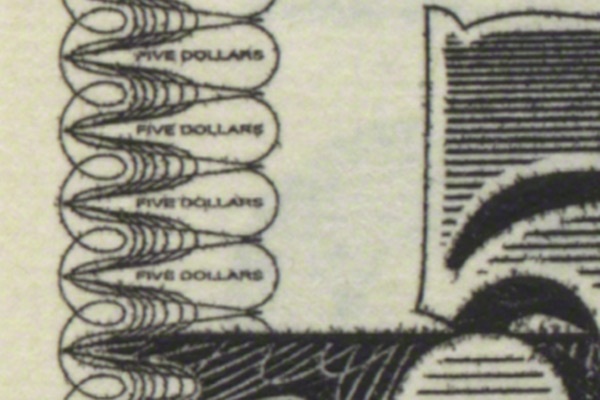

Microprinting

Micoprinting is exactly what it sounds like: extremely small print. The microprinting on each bill are found in creatively strategic locations, according to denomination. For example, as seen in the above image, the 2000-2008 issue of the $5 bill has the text “FIVE DOLLARS” printed within the (left and right) borders.

Some people may find they need a magnifying glass to see microprinting, but most people should be able to see the microprinting - to an extent - with just their naked eyes.

With the exception of the $1 and $2 bills, microprinting exists on each denomination issue released 1990 and later.

Color-Shifting Ink

Color-shifting ink is describes ink that is capable of shifting, or changing, colors, based on the angle the ink is held to the light. To see the transition between the colors, tilt the note at various angles. The color-shifting ink will either shift between green and black or green and copper. For example, as seen on the above image, the numeral 20 printed in color-shifting ink can be seen at the bottom right corner of the 2003-Present issue of the $20 bill.

The $10, $20, $50, and $100 denomination issues released 1996 and later have numerals respective to the denomination located at the lower right corner that is printed in color-shifting ink that transitions from green to black. The $10, $20, $50, and $100 denomination issues released 2003 and later have numerals respective to the denomination located at the lower right corner that is printed in color-shifting ink that transitions from copper to green.

Watermark

A watermark is exactly what it sounds like: a faint image that can only be seen when held up to the light. With the exception of the 2008-Present issue of the $5 bill - which has watermarks of the number “5”, all watermarks should look like a smaller version of the portrait that appears on the note. For example, as seen on the above image, the watermark of Ulysses S. Grant’s portrait can be seen to the right of his portrait on the 1997-2004 issue of the $50 bill.

With the exception of the $1 and $2 bills, watermarks exist on each denomination issue released 1996 and later.

3-d Security Ribbon

The 3-D security ribbon is a blue ribbon that is woven into the front of the bill. Currently, the 2013-Present issue of the $100 bill is the only note that has the 3-D security ribbon.

There are two types of images on the ribbon: bells and the numeral 100. Much like the color-shifting ink, the images on the ribbon shift between bells and the 100s, depending on the angle at which the bill is viewed.

In addition, when the bill is tilted back and forth, the images move side to side, and when the bill is tilted up and down, the images move up and down. For example, as seen on the above animated image, the images move up and down or side to side, depending on the direction of the bill is being tilted.

Want to see all the visible security features on each denomination of Federal Reserve Notes? Click here to download our Visible Security Features on Federal Reserve Notes Guide.

As mentioned above, detecting or not detecting via touch and/or the naked eye the listed security features on a bill in question does not mean that you can say with certainty whether or not a bill is real or fake. Some older bills may have worn areas that make the detection of microprinting difficult or seem off.

Also, the exact measurements and placement of security features are almost impossible to detect with just the naked eye; there exist counterfeit bills that are so well-made that all these security features are placed on the bills so accurately that only a machine is able to detect the minute differences that set them apart from a genuine bill. For instance, how can one be sure that the font size of the microprinting is exactly what the font size should be? There are many potential minute differences that can exist that cannot be discerned without the aid of a counterfeit detector.

Further, certain characteristics of security features cannot be seen nor felt, such as the glowing color of the security thread, which can only be seen when placed under a UV light from a counterfeit detector. In other words, there are invisible security features that can only be detected with the aid of a counterfeit detector.

Of course, this isn’t to say that checking bills via touch or the naked eye is useless – it is the first effective step towards efficient counterfeit detection. Although there are counterfeit bills that are made well enough to fool the naked eye, there still exist many counterfeit bills that won’t be able to pass the scrutiny of a well-trained cashier.

If detecting any and all counterfeit bills is what your business needs, counterfeit detectors are the only way to go.

Counterfeit Detector Types

There are essentially two types of counterfeit detectors: manual and automatic.

The difference between manual counterfeit detectors and automatic counterfeit detectors is similar to the difference between manual transmissions and automatic transmissions on cars: in order to work, manual counterfeit detectors need human input whereas automatic counterfeit detectors do not.

Manual counterfeit detectors work by highlighting the UV characteristics of security features. As mentioned above, the security thread glows different colors respective of the denomination, but this color can only be seen under a UV light. By placing a bill under the UV light on a counterfeit detector, the security thread’s color – as well as location on the bill – can clearly be seen. If the security thread is the correct color for the denomination and the security thread lines up exactly along a strip that marks where each security thread should be based on denomination, the bill is considered a real note.

Determining whether or not the security thread is the correct color and in the correct location is where the human input comes in.

Often times, checking for just the security thread’s color is sufficient for some businesses’ fraud prevention needs – and for those businesses, a manual counterfeit detector that does not aid in the determination as to the accuracy of the security thread’s location will suffice.

An automatic counterfeit detector, on the other hand, determines whether or not the security thread is the correct color and in the correct location by itself. In addition, automatic counterfeit detectors check for other invisible, minute characteristics of security features that are not discernable to the naked eye or by touch.

For example, an automatic counterfeit detector may check for the presence of a security feature not mentioned above: infrared ink. This particular security feature was left out due to the fact that there is no way that infrared ink can be detected with just the naked eye or by touch; infrared ink looks just like regular ink until it is placed under infrared light. Each issue of each denomination has certain areas that are printed with infrared ink – and the presence and location of the infrared ink is what an automatic counterfeit detector may check.

Additionally, automatic counterfeit detectors may check for other characteristics of bills that aren’t necessarily considered security features but are features that are hard to correctly mimic nonetheless. For example, an automatic counterfeit detector may check bills’ thickness. In other words, they may check whether or not the thickness of the bill is correct down to the micrometer, which is certainly beyond the capability of a human to detect.

You may be wondering why a business would even choose a manual counterfeit detector over an automatic counterfeit detector – it’s because manual counterfeit detectors tend to be more budget-friendly than automatic counterfeit detectors. In addition, many types of manual counterfeit detectors tend to be more space-efficient than automatic counterfeit detectors.

Since manual counterfeit detectors are more budget-friendly, why would a business spring for automatic counterfeit detectors? One reason may be that a business may be wary of human error or negligence. Another reason could be due to the fact that automatic counterfeit detectors are more time-efficient than manual counterfeit detectors. There are even automatic counterfeit detectors that can check money in bulk.

When it comes to counterfeit money detection, the choice is yours: there are ways to protect against counterfeit money that are free, but that risks the chance that well-made counterfeit bills will nonetheless slip through your defenses and hurt your bottom line. On the other hand, there are ways that have up-front costs but end up paying for themselves relatively quickly considering that there is potentially billions in counterfeit cash currently in circulation.

Whether or not you choose to incorporate a counterfeit money detection measure, always keep in mind that it pays to be vigilant about money.

.png)