Out of the three groups affected by retail

fraud – consumers,

financial institutions and merchants – the latter suffer the biggest losses: $100 billion, according to the latest research by Lexis-Nexis, equivalent to ten times the amount lost by FIs ($11 billion), and twenty times the cost borne by consumers ($4.8 billion). Notably, this amount includes only fees and interest on issuing chargebacks; factor in the cost of replacing the merchandise taken away by fraud and the loss amount nearly doubles to $191 billion.

As merchants are the largest, and most complex group affected by retail fraud, we will take the rest of this post to examine some specific threats they face, and the retail sectors and merchant types at biggest risk for fraud.

Brick & Mortars Lose As Much As E-Merchants

A common objection from merchants selling mostly out of physical locations is that fraud mostly affects their online brethren. The Lexis-Nexis numbers do not bear this out. Physical store merchants lost 0.9% of revenue to fraud in 2008, compared with 0.9 for all merchants in general. The one significant difference is that physical store merchants are also very susceptible to fraudulent checks, as more than half of unauthorized transactions occurred involved fake checks.

Credit Card Fraud From Stolen Identities

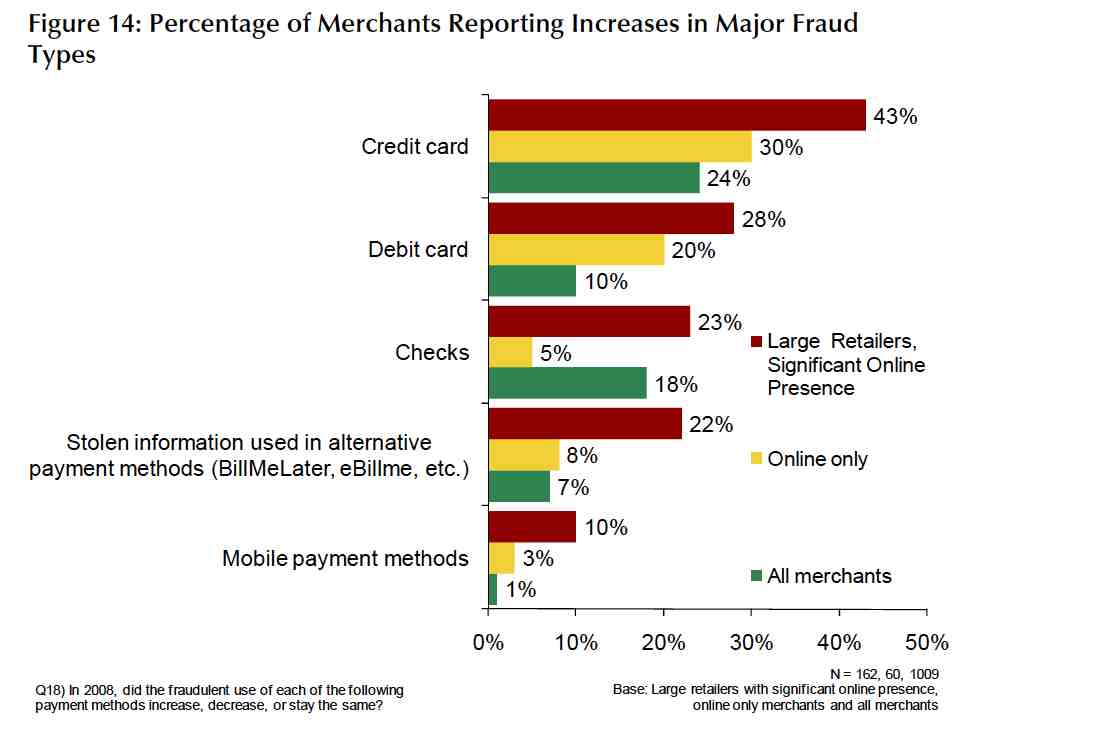

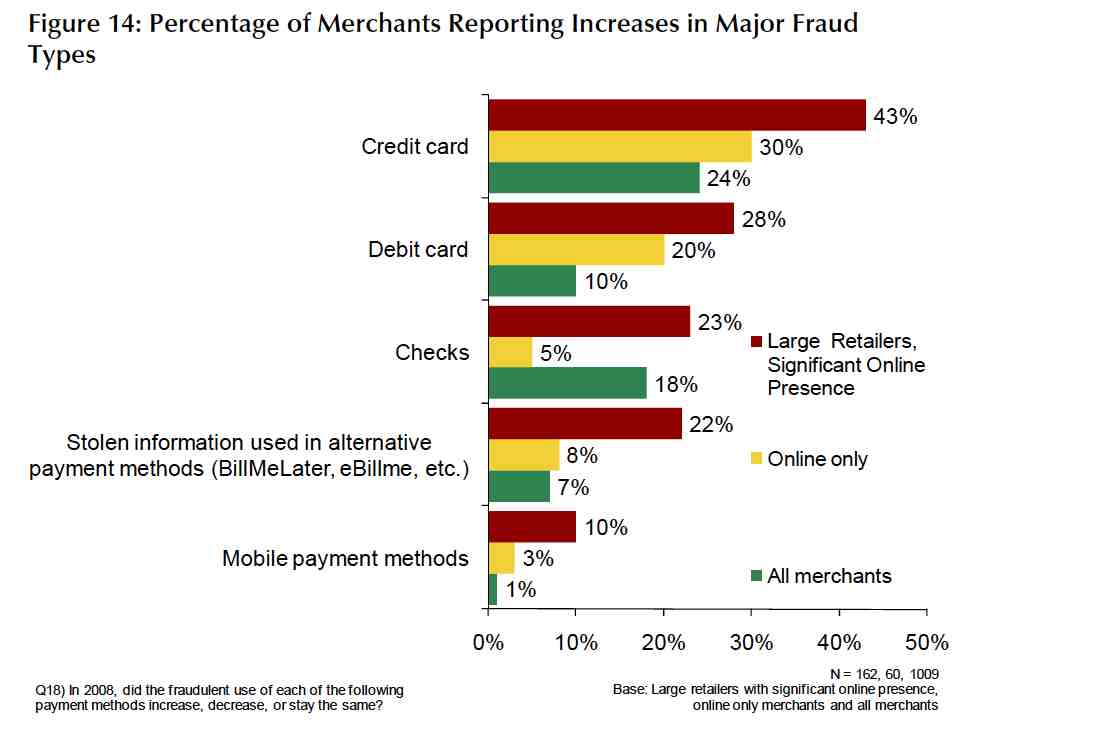

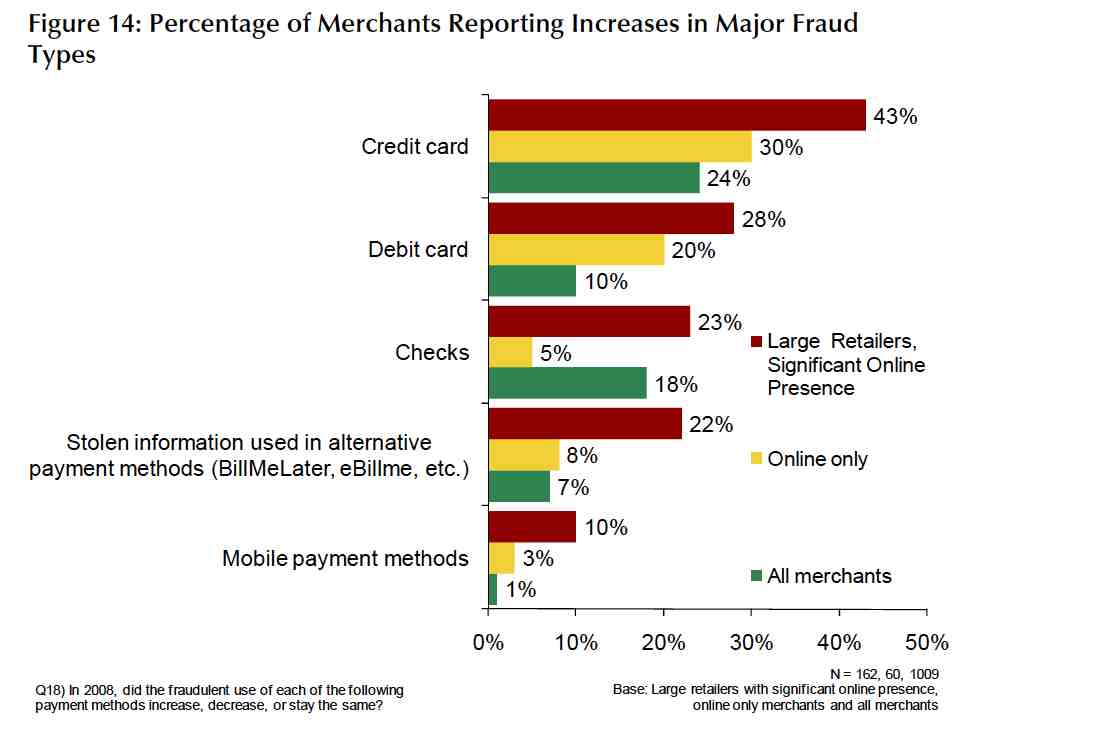

There has been a lot of talk among retail managers and professionals over the proliferation of so-called “alternative payment methods,” which include online payments processor Bill Me Later and Google checkout, as well as payments by mobile phones. While these undoubtedly are growing in use and acceptance, they are projected to remain on the fringe of both payments made and, correspondingly, fraud committed. As most payments are made by cards, whether debit or credit, this remain the largest pain point for merchants of all stripes. According to Lexis-Nexis's survey, of large merchants, 28% reported an increase in fraudulent payments on debit cards, while a whopping 43% reported an increase in fraudulent purchases made on credit cards.

It should come as no surprise that most of the credit card fraud comes from stolen identities. The sophistication of modern criminal enterprises allows them to easily create cards superficially indistinguishable from the real thing. Only an inspection of its “hidden” security features under ultraviolet light would reveal them to be fake. Printing stolen identity info onto the cards' magnetic strips is likewise an easy task for a motivated fraudster. Thus do roughly one in five of all merchants, and one in two of large merchants with more than $50 million in annual sales, report a rise in identity fraud.

Industries At Risk

Electronics retailers by far suffer the biggest average annual losses, estimated at $1.2 million. Computers, cameras and cellphones are high-value goods and easily re-sellable, making them the perfect  target – an average of $265 per fraudulent purchase in chargeback fees and interest alone. Non-electronic specialty stores, such as home-improvement,

target – an average of $265 per fraudulent purchase in chargeback fees and interest alone. Non-electronic specialty stores, such as home-improvement,

food & beverage and cosmetics, tend to lose much less in comparison – only around $100 million on average, and general merchandise stores lose around $90 million.home-improvement, food & beverage and cosmetics, tend to lose much less in comparison – only around $100 million on average, and general merchandise stores lose around $90 million.

No matter what sector of industry, businesses across the spectrum agree that identity fraud causes the most losses, and the first priority in any anti-fraud campaign. Given the enormous losses to fraud faced by retailers of all stripes, and the prevalence of identity fraud as a method of perpetrating this fraud, an unobtrusive method for verifying the authenticity of both the method of payment and the buyer's identity would be a sound investment indeed.