LexisNexis (LN) recently released its Financial Services & Lending focused 2022 True Cost of Fraud Study, which points to fraud trends that will significantly impact banks/credit unions, investment firms, and lending institutions in the months and years ahead.

The company surveyed 502 risk and fraud executives in this space and came away with stark assessments of how fraud costs have accelerated since their first FinServ report in 2017.

LexisNexis defines "fraud" as:

In aggregate, these fraud "actions" result in sizeable fraud "costs". LexisNexis' core thesis is that a fraudster's impact on a business extends well beyond the direct fraud transactional cost. If a bank loses $1 to a fraudster, in actuality, their total loss is a multiple over and above each dollar siphoned away.

This "True Cost of Fraud" is the sum of the direct losses in transaction value, plus the following post-fraud costs:

Since initiating its Financial Services research in 2017, LexisNexis found that not only are (total and successful) fraud attempts rising, but also the true cost of fraud.

As such, it is imperative that companies act now to deploy and/or bolster anti-fraud efforts to mitigate the impact of inevitable fraud. Why?

The true costs of fraud are rising at an accelerated rate year after year.

In broad strokes, financial services and lending fraud incidence rates (attempted and successful) aggressively rose and are up 19.6% - 22.4% since early 2020.

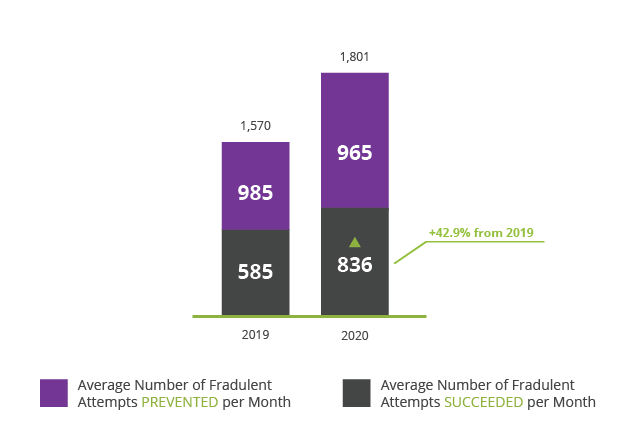

In a typical month in 2020, US financial services and lending companies prevented 965 fraud transactions at their respective companies, but in that same month, the companies fell victim to 836 successful fraud transactions, for a total of 1,801 monthly fraud attempts.

Source: LexisNexis Risk Solutions 2020 True Cost of Fraud Study Financial Services & Lending Report

A key takeaway is that every single metric (total attempts, prevention, successful fraud) was worse in 2020 as compared to the year before. Total fraud attempts were up, successful fraud transactions were way up, and the number of prevented fraud attempts was down.

I.e., Financial Services and Lending companies are seeing more fraud attempts and are getting worse at stopping them. Sophisticated fraudsters are getting better at avoiding detection and penetrating system and process defenses.

Fraud's impact on U.S. businesses and on the economy as a whole can be measured in many ways, such as the total dollars lost over the course of a year, or how fraud might be gaining greater traction in some vertical industries or transaction platforms over others.

For its part, LexisNexis presented fraud's impact on Financial Services in a holistic manner, having calculated the total picture of post-fraud financial pain.

"Fraud" doesn't just equal the dollars lost in an unauthorized (and unrecovered) funds transfer or a bad loan issued to a customer presenting a synthetic identity. There are significant financially punitive downstream consequences and costs from the resultant fees, fines, investigation, and recovery efforts.

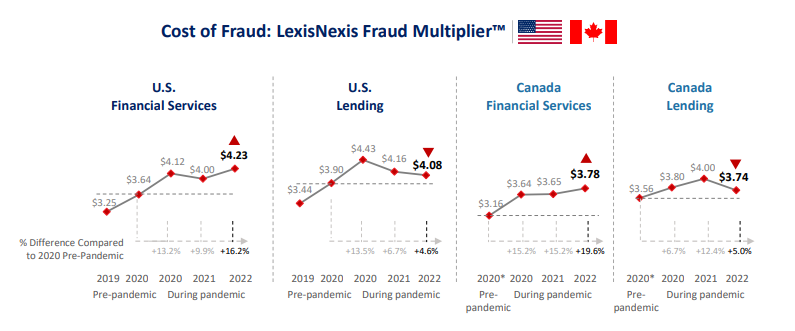

In 2022, LN found that for every $1 of fraud, it actually costs financial services firms anywhere from $3.74 - $4.23 -- this "True Cost of Fraud" multiple is up from $2.67 in 2017, a significant increase in the fraud multiplier.

Source: LexisNexis Risk Solutions 2022 True Cost of Fraud Study Financial Services & Lending Report

Perhaps even more concerning is that fraud multiplier growth is accelerating year over year for Financial Services. LN researchers tied the accelerating multiplier growth to rising costs in labor and external support called upon to investigate and recover from fraud loss incidents.

These post-fraud fees, fines, and recovery costs are only slated to rise in the future. Fraudsters are increasingly organized and connected on a global scale, tapping illicit online resources for personally identifiable information (PII) and collaborating on fraud tactics.

To the financial services firms LN surveyed, what does fraud actually look like? What form does it take in the daily business of a bank, credit union, or investment firm?

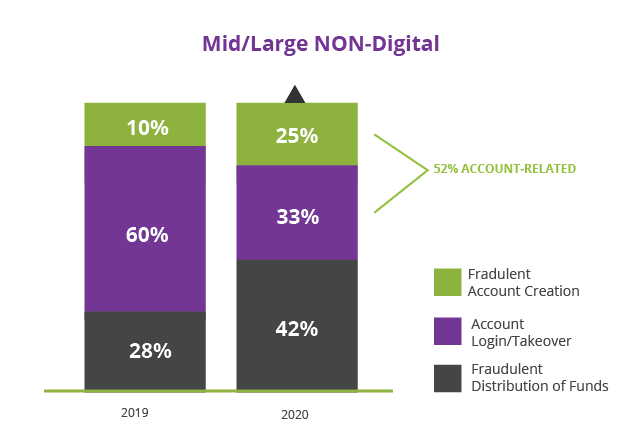

For mid to large financial firms that do not rely on digital (online/mobile) channels for the majority of their transactions, fraud increasingly came in the form of unauthorized distribution of funds in 2020, accounting for 42% of fraud incidence activity vs. 28% seen the year prior.

Source: LexisNexis Risk Solutions 2020 True Cost of Fraud Study Financial Services & Lending Report

While the drop in Account takeover activity share is seemingly good news, it's tempered by the aforementioned rise in funds distribution fraud and also the significant growth in fraudulent account creation - the latter likely due to usage of synthetic identities.

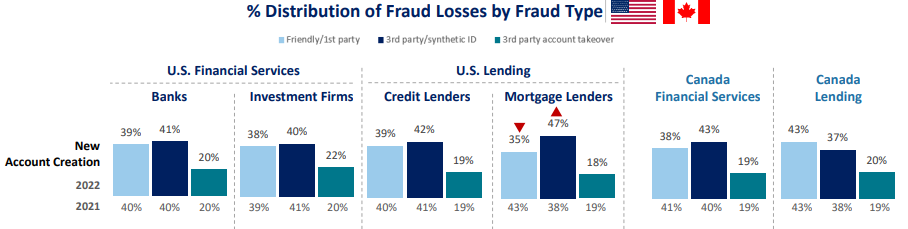

With the help of new AI technology, Synthetic Identity Fraud has only continued to grow. This has been a huge problem for new accounts where Third Party / Synthetic Identity Fraud has caused the largest amount of fraud losses.

Source: LexisNexis Risk Solutions 2022 True Cost of Fraud Study Financial Services & Lending Report

Since publishing their first True Cost of Fraud report in 2017, LexisNexis researchers have found that the fraud landscape has only gotten more dire for financial institutions and lending firms, as evidenced by the "fraud trifecta" of:

1) Higher Y/Y incidence rates of total and successful fraud attempts (and lower fraud prevention rates).

2) Continually increasing and accelerating fraud multipliers, raising the True Cost of Fraud up to $4.23 for every $1 lost.

All caused by:

3) More sophisticated and globally coordinated fraudsters exploiting easily accessed PII data from the dark web.

More than ever, financial firms and lenders need to have a complete picture of their customer's identities, fundamentally aligning a proven physical identity with a true digital history, to enable an accurate understanding of the risk this persona presents to the business.

Further, analysis of individual and macro population fraud behavior is essential to spot possible trends occurring and developing throughout time. A one-time snapshot of a person's history, or of your entire customer base's history is insufficient to understand what has happened and what might take place in the future.

As such, FraudFighter created PALIDIN, the deepest identity authentication methodology available in the market today that forensically interrogates an individual's physical government-issued ID document. Once information that proves an identity to be true (or fraudulent) is captured, that knowledge should not be allowed to die on the vine.

Instead, identity authentication events can be integrated with all identity datapoints captured and aggregated in our intuitive PALIDIN analytics platform. The PALIDIN dashboard can provide essential insights into customer behavior and possible fraud trends as linked to ID type, transaction type, time / date stamps, and site location.

.png)