mortgage fraud

In the fast-paced world of real estate, it's essential to stay one step ahead of fraudsters.Real...

Warning:The following information is scary. Stop reading now unless you have a robust identity...

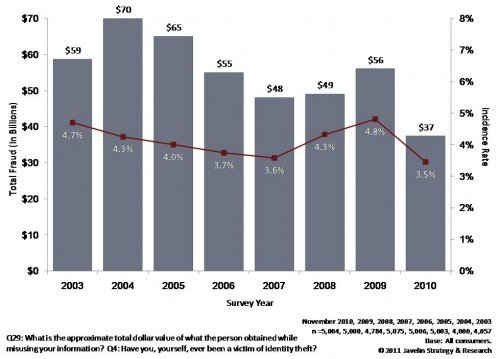

Two very important studies delving into fraud reports from 2010 were issued recently. The first, a...

Imagine you were offered this amazing business opportunity: you would join an effort by a local...

In continuing our September Mortgage Fraud spotlight, this week we are talking about the...

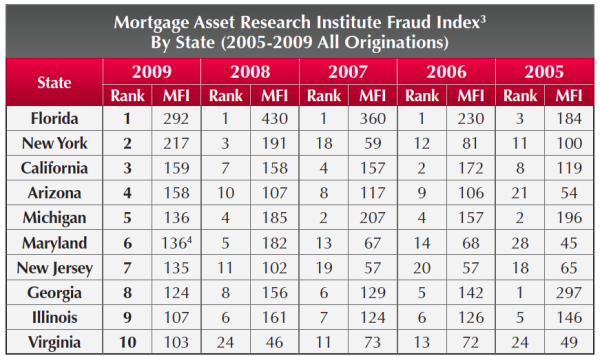

For anyone concerned about how mortgage fraud can affect them specifically, the LexisNexis...

Mortgage fraud has been much in the news in recent years. After the dust created by the...

Every day in the business world, organizations strive to be the best. They work to identify the...