The reality is identity fraud has and will continue to rise. Over recent years, we have seen fraudsters consistently come up with more elaborate schemes to steal or fabricate identities. With these imposter IDs they then defraud businesses. Unfortunately, the auto industry is no exception to the trend, and as we discussed in our recent article, The Alarming Rise of Car Theft Due to Fraud (fraudfighter.com), car theft due to fraud has been on the rise with over 80,000 cars stolen in 2023 alone using this method.

On top of the alarming quantity, each stolen vehicle can cost a dealership a considerable amount in losses (on average about $100K) due to the original car value, insurance premiums, and time/resources invested into the car’s recovery. How can dealerships battle the ever-growing problem of fraud? While we have our own ideas, we thought we’d reach out to some of the dealerships who use our software and see what practices and procedures have been working for them.

Below, we have three of the most common responses from our customers:

Scan ALL Drivers’ Licenses

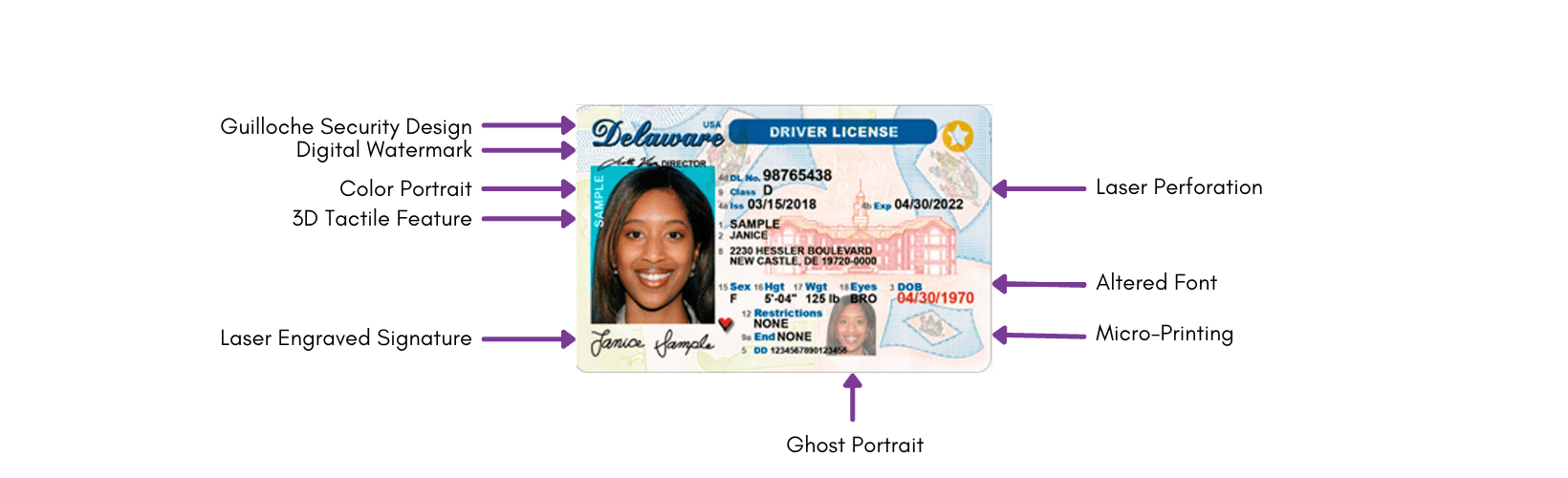

Many of the dealerships said they have a strict policy of ensuring all drivers’ licenses are scanned through an identity authentication system (such as PALIDIN). The system helps stop fraudsters by running over 36+ forensic level tests and data crosschecks on the various security features of the document to ensure authenticity. This step is therefore crucial in ensuring fake IDs do not slip through. Below is a graphic showing some of the features that can be found on an ID.

On top of the features displayed above, there are many additional security features which are invisible to the naked eye such as infra-red, Ultraviolet (UV), or magnetic ink. While sophisticated fraudsters may be able to copy some of these details on their fakes, most will still fail several tests when put through a robust ID scanner and authentication system.

When should the ID scan be conducted? Depends on the policies at your dealership. While some of our clients scan licenses just before the auto purchase is made, others make sure to authenticate earlier in the process such as before a test drive is done by the prospect.

What if my client is remote? Many of our dealerships use both PALIDIN Desktop and PALIDIN WebID to ensure scans can be done for customers no matter where they are located.

PALIDIN Desktop is our in-branch solution that utilizes both a physical ID scanner and a computer desktop system to scan IDs. This system runs on an annual subscription with unlimited scans, making it the perfect choice for the majority of authentications done by our dealers. This system can be kept at the reception desk or even the desk where the deal is processed.

PALIDIN WebID on the other hand, is our solution for clients whose customers are conducting the transaction remotely. Our dealers simply send out a secure link to their customer who will then follow the prompts to scan their ID and take a live selfie of themselves. The system will then not only authenticate the ID, but will also do a facial match to make sure the person in the photo is in fact the owner of the ID. This solution works perfectly for customers who are getting the car delivered directly to them or scheduling a time to pick up their car from a lot.

What if the PALIDIN system goes down? Our dealers recommend a few different steps depending on the situation. While our support is always ready to help, some dealerships require that management be informed of equipment issues before a sales representative reaches out to FraudFighter support. Many of our clients agree, that if for any reason a license cannot be scanned, management should be looped in before the deal is completed and a photocopy of the ID should be taken for records.

Secure the scan results screen

Our dealers know that keeping the Personal Identifying Information (PII) of their customers secure is of the upmost importance. This means limiting who sees and who has access to private information. Many dealers limit who can see the physical desktop monitor that displays ID scan results. Some ways to do this are to strategically position computer(s) to limit viewing access by the public and adding privacy screens to control which angles information can be seen from. Our clients do their part to ensure non-authorized people are not getting hold of private PII information.

PALIDIN Desktop also lets you control which information is shown on the results screen, giving you options to reduce the amount of PII displayed on the screen. Furthermore, scan results can be saved to a folder with a password requirement to prevent access from bad actors.

Include a Copy of the Driver’s License with every deal

Regulatory compliance is essential for many dealerships. Thus, keeping thorough records of scan results is critical. Many of our dealers have their own internal policies to ensure scan results are kept with the original deal information. While some print out all deals and scan results and file them securely away, others store them in digital folders and add the saved transaction report from PALIDIN. No matter the method it is saved, limiting PII displayed on the transaction report can also help to keep information safe. Our dealers have found that in general, the main information they need is as follows:

- Customer Name

- Customer Address

- Customer Date of Birth

- DL#

- DL Expiration Date

- Passed Result

While having a photo on the saved report is helpful, the personnel at the dealership are primarily responsible for confirming identity and ensuring the person in front of them matches the photo on the physical ID. Clear communication between reception, sales reps, and management is critical for stopping fraudsters and keeping the fleet safe.

By taking the steps outlined above, our customers have seen a sharp decrease in fraud both at their physical branches and during remote transactions. Got some killer fraud prevention tips of your own you’d like to share? Add a comment below!