.jpg)

How Retail Fraud Has Increased in the Wake of COVID-19

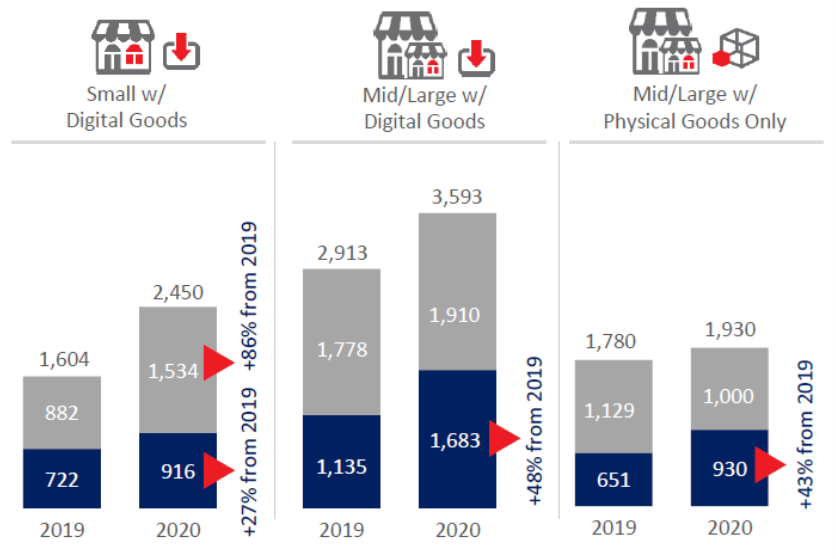

Retailers of all types face the inescapable reality that transactional fraud has been on the rise for many years. In one glaring example of this trend, data shows that the number of successful fraud attempts against retailers in 2020 increased between 27% - to - 48% compared to 2019, depending on the size of the retailer. Medium and large retailers saw the greatest increases.

What is Retail Fraud?

Retail fraud various in type and includes the following:

- Fraudulent and / or unauthorized transactions;

- Fraudulent requests for a refund/return;

- Bounced checks;

- Lost or stolen merchandise;

- Redistribution costs associated with re-delivering purchased items (including carrier fraud).

Why has Retail Fraud increased during COVID-19?

American retailers have steadily experienced increasing fraud losses for most of the last two decades, and this trend continued in 2020. However, the extra increase in 2020 has been due in large to the rapid growth of online business during the pandemic. Both Large eCommerce (online) and mCommerce (mobile) operations are forced to deal with increasing fraudulent activity in several key areas, including:

- An increased volume of successful fraud attempts - More and more, fraud transactions can pass through the security measures in place and cost the company valuable money.

- A rise in dollar losses per fraudulent event - Not only are there more transactions slipping through, but the dollar amount per a fraudulent attempt is higher.

- An increase in the “Fraud Multiplier” (Lexis-Nexis True Cost of Fraud™). - These are the extra costs to the business when a fraud attempt is successful and includes fees, interest, merchandise replacements.

Increased “Sophisticated Fraud” during COVID-19

One trend that exploded in 2020 as a result of the pandemic and the shutdown of physical store locations was the rise of “sophisticated fraud”. This term loosely describes an increase in internationally active fraud networks sharing stolen identity information and collaborating with various fraud attacks.

Examples include the creation of Synthetic IDs, the use of “bots” to systematically test stolen/purchased login credentials, and increased activities among Identity Fraud Rings.

Some run-on trends that result from the above sophisticated fraud behavior include:

- Mobile browsers making up a larger portion of E-commerce fraud losses within the mobile channel.

- Fraud losses related to international eCommerce transactions have increased for US E-commerce merchants.

- Identity fraud continues to be a sizeable portion of fraud losses and remains higher for Mid / Large pure E-commerce compared to others.

- Payment / credit card fraud remains high and has increased for US retailers that sell digital goods (e-gift cards, subscriptions, games, etc…which can be easily sold for a profit.)

Which types of Retail Businesses have been most affected?

The Total Cost of Fraud has Gone Up.

Another result of the Lexis-Nexis study was the revelation that the total cost of fraud – after factoring all the costs associated with a given fraud loss – are also increasing. For years, Lexis-Nexis has been calculating and tracking a “fraud multiplier.” This multiplier measures the actual cost of a fraud event to the organization that experienced the loss. The multiplier tries to factor non-direct expenses, such as the cost of investigations, special accounting work, legal filings, client relationship management and other costs that are created solely as the result of the fraud event.

Figure 1 - Lexis/Nexis 2020 True Cost of Fraud™ Report (Retail Edition)

It appears that the fraudulent deviants have been widespread in their reach, increasing in all areas. That being said, Mobile is the Leading Contributor to the Increases in fraud.

How much has Mobile Fraud increased?

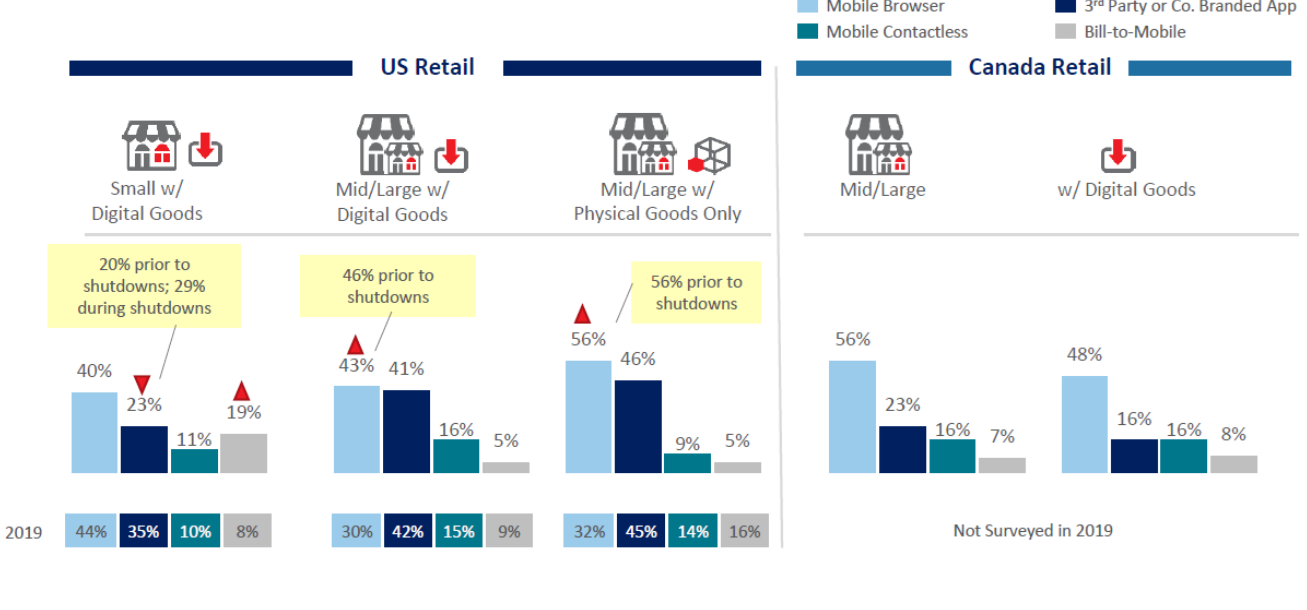

Mobile transaction volume increased in 2020 for retailers, leading to increases in total online fraud costs. While some of this relates to the COVID-19 shutdown, there was an upward trend prior to that.

Mobile browsers accounted for a larger share of mobile channel fraud costs in 2020 compared to 2019.

Figure 4Lexis-Nexis True Cost of Fraud™ 2020 Report

Among the takeaways from figure 4 is that mid-to-large sized retailers, both physical and eCommerce, saw sharp increases in mobile-browser based fraud, and that similar numbers held true in Canada.

Both Online and Mobile Transactions Suffer Disproportionately from Identity-Related Fraud

Identity theft is a greater problem for organizations that operate online or mobile channels than for those that don’t. The anonymity of “Card Not Present” (CNP) transactions makes identity theft much easier for fraudsters using remote channels than in person at a store or branch location.

Identity thieves can capitalize on the trend of retailers offering the convenience of buying goods online and then allowing a return to be made in-store – especially when there is no requirement to authenticate identity during the return. Because larger multi-channel operators are exposed to both remote fraud and in-store fraud, they have become the major target of identity theft rings.

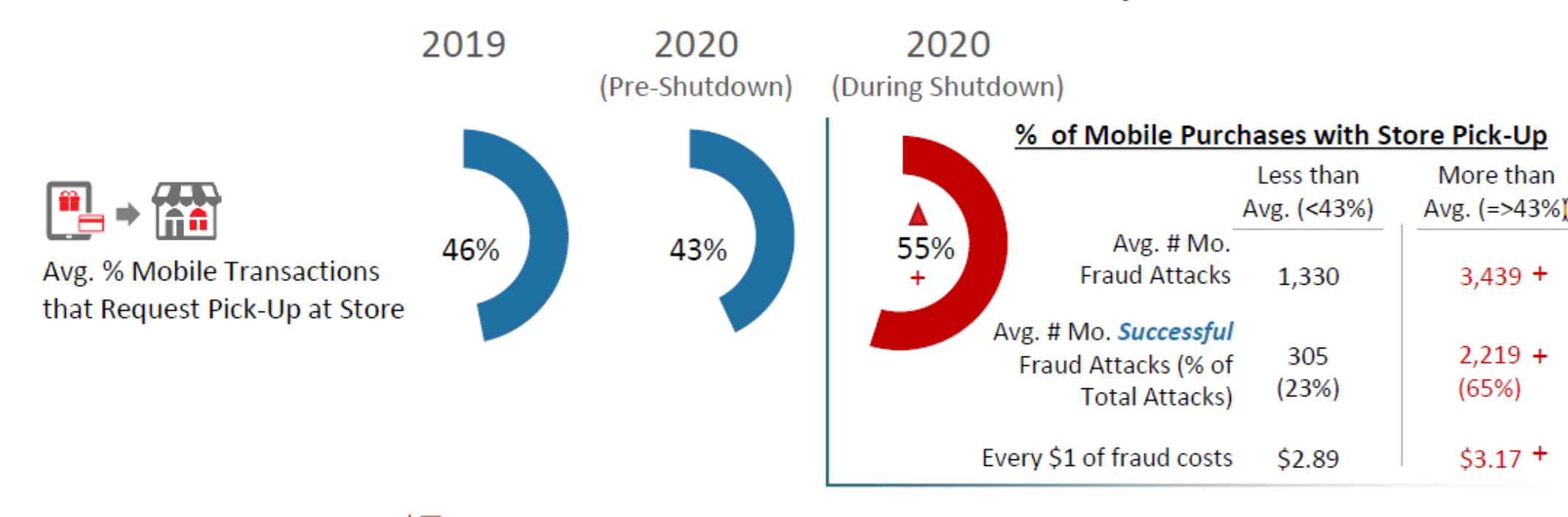

The average percent of mobile transactions involving pick-up at store increased significantly during the shutdown, leading to higher fraud attacks and costs.

Figure 5 Buy Mobile/Pickup in store from Lexis-Nexis True Cost of Fraud Report 2020

Buy online (mobile) and pick-up In-store risks much higher fraud cases than other channels. Employees are often less trained regarding identity authentication. Given no significant changes with online purchasing / in-store pick-up, it suggests that fraudsters not only recognize the increased fraud opportunities with mobile, but also that several retailers have not fully invested in solutions designed to detect mobile channel fraud. The ability to distinguish legitimate customers from malicious bots is becoming harder.

eCommerce and Mobile Retailers Struggle to find the Balance between Preventing Identity Theft while not Denying or Delaying Genuine Transactions

As already discussed, ID fraud is more common in CNP transactions than others. Thus, operations which conduct transactions through remote channels have greater need to determine whether their customers are genuine or not. If an error is made during this critical step, it is possible that legitimate customers might have their transactions declined. This is not a minor problem as customers are prone to abandon online vendors after only a single negative experience. This implies not only the loss of the present transaction but potentially the full lifetime value that would have come from future purchases.

Rejecting a valid transaction is, unfortunately, not the only way to lose a customer. If a transaction experience has slower confirmation times than other websites, this can cause friction for customers, which may lead to them exiting the merchant’s website before the transaction is completed. Again, a single negative experience may cause customers to avoid that merchant in the future.

If, even worse, the customer exits the website before a transaction is confirmed, but still gets charged for the transaction, this can result in chargebacks for the retailer – along with the potential for lost future business. Therefore, remote channel merchants struggle between concerns about lessening customer friction while needing to ensure that the person is in fact valid.

Conducting transactions online means that the retailer does not physically hand purchases to the customer. Therefore, it’s not always clear if the goods have been delivered to a legitimate location. Not having delivery confirmation (i.e., not getting signature upon delivery) can weaken merchants’ defenses against chargebacks, especially in the case of friendly fraud.

The Mobile Retail Movement isn’t Going Away After COVID-19

mCommerce is expected to increase significantly over the next several years. This will lead to continuing growth in the issues associated with fraud on the mCommerce channel. Presently, companies with an active mCommerce channel are typically larger in terms of annual revenues ($50M+) and are already conducting eCommerce and international transactions. Survey results seen below show that anticipated growth over the coming years will likely be fueled by mid-sized merchants who already conduct eCommerce but are looking to compete in the emerging mCommerce space. This means that fraudsters will have a whole new batch of organizations just entering the remote marketplace to target and the overall size of the remote fraud marketplace will grow.

FraudFighter is Here to Help!

As the landscape for retailers continues to shift more mobile, we continue to do the same here at FraudFighter. With over 20 years of experience in the fraud prevention industry, we have been helping retailers across the nation outwit fraudsters and reduce unnecessary losses. Reach out to us today to see how we can meet your businesses fraud prevention needs!

.png)