Synthetic Identity Fraud Challenges faced by Auto Dealers and Lenders

Synthetic identity fraud combines real identity attributes, such as using an illegally obtained SSN to get money, and fake information (name/address) for the purpose of committing financial crime.

Synthetic ID fraud differs from "traditional" identity theft fraud, in that the latter links to and impacts a real person, with a fraudster acquiring key information that enables them to conduct unauthorized transactions and acquire illicit gains under the name of the victim. A real person is likely to notice fraudulent behavior on their profile and take action to correct it, while synthetic identity fraud doesn’t have anyone connected to it to raise an alarm, and so, can run unchecked and/or lie latent for years.

Synthetic Identity Fraud and Financial Institutions

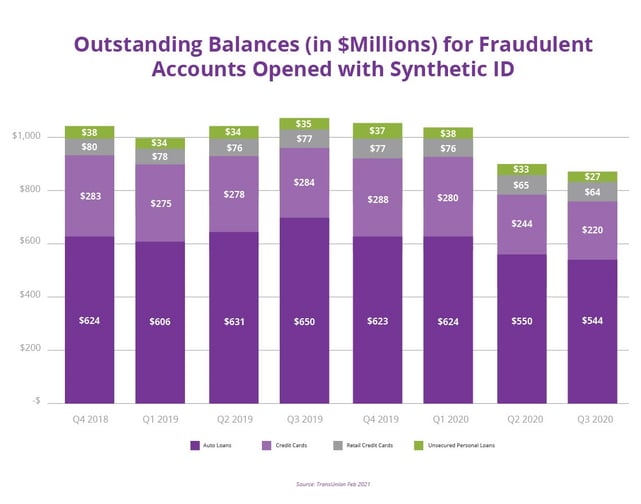

As seen in the chart below, synthetic identity fraud strikes at a wide array of financial institutions, but clearly none so much as the banks that provide auto loans.

Outstanding Balances (in $Millions) for Fraudulent Accounts Opened with Synthetic ID

Source: TransUnion Feb 2021

As of the data available in Q3 2020, combined synthetic fraud balances spanning the Auto Loan, Credit Card, Retail Credit Card, and Personal Loan segments totaled $855 million, notably down from $1.03 billion in Q4 2018.

Key Takeaways

1) While the decrease in synthetic fraud balances in Y2020 is certainly a positive trend in the short term, it is not expected be sustained. Research firm Aite Group believes that synthetic identity fraud incidents and costs will actually rebound post-pandemic, even exceeding previous highs.

2) While total auto loan synthetic account balances dropped to its lowest point at $544 million in Q3 2020, this segment still held steady with a 62% share of all outstanding balances. In other words, while the monetary impact to the auto loan segment dropped a good amount, this category didn't perform any better or worse in stopping fraudulent, synthetic accounts from entering its books.

Further industry data bears out the immense challenges auto dealers and their lending banks face:

- Per Lightico research, synthetic identity fraud accounts for a staggering 80% of the new account fraud in auto lending. Take that figure within the context of 2.3 million new auto loans per month, amounting to $56 Billion in new monthly auto loan debt, and the seriousness of fighting synthetic identity fraud comes into crystal clear focus.

- Fraud detection firm PointPredictive estimates that $7 billion in auto loans was directly tied to fraudulent (customer provided) information in 2019, including misrepresented income, employment, identity and collateral. That figure is up about 5% from 2018, when $6.7 billion in auto loans was tied to fraudulent activity.

Inherent Conditions with Auto Loan Fraud

So what’s going on with auto loans? Why does this segment contribute an outsized share to the total synthetic fraud landscape?

Researchers have identified these conditions that have enabled synthetic identity auto loan fraud to thrive:

Hyper transaction volume demand fosters an indifferent risk environment:- Speed to sell and speed to finance are Primary considerations

- Fraud and risk mindshare are Secondary

- Paperwork shuffling and document exchange at loan origination

- Slow adoption of digitization. Fax transmissions still utilized

- Continued reliance on credit files to determine customer identity

- Non-validation / linkage of TRUE Social Security number to customer

- Under 10% of income verification documents are validated

- Synthetic ID fraudster acquires or generates Social Security number

- Applies for credit and fails, but has new profile (real name, real DOB, fake SS#) in system

- Applies again and succeeds. Small loan, high APR. Cultivates new credit identity, pays on time, building score.

- Applies for and acquires big loan, strategic purchase goal.

- Busts out

- Typical auto loan (national average of $34,000) far exceeds what other creditors are willing to lend

- No shortage of foreign nationals establishing and cultivating a synthetic identity over the course of their education or work VISA stays, fraudulently acquiring the automobile and shipping the vehicle overseas, and then permanently leaving the country

eCBSV to the Rescue?

Better late than never, true source verification of Social Security numbers is finally here, albeit for a limited set of "permitted entities". In June 2020, the Social Security Administration rolled out the electronic Consent-Based Social Security Number Verification system, or eCBSV for short, which provides a source of truth to cross-check an individual's unique ID combination of SSN, Name, and DoB to SSA records.

As mentioned, this service is only extended to "permitted entities", which includes financial institutions or the service providers, subsidiaries, affiliates, agents, subcontractors, or assignees of the financial institution.

Notable exclusions from that list are companies that create or manage Consumer Services (gambling, social, ecom), Deposit accounts, and Business lending. True understanding of implications and impact of having synthetic identities exist in these ecosystems are TBD.

One key caveat of the eCBSV is that this process does not in and of itself "prove identity". It acts as one vector of information for a lender to consider, alongside and concurrent with the fundamental process of forensic government issued document authentication.

The eCBSV check result will be a binary "Yes" or "No" that indicates if a provided combination of "SSN+Name+DoB" matches the SSA records. It does not provide proof that the combination belongs to the person attempting to open an account.

That said, the eCBSV is expected to have two primary impacts on the multi-billion-dollar synthetic identity fraud landscape:

1) As the eCBSV gains full steam and adoption in the market, the creation of synthetic identities will slow as lenders gain the ability to cross-check customer PII (alongside authentic ID document) in real time. Its full implementation is expected to take some time given cost and inherent operational challenges in adopting new measures.

2) Fraudsters are expected to take advantage of the full rollout delay and ramp back up their synthetic identity fraud activities to create A) sleeper (early credit establishing/cultivation) accounts now, while they still can and B) fake goal bust-out accounts that take advantage of pandemic loan forbearance programs.

Fight the Fight with a Partner

At UVeritech, we have over two decades of experience in proving the authenticity of currency and identity documents for our hundreds of auto, banking, retail, and government customers. We work with firms of all sizes to ensure KYC compliance and protect your hard earned reputation (and your margins).

Contact us to learn how our innovative solutions dramatically reduce your risk exposure to synthetic identity losses and how we provide valuable insights into attempted (or repeated) fraud transactions spanning your entire organizational footprint.

.png)