fraud prevention tips

Note: This story is based on the real experiences and stories shared with us by our customers. All...

In today's increasingly digital and interconnected world, the threat of counterfeiting has...

To ensure your FraudFighter equipment remains effective and reliable, routine maintenance is...

Economic downturns have long been a catalyst for fraud. During tough times, the vulnerabilities of...

If you thought losing your phone was bad, imagine losing your entire identity. That’s what happened...

If you're in the tribal gaming world, you don’t want to miss the 27th Annual Western Indian Gaming...

Data leaks are no longer isolated incidents; they’ve regretfully become a recurring headline in the...

You might be asking yourself; do I really need to pay for another service? Sometimes it seems like...

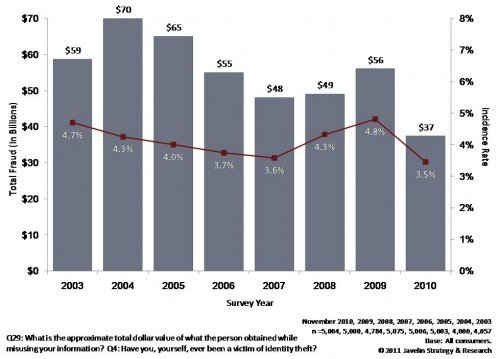

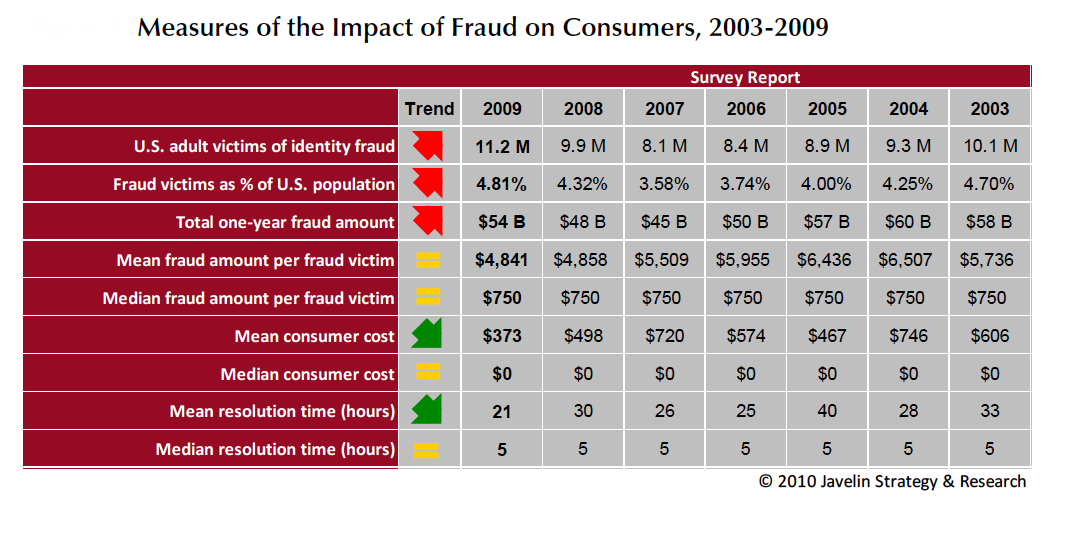

The reality is identity fraud has and will continue to rise. Over recent years, we have seen...

In today's digital age, hiring a contractor for home improvement projects has become easier than...

Fraudsters are becoming increasingly sophisticated in their methods, making it ever more essential...

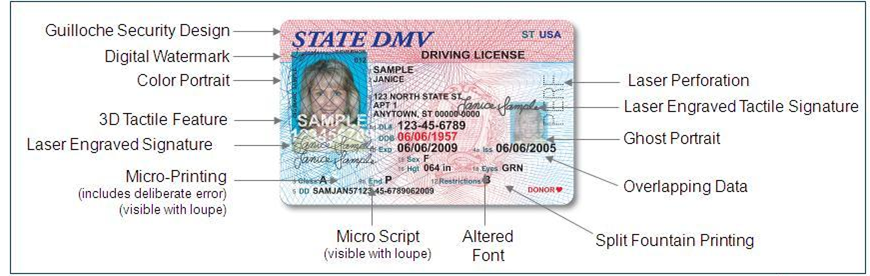

IDscan.net recently released a report, Fake ID Report 2023, which reveals crucial insights into the...

Identity theft cases are on the rise. Again. Year after year cases continue to skyrocket and are...

Recent fraud events demonstrate how a business’ reliance just on DATA to verify customer identity...

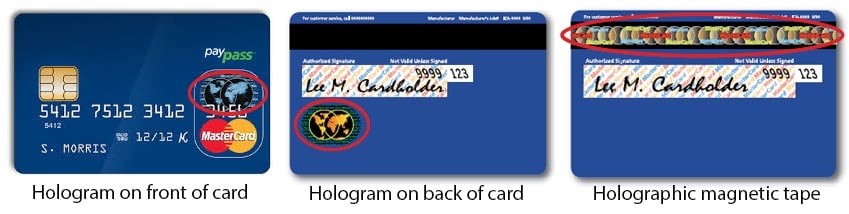

Counterfeit detection continues to be one of the most crucial steps a brick-n-mortar operation can...

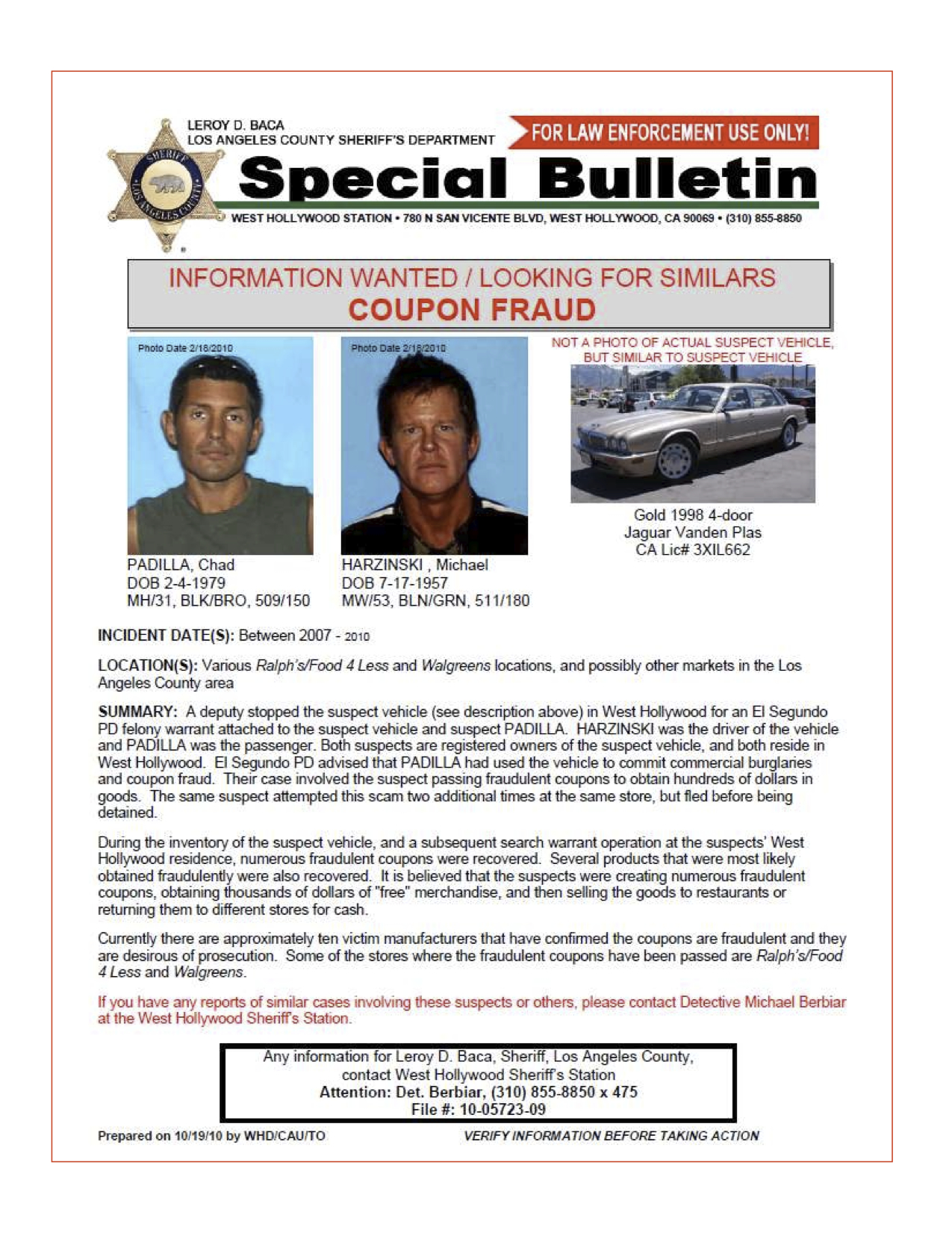

This article addresses the ongoing epidemic of vehicle thefts in this country, first citing...

Just how prevalent is Credit Card Fraud today? The Federal Trade Commission’s Annual Data Book of...

The rate at which Identity Theft is growing in the United States is nothing less than shocking....

Retailers of all types face the inescapable reality that transactional fraud has been on the rise...

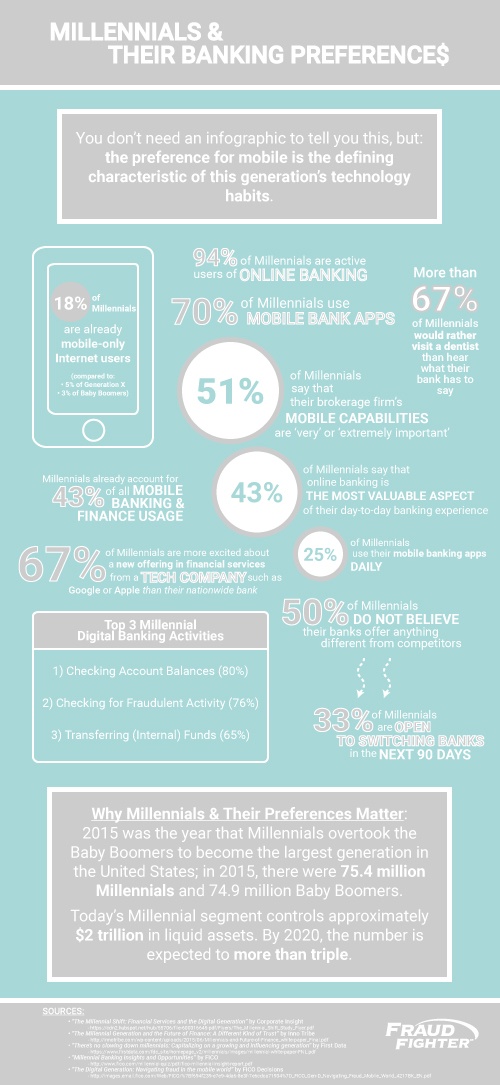

Incumbent banking institutions have emerged out of the pandemic to a landscape scattered with...

LexisNexis (LN) recently released its Financial Services & Lending focused 2022 True Cost of Fraud...

Employees tasked with running cash registers and point of sale (POS) systems are a store’s first...

As of this writing in early March 2021, COVID19 vaccine deployments have given society a proverbial...

Ah, the Selfie. Equal parts necessary vacation documenter to cringe worthy "maybe that wasn't such...

Two Packages, $136K of Counterfeit Currency CBP Officers in Chicago Seize Shipments Containing...

When it comes to assessing your risk of identity theft and fraud, being digitally compromised in a...

You know it’s important to protect your business against fraud, but how do you protect your...

Retailers are on course to lose more than $70 billion globally to remote “card-not present” (CNP)...

• TABLE OF CONTENTS •Why You Need to be Vigilant about Checking MoneyNaked Eye vs. Counterfeit...

• TABLE OF CONTENTS •Remote BankingMobile Client Onboarding is the Next FrontierMobile Identity...

• TABLE OF CONTENTS •What is Return Fraud?Return Fraud StatisticsWhy is Return Fraud such a Problem?

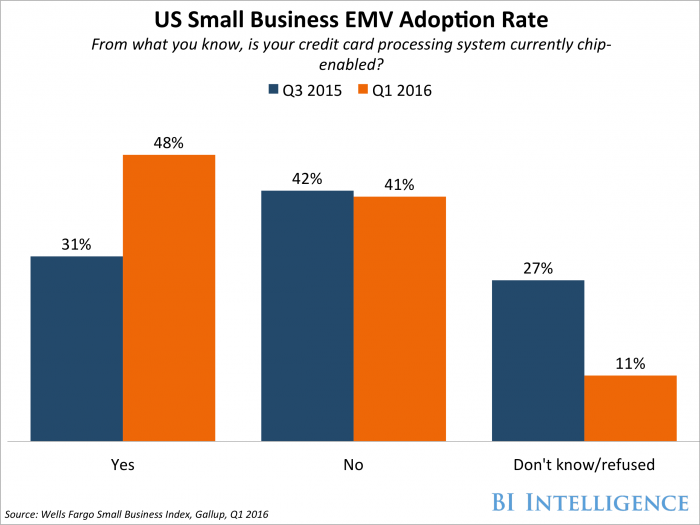

Chip-enabled (EMV) credit cards are designed to be more secure than magnetic stripe cards because...

An estimated 9 million American identities are stolen each year – it’s no wonder why identity theft...

Mobile Identity Authentication Many potential business-cases point to the desire to have an...

It was last year that I heard a prominent loss prevention professional - a name that many in the...

Before the advent of the internet, global electronic communications, and online databases, it was a...

In the previous post, we discussed what EMV and the fraud liability shift are as well as how it...

Most people have some exposure to fraud deterrents in their daily lives. For the honest person,...

Young people who are under the drinking age have long looked to fake IDs to get around the law....

To combat the recent tidalwave of identity theft cases across the United States, the Internal...

With the increase of mobile commerce brings a parallel increase in fraudulent mobile transactions,...

Fraud is big business.The Federal Trade Commission has estimated that 10.8 percent of U.S. adults...

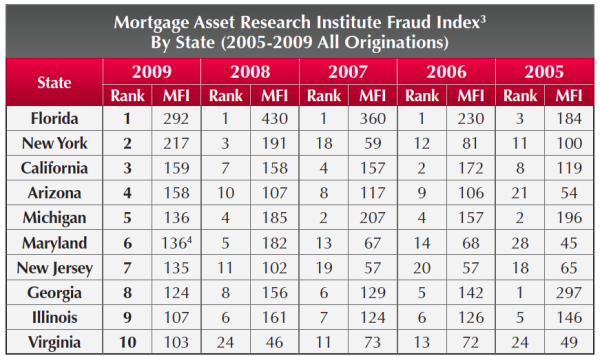

According to a new report, the majority of online fraud in the United States is coming from several...

In our tech-based society, smartphones, tablets, and other mobile devices are central to our daily...

No matter how careful you've been to protect your personal data and information, there are still a...

We often assume that major identity theft issues come from data breaches or scammers - but have you...

We'd all like to assume that we are quick enough to recognize a scam before falling into a trap -...

Financial institutions have long been the target of phishing schemes and fraudulent activity- from...

Identity theft and fraud among senior citizens is rising across the country, with many states as...

The United Kingdom is reporting a huge jump in liability fraud, citing a 75% increase in bogus...

As the Internal Revenue Service continues to work to combat tax fraud this year, other federal...

Despite the Securities and Exchange Commission's focus upon regulating the securities industry and...

In a wave of preventative measures for data protection, the Blue Cross Blue Shield Assocation...

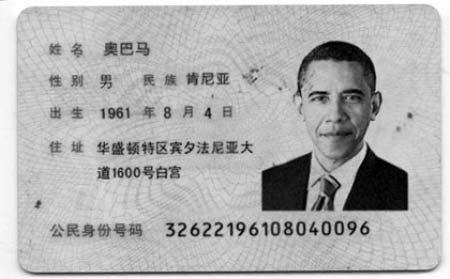

Accurate identification papers are essential to safeguarding financial and legal transactions as...

Identity theft issues continue to plague the Internal Revenue Service, and the U.S. Treasury...

Counterfeiting and identity theft are major concerns for the public, and safety of private...

Millennials probably don't worry too much about identity theft or fraud -- but according to a...

Following a recent online attack that resulted in the diversion of tax refunds and the theft of...

Recently, in Brooklyn, a man successfully made a $1,500 purchase using fake identification at a...

The holiday season is nearing meaning the busiest time of the year for retail businesses is...

Tax refund fraud is another form of identity theft that has recently afflicted the IRS. Recently

Fraud and data security breaches come in so many different forms and from so many different...

Simply put, multi-layered fraud prevention means that you must seek to understand the...

Manually counting cash is one of the best ways to lose money in your retail business. Cash...

Most loss prevention and asset management personnel make the mistake of thinking that shrinkage...

If you have followed the news at all lately, you have likely heard that financial institutions of...

It is perhaps a sign of the times when the annual convention of anti-money laundering...

Scenario:A financial institution is opening a new branch, and is starting a major local PR blitz...

One of the biggest concerns of any financial institution – that is, any institution that routes...

The last several weeks have seen a number of noteworthy arrests for money laundering. A fugitive...

The last decade brought about a tumultuous change in financial institution regulations. Many...

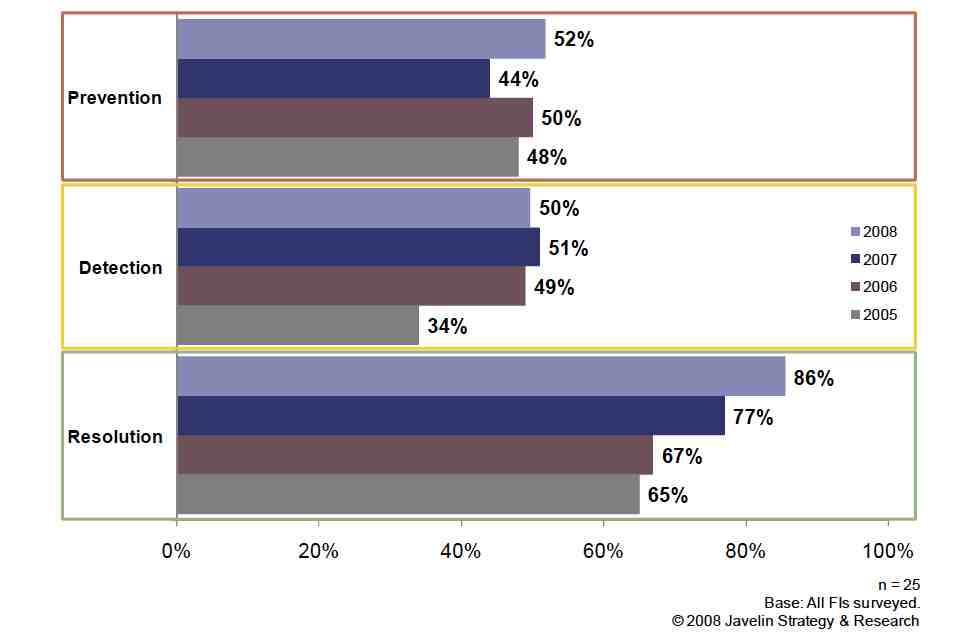

If you read Part I of our blog series on identity fraud you almost surely remember the sum totals...

Two very important studies delving into fraud reports from 2010 were issued recently. The first, a...

Credit card processing servers. Poorly secured corporate networks. Point-of-sale terminals in gas...

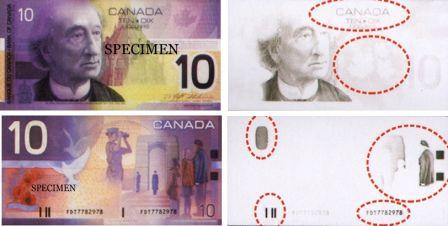

We have mentioned in a number of previous posts the international nature of many counterfeit money...

How easy is it to create counterfeit money? Up until a few months ago, the Reid brothers would...

(Note: This is the second article in our series Best Practices for Counterfeit Detection. For the...

Want an entertaining dinner party activity? Ask people around the table if they know how to tell...

Good news from the front in the battle against identity theft! Well, somewhat good news. With an...

It is always a treat to hear from actual identity thieves: understandably they are not often...

On the heels of last week's story about Australian airline tickets bought with counterfeit credit...

We have mentioned in our previous posts that fraud committed on a stolen credit card affects three...

For anyone concerned about how mortgage fraud can affect them specifically, the LexisNexis...

Hardly a day goes by without a news report mentioning identity theft or giving a heart-rending...

We have talked in previous posts about international financial fraud as it relates to employment...

Money counterfeiting, as any other crime, doesn't stand still. Fraudsters continually evolve...

So far, we have been discussing the problem of counterfeiting only within the U.S., although it...

There’s a lot of semantic debate these days over what to name foreign nationals who violate U.S....

This past Sunday's Los Angeles Times featured an article quoting Fraud Fighter's own VP of Sales...

International Law Enforcement Takes-Down a “Top 10” Site

We mentioned previously the intaglio printing process that creates fine lines around the portraits...

(This is the third post in our counterfeit money series. The U.S. dollar printing machinery that...

In a startling revelation yesterday, one of the largest U.S. banks admitted in court that a...

As credit cards continue to supplant cash and checks as the preferred method of payment, credit...

We have mentioned here previously the new high-tech anti-counterfeitting features of the new $100,...

Big-box stores are a favorite target of fraudsters, because of the value of their products. So...

Burden, or Benefit?

Casino environments are beset by opportunities to experience losses from counterfeit fraud....

Imagine for a moment you are a modern-day Al Capone. Through a combination of robbery, embezzlement...

This is the first in a series of articles discussing the challenges faced by casinos - regarding...

NRF Loss Prevention Blog Article In a very interesting blog article found an the National Retail...

.png)

.jpg)