credit card fraud

Nearing the end of Q2 in 2023, it seems like fraud is already abundant. T-Mobile had yet another ...

Fraudsters continue to use various nefarious methods to defraud liquor businesses and consumers...

Counterfeit detection continues to be one of the most crucial steps a brick-n-mortar operation can...

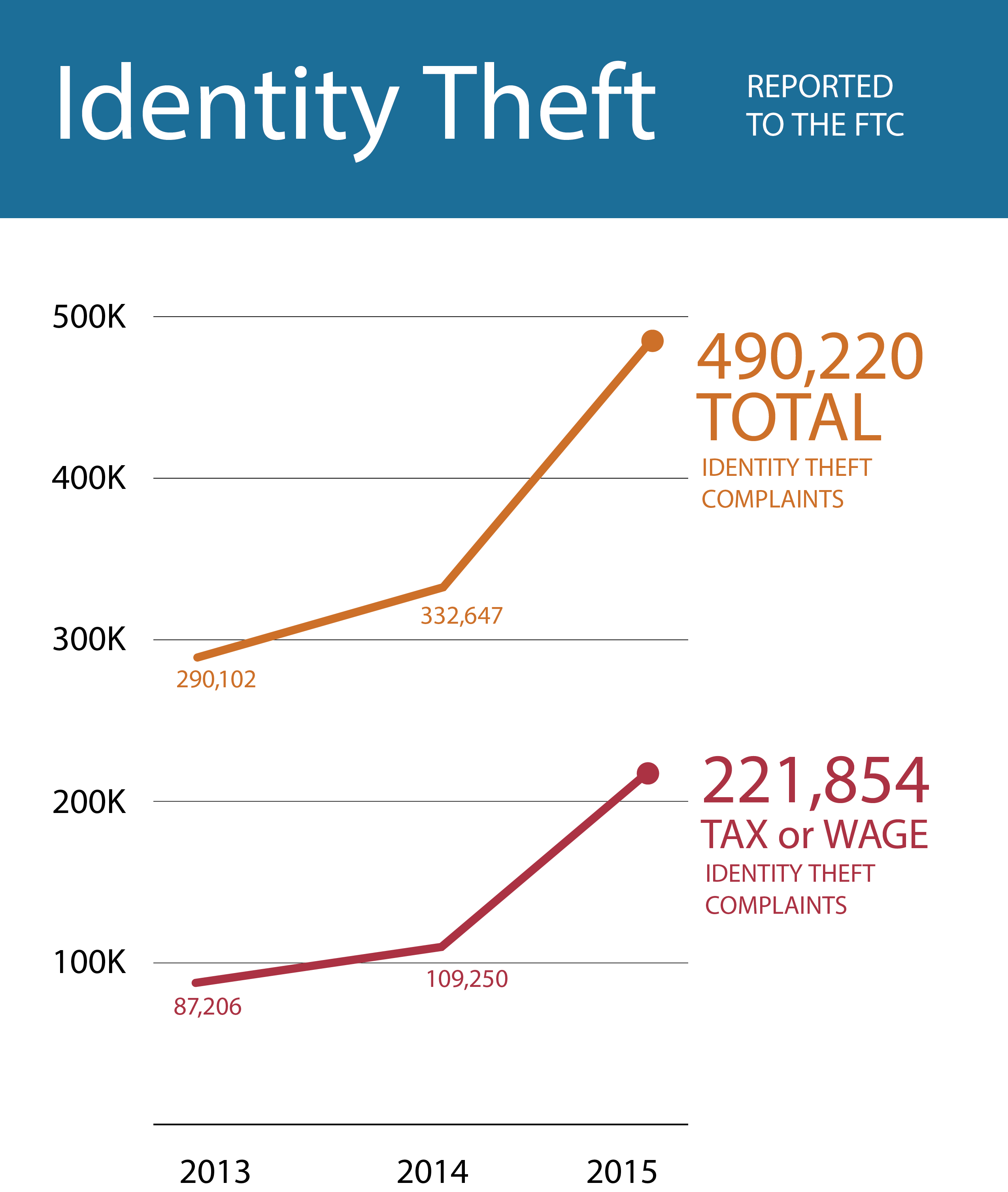

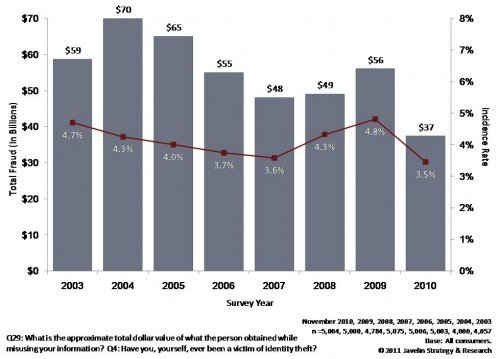

Just how prevalent is Credit Card Fraud today? The Federal Trade Commission’s Annual Data Book of...

At this point, the concept of identity theft has thoroughly pervaded our popular lexicon and...

Several weeks ago, we began getting calls from a few clients asking us whether specific versions of...

• TABLE OF CONTENTS •What is Card Shimming?Card Shimming vs. Card SkimmingWhat are CVVs?Why Cards...

Traditionally, “skimming” meant secretly taking small amounts of money from a larger amount of...

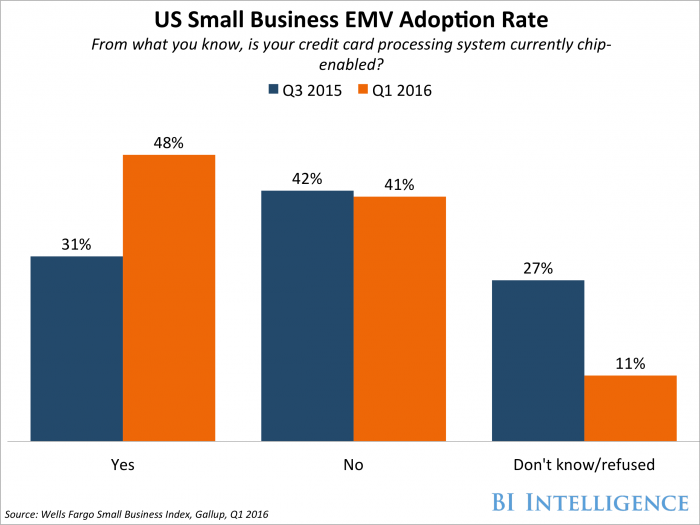

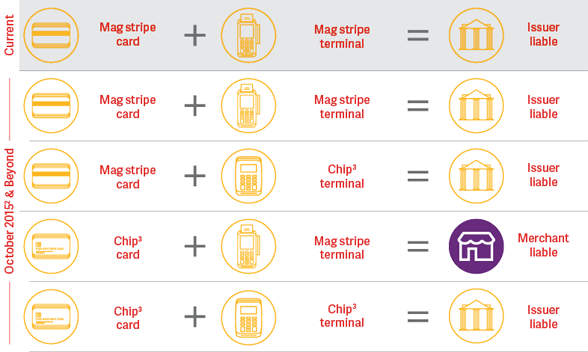

October 1, 2016 was the first anniversary of EMV’s adoption by the United States. Businesses who...

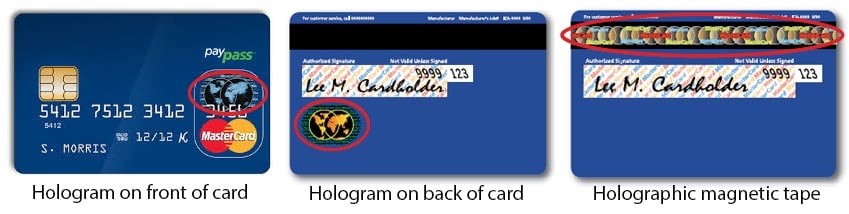

Chip-enabled (EMV) credit cards are designed to be more secure than magnetic stripe cards because...

If preliminary estimates hold steady, the amount of fraud victims and the total amount lost to...

Photo by Whym via Wikimedia Commons

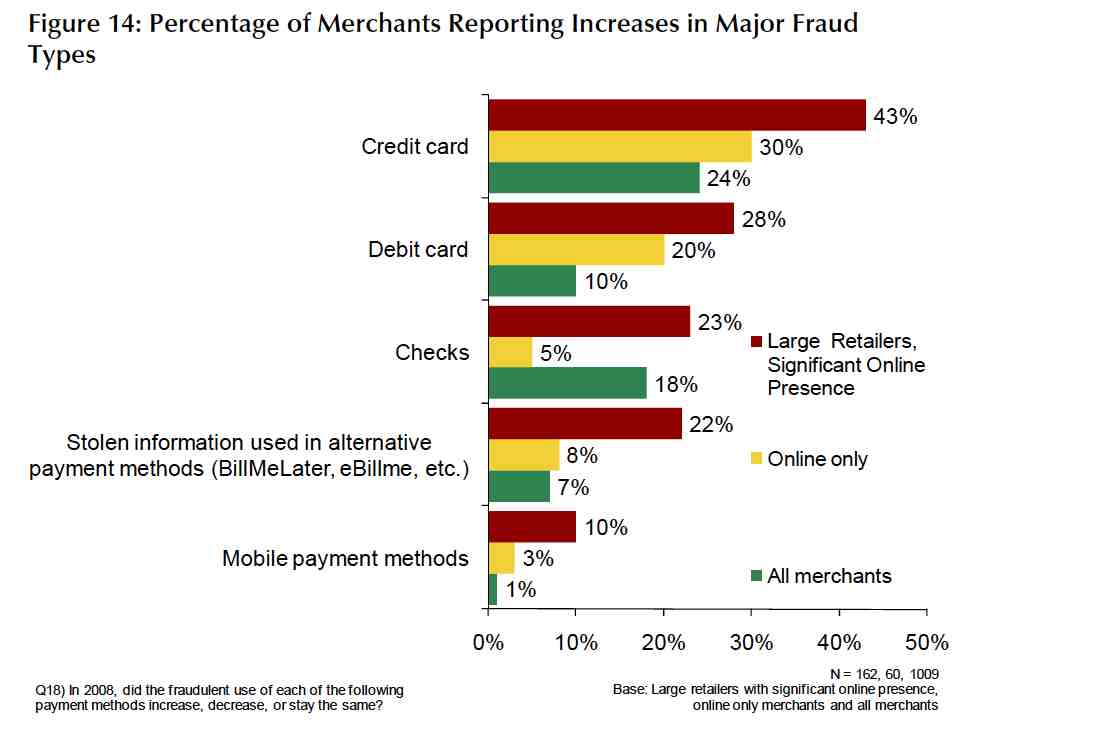

For many years, credit card fraud has been the favored method for fraudsters seeking to profit from...

It was only a decade ago that we lived in a 4G-less world – at an intersection of equal parts...

In the previous post, we discussed what EMV and the fraud liability shift are as well as how it...

You may have noticed that new debit cards and credit cards are being issued with a visible...

Counterfeiting and identity theft are major concerns for the public, and safety of private...

The New Year is bringing a change to the credit card industry. In the United States, credit card...

The busiest shopping day of the year is approaching, Black Friday. Businesses are expecting their...

Just when we all thought cash was going obsolete it looks like this holiday season shoppers will...

Good news from the front in the battle against identity theft! Well, somewhat good news. With an...

It is always a treat to hear from actual identity thieves: understandably they are not often...

Go into any of tens of thousands of restaurants, bars or retail stores these days, and chances are...

On the heels of last week's story about Australian airline tickets bought with counterfeit credit...

Out of the three groups affected by retail fraud – consumers, financial institutions and merchants...

.jpg)