How ID Authentication can help the war against terrorism

The world has changed much since September 11, 2001. Awareness of how fragile our way of life can be, what steps must be taken to protect it and...

The world has changed much since September 11, 2001. Awareness of how fragile our way of life can be, what steps must be taken to protect it and...

If you have followed the news at all lately, you have likely heard that financial institutions of all stripes are coming under greater scrutiny,...

It is perhaps a sign of the times when the annual convention of anti-money laundering professionals draws a record attendance. This year, the...

Scenario:A financial institution is opening a new branch, and is starting a major local PR blitz for new customer acquisition.Great incentives are...

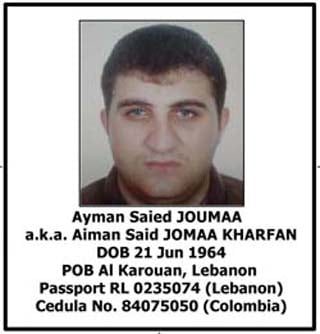

The last several weeks have seen a number of noteworthy arrests for money laundering. A fugitive American, who pled guilty to money laundering...

The last decade brought about a tumultuous change in financial institution regulations. Many pre-2000 “suggestions” or “guidelines” became hard...

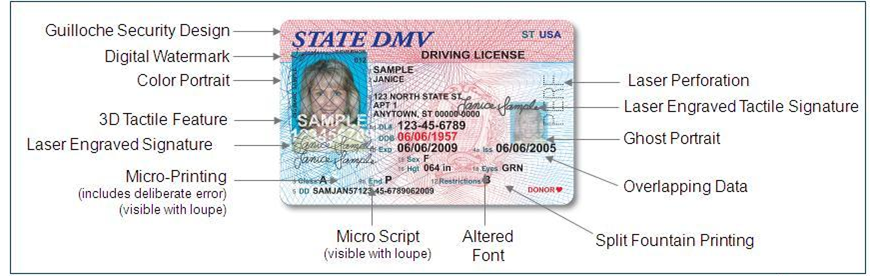

As if it weren’t already difficult enough to verify identity documents, now comes a new wrinkle in the game – high-quality counterfeit driver...