Identity Theft Tied to Fake IDs for College Students

Young people who are under the drinking age have long looked to fake IDs to get around the law....

According to FBI statistics Identity Theft is the nation's fastest growing crime. Identity theft and fraud involving stolen identities is also the fastest-growing category of complaints filed by consumers with the Federal Trade Commission (FTC).

According to FBI statistics Identity Theft is the nation's fastest growing crime. Identity theft and fraud involving stolen identities is also the fastest-growing category of complaints filed by consumers with the Federal Trade Commission (FTC).

Identity theft occurs when someone uses another person’s personally identifying information, like their name, Social Security number, or credit card number, without the owner's permission. This activity is conducted with the intention of committing fraud or other crimes.

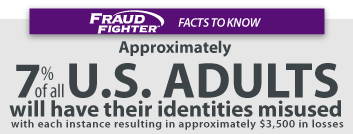

The FTC estimates that as many as 9 million Americans have their identities stolen each year. In fact, you or someone you know may have experienced some form of identity theft. The crime takes many forms. Identity thieves may rent an apartment, obtain a credit card, or establish a telephone account in your name. You may not find out about the theft until you review your credit report or a credit card statement and notice charges you didn’t make—or until you’re contacted by a debt collector.

Identity theft is serious. While some identity theft victims can resolve their problems quickly, others spend hundreds of dollars and many days repairing damage to their good name and credit record. Some consumers victimized by identity theft may lose out on job opportunities, or be denied loans for education, housing or cars because of negative information on their credit reports. In rare cases, they may even be arrested for crimes they did not commit.

"Identity theft" refers to crimes in which someone wrongfully obtains and uses another person's personal data (i.e., name, date of birth, social security number, driver's license number) and your financial identity (credit card, bank account and phone-card numbers) in some way that involves fraud or deception, typically for economic gain (to obtain money or goods/services). Criminals also use identity theft to fraudulently obtain identification cards, driver licenses, birth certificates, social security numbers, travel visas and other official government papers.

which someone wrongfully obtains and uses another person's personal data (i.e., name, date of birth, social security number, driver's license number) and your financial identity (credit card, bank account and phone-card numbers) in some way that involves fraud or deception, typically for economic gain (to obtain money or goods/services). Criminals also use identity theft to fraudulently obtain identification cards, driver licenses, birth certificates, social security numbers, travel visas and other official government papers.

Unlike your fingerprints (which are unique to you and can't easily be given to, or stolen by, someone else for their use), your personal data can be used, if it falls into the wrong hands, allowing criminals to profit at your expense. Plus, according to the FTC, —on average, most victims don't even know their identity has been stolen until more than a year later.

Identity theft can have devastating consequences for the victim, who may face long hours of closing bad accounts, opening new ones, and repairing their ruined credit record. And, it may take significant out-of-pocket expenses to clear one's good name after these events happen.

While the victim is working on clearing-up the wreckage of the fraudulent events, they may be denied jobs, loans, education, housing, and cars, or even get arrested for crimes they didn't commit. Unfortunately, the experience of thousands of victims is that it often requires months, and even years, to navigate the frustrating, identity-recovery process.

Identity thieves can use a variety methods, both high and low tech, to gain access to another's personal information. Below is a brief list of some techniques used by creative criminals to obtain personal information and take over someone's identity. Some examples of methods used by fraudsters include:

Business Record Theft: They get information from businesses or institutions by stealing files out of offices where their victim is a customer, employee, patient or student; or by bribing an employee who has access to your files; or even "hacking" into the organization's computer files.

Shoulder Surfing: A "shoulder-surfing" identity thief, by tanding next to their victim in a checkout line, can memorize name, address and phone number during the short time it takes you to write a check. An identity thief can stand near a public phone and watch you punch in your phone or credit card numbers (or even listen in when you give your credit-card number over the phone for a hotel room or rental-car.)

Dumpster Diving: Criminals rummage through trash, or the trash of businesses, and landfills, mining for personal data.

Under the Color of Authority: They fraudulently obtain credit reports by abusing their employer's authorized access to credit reports, or by posing as landlords, employers or others who may have a legitimate need/right to the information.

Skimming: They steal credit/debit card account numbers as your card is processed at a restaurant, store or other business location, using a special data collection/storage device (known as "skimmer".)

Other methods utilized by thieves seeking your personal information might include:

Stealing wallets and purses containing identification and credit and bank cards.

Stealing mail, including bank and credit card statements, pre-approved credit offers, new checks, or tax information.

Completing a "change of address form" to divert mail to another location.

Stealing personal information from your home.

Using personal information you share on the Internet.

Scamming information from you, often through email, by posing as legitimate companies or government agencies.

A criminal can do a lot with stolen identification information. Much of what determines how they will act is driven by two factors.

First, are they a solo operator? If so, they will likely attempt some type of small fraud. Purchases below a certain threshold, like $500, or application for a credit card with a relatively low credit limit. If, on the other hand, they are part of an organized crime ring, then the fraud can be much more serious. This is because a small piece of data stolen from you by one individual can be matched to other sources of data by organized rings. "Dark markets" in which identity data is bought and sold may allow this person who stole, for example, your Driver License number to also find your social security number and bank account information. Now, they are armed with enough data to replicate your profile and apply for a mortgage, or open bank accounts and use them to launder illegally gotten funds, or conduct a host of other activities of a very serious nature.

Second, what data did they steal from you? Fundamental "public record" data, like name, address, phone number, etc can be used to allow the next phase of identity theft, such as having your mail redirected, or applying for replacement credit cards or medical insurance cards. If, instead, they have stolen something vital, like bank account PIN, or credit card number, with the expiration date and the CVC codes, then they can really do some damage.

A list of actions commonly experienced by victims of identity theft includes the following:

Spending sprees using victim's credit and debit card account numbers to buy "big-ticket" items like computers, name-brand fashion and accessories, or large-screen TV's that they can easily sell.

Opening a new credit card account, using victim's name, date of birth and SSN. When they use the credit card and don’t pay the bills, the delinquent account is reported on the victim's credit report.

Call the victim's credit card issuer and, pretending to be them, ask to change the mailing address on the credit card account. The imposter then runs up charges on the account. Because the bills are being sent to the new address, it may take some time before you realize there’s a problem.

Buy cars by taking out auto loans in the victim's name.

Establish phone or wireless service in the victim's name.

Counterfeit checks or debit cards, and drain the victim's bank account.

Open a bank account in the victim's name and write bad checks on that account.

File for bankruptcy under the victim's name to avoid paying debts they’ve incurred under their name, or to avoid eviction.

Give the victim's name to the police during an arrest. If they’re released from police custody, but don’t show up for their court date, an arrest warrant is issued in the victim's name.

As you can see, there can be some very serious consequences to a person if they should happen to be victimized by a knowledgeable ID theft professional.

Young people who are under the drinking age have long looked to fake IDs to get around the law....

Credit card processing servers. Poorly secured corporate networks. Point-of-sale terminals in gas...

Leave a Comment